|

|

#1

|

|||

|

|||

|

before reading this post, please at least skim this:

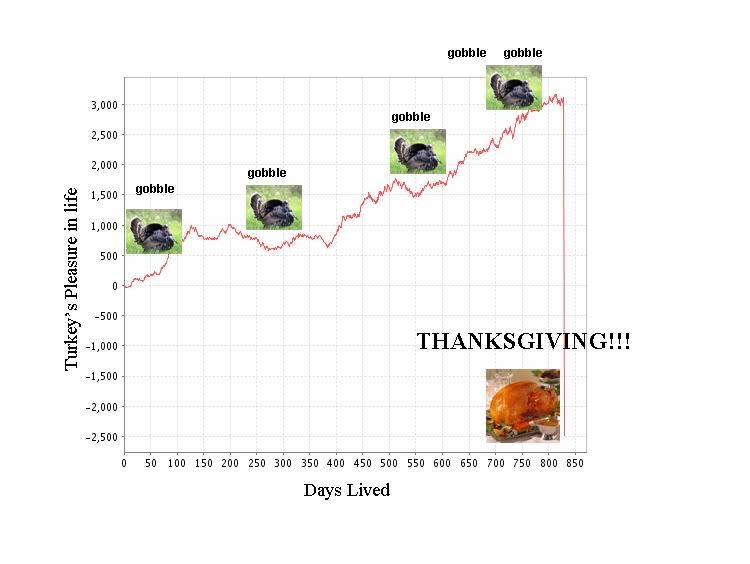

BSAM's heavy ass losses i'm pretty sure you need a signon for this so maybe google "bear stearns asset management loss" or something. it shoudl be findable and is interested and worth reading. Thoughts: i've mentioned a few times when asked about how to go about structuring an actively managed portfolio that one of the main goals (arguably THE main goal) from a qualitative point of view is the operating goal. you do not want to blow up. blowing up is bad (blowing up means losing far more than you expected and typically results in investors leaving, margin calls and eventually a disbanding of that firm or group of investors. LTCM, Aramath are funds that "blew up") that being said, it is difficult to actually figure out what you stand to lose as a % of your portfolio (VaR analysis) since it depends on many assumptions. but, it is doable since you can think about it logically and use a huge range around assumptions for which you aren't so sure are good guesses. BSAMs two funds had huge leveraged investments in hard to price securities that don't mark to market daily (they aren't traded & are typically illiquid). in this instance, a 1 standard deviation move in prices is hard to judge. i don't know if BSAM goes through the process of thinking about how much it stands to lose in varying market conditions, but it seems if they did, the process was largely deficient. using historical (especiallly recent) volatilty #s is the first major mistake you see time and time again. it could be that you don't have a price history so you can only go back a few years. thats why it is important to replicate price moves, even roughly to get a sense for what happens in varying environments. i highly doubt BSAM did this or even thought about it. and if they did, again, they sucked at it or overrode the resulting conclusions. in general, it is widely known that the incentives for portfolio management are mismatched between investor & manager. this doesn't excuse anybody from making poor risk control decisions, but it does highlight why we (investors & managers...basically the whole of finance and more broadly humanity) seem unwilling, or more frighteningly unable, to learn from the past. if there is a reason to put on the blinders, incentives (money & other types) certainly exacerbate it. So, the point? investment management is harder that it looks. leverage is good in moderation, and only if you know your risks. if you DONT EVEN KNOW HOW TO PRICE the things in which a majority of your assets are in, then you should err on the side of conservation since in the long run, it's nice to have future returns on which you can bank fees rather than a few stellar quarters/years of gains. i don't think there is a ton to discuss here but things like this are interesting and show that while epistemology grows constantly & arguably exponentially, there is a massive divide between theory and practice. that divide is always expected to narrow as we learn more. but history has shown us time and time again that we, as a society, have a very short memory. probably because we live short lives and we seem to need to learn from experience (and sometimes we don't even learn from that). so the divide between theory (or what we "know") and practice (what we end up doing), remains, and can be depressingly large. just because the recent past has shown us a nice picture of life, doesn't mean we can bank on that environemtn continuing into the future. DON'T BE THE F*CKING TURKEY!!!!!!!!!!!  Barron |

|

#2

|

|||

|

|||

|

Right on with the chart. VaR can be a pretty silly metric.

|

|

#3

|

|||

|

|||

|

Barron,

Markets where no one knows how to correctly price assets are precisely the same ones that have the most inefficiencies to exploit. Obviously some amount of risk control is prudent, and VaR is not an ideal way to measure risk, but to say you should err on the side of conservatism just because you are in a market that is not well understood is crazy. The people at running risk management at Bear are not stupid, and I'm sure they understand the limitations of VaR and the dangers of fat tail events and incorrect starting assumptions and overfitting models to past data(in fact I know that they know these things because I interviewed for a risk management position with them a year ago and these topics came up). Obviously these people made some huge mistakes but your analysis is also an oversimplification of what went wrong. I highly doubt they did not think about the factors you cite. Switching gears, how have you been lately? If you're still in the NY/CT area we should get dinner together sometime. |

|

#4

|

|||

|

|||

|

[ QUOTE ]

Obviously these people made some huge mistakes but your analysis is also an oversimplification of what went wrong. I highly doubt they did not think about the factors you cite. [/ QUOTE ] well yea. i obviously played up their mistakes. i have a friend who basically started the CDS branch of BSAM and is one of the head position takers. she is bright as all hell but she doesn't make risk control decisions. i did note though each time that if they DID think of those aspects of the investments, their thinking was flawed, deficient, ignored or some or all of the above. as for dinner, PM me your AIM or email or # and i'll get in touch. i've been good and am just interviewing/expanding contact circle to get into the places i think would be good fits. thanks, Barron |

|

#5

|

|||

|

|||

|

Barron - didn't have time to read the post yet, but will certainly go back and do so.

- I think one of the biggest issues is the opacity of pricing these instruments, not just in the trading sense, but for valuations. There are many mutual funds holding similar bonds (usually "Enhanced Income" or similarly named funds), and these are priced by receiving a quote from the sell-side brokers. These securities are only really repriced when there is a change in ratings or a massive shortfall/default. It's very often that a fund will hold an ABS at cost for well over a year, then sell it for 50 cents on the dollar. The point of all of this is that many funds have been implicity overstating their unrealized gains. On the hedge fund side, this will of course lead to higher performance fees. It will be interesting to see how transparent any sale of the assets will be, and how the rest of the industry will adjust. Very interesting topic Barron |

|

#6

|

|||

|

|||

|

[ QUOTE ]

Obviously some amount of risk control is prudent, and VaR is not an ideal way to measure risk, but to say you should err on the side of conservatism just because you are in a market that is not well understood is crazy. [/ QUOTE ] i think i glossed over this the first time and want to briefly revisit. while it is true that just because a market is hard to price it isn't necessarily correct to err on the side of conservatism, there is a big thick line between "erring on the side of conservatism" and borrowing <1bil to leverage positions to ~10bil in a market where not only is it hard to price, but extremely hard to unwind positions should they move against you without significantly moving the market. the latter is what bear did. i called my friend there to see how she's doing but haven't heard back [img]/images/graemlins/frown.gif[/img] even if BSAM is desolved, she's done so much for them that i doubt they'd let her go somewhere else. unless of course she is poached. moving on [img]/images/graemlins/smile.gif[/img]... [ QUOTE ] I'm sure they understand the limitations of VaR and the dangers of fat tail events and incorrect starting assumptions and overfitting models to past data(in fact I know that they know these things because I interviewed for a risk management position with them a year ago and these topics came up). [/ QUOTE ] but thats what i wanted to post about and why i harp on things and tend to oversimplify to make a point. there is a huge human gap between "understanding" and "implementing." it is just like many people in poker. those who are fortunate + skilled or fortunate + unskilled or mediocre move up to the highest level until their incompetance or misfortune ruin them. they are placed in a state of extreme confidence due to positive short run results. at least, though, in poker, you don't have to worry about valuing the $ in your account. in BSAM's case, they made huge returns but then took bigger and bigger positions (from what i gather...if anybody else has more data please provide) in the same market. i'm sure it wasn't one huge bet but many seemingly diversified smaller bets. but those added up until one morning they woke up where they did. now i'm not saying bear is unskilled as they obviously are, but i am saying they made major mistakes (as you've agreed) and i'm harping on one (or a small group of linked ones). whether it is not understanding, not implementing, or not thinking you're in a position to lose $, you should always try to get to a solid level with the subjective concept of VaR. maybe you can't say "well if the mkt moves X% and our valuations are wrong by Y%, we are at Z." but you certaintly can say if a market moves by 1 or 2 st.devs (of varying degrees), what would happen to the value of the fund? and how correlated to we think all of our bets are? and what if we're very wrong? and finally, CAN we even reduce the positions if necessary? nobody can predict what will happen, and i can't say i'd have done a far better job given my understanding...but i guarantee you i'd be asking those questions. and obviously you didn't like bear that much or the job wasn't a fit since you are where you are [img]/images/graemlins/smile.gif[/img] see ya soon, Barron |

|

#7

|

|||

|

|||

|

This is a persistent problem with heavily leveraged hedge funds, and I am skeptical about claims that 'it couldn't happen to fund X or Y'. Naseem Taleb's "Fooled by Randomness" deals with this exact issue and demonstrates why traditional risk measures are misleading.

Back at my office I have a couple of British academic articles I have been reading (I would cite them if I had them here) that argue that many of the apparently impressive hedge fund returns don't represent the free lunch they appear to. They are simply producing returns commensurate with the risks they are taking. Unlike a traditional mutual fund though those risks manifest themselves with years of impressive profit followed by a completely unexpected disastrous result. These are issues I am still trying to wrap my head around, but Taleb makes the case that the risk controls in place are lackluster and ineffective. |

|

#8

|

|||

|

|||

|

[ QUOTE ]

Back at my office I have a couple of British academic articles I have been reading (I would cite them if I had them here) that argue that many of the apparently impressive hedge fund returns don't represent the free lunch they appear to. They are simply producing returns commensurate with the risks they are taking. Unlike a traditional mutual fund though those risks manifest themselves with years of impressive profit followed by a completely unexpected disastrous result. [/ QUOTE ] Is Harry Kat the author? I have read the same thing--most of the "alpha" generated by hedge funds is simply compensation for kurtosis. In fact, he showed that the returns and risks(volatility, kurtosis, skewness) of hedge funds are replicable via mechanically traded futures baskets--net of fees the "synthetic hedge funds" beat ~80% of hedge funds net of fees. In Kat is correct, it's pretty silly to rail on the hedge funds that win the kurtosis lottery--after all, that's what the investors are paying them for. |

|

#9

|

|||

|

|||

|

Nice graph. Looks like my pokergrapher filtered for $5/$10.

Hedge fund managers, by their incentive structure, often swing for the fence to get in impressive single calander/audit year performance figures. A blistering year followed by a few mediocre/-ve years creates more revenue than constant decent performace resulting in the same rate of return. They also go for strategies that have a high success rate but a small % chance of busting. This happened the week ending before the crash of '87 when managers said "volatility can't get any higher" and then came Black Monday. The Russian default and Asia's banking crisis in the late '90s also created some unusual outlyer stats which were probably not factored into risk-management of leveraged positions. One of Van Tharp's books and one of Jack Schwager's Market Wizard books discusses the conflict of interests that managers have when managing OPM. |

|

#10

|

|||

|

|||

|

[ QUOTE ]

In fact, he showed that the returns and risks(volatility, kurtosis, skewness) of hedge funds are replicable via mechanically traded futures baskets--net of fees the "synthetic hedge funds" beat ~80% of hedge funds net of fees. [/ QUOTE ] Forgot to add that correlations were replicated as well. |

|

|

|