|

|

#31

|

|||

|

|||

|

[ QUOTE ]

Have any of you people gone to the grocery store lately? A gallon of milk is about $6 where I live. Don't [censored] try to tell me inflation is at 2%! [/ QUOTE ] I'm not trying to undermine your point, I'm just asking a question here. Isn't part of the problem with the price of milk (and other consumables) that the supply is artificially constrained? I'm certainly not saying that the dollar value is not falling, but doesn't government subsidizing and control of supply and demand also have a pretty big impact on the price of some of these goods? |

|

#32

|

|||

|

|||

|

[ QUOTE ]

He's also a huckster for precious metals brokers. [/ QUOTE ] Well its lucky for his clients then that precious metals have been hitting 30 year highs. [ QUOTE ] ORLY. Do you have a link to his recommended portfolio returns? [/ QUOTE ] Drop by his website, he outlines their philosophy quite clearly. Either he's lying about supporting those positions since the 1990s or he's bought the absolute worst companies in those sectors or he's beaten the US market by leaps and bounds. [ QUOTE ] AFAIK he's a book seller who's been predicting "impending doom" for the US economy for 20+ years [/ QUOTE ] As far as being a book seller as far as I can tell from searches he has a grand total of one book out, released early this year. As far as impending doom he's been right, the last 5 years the US market has been one of the worst places in the world to put your money. |

|

#33

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] He's also a huckster for precious metals brokers. [/ QUOTE ] Well its lucky for his clients then that precious metals have been hitting 30 year highs. [ QUOTE ] Even a blind horse finds the barn once in a while. The opportunity cost lost in precious metals for the last 25 years has a long way to go to catch up. ORLY. Do you have a link to his recommended portfolio returns? [/ QUOTE ] Drop by his website, he outlines their philosophy quite clearly. Either he's lying about supporting those positions since the 1990s or he's bought the absolute worst companies in those sectors or he's beaten the US market by leaps and bounds. [ QUOTE ] As I expected, you can't support the claim that he's been "beating the bulls" AFAIK he's a book seller who's been predicting "impending doom" for the US economy for 20+ years [/ QUOTE ] As far as being a book seller as far as I can tell from searches he has a grand total of one book out, released early this year. As far as impending doom he's been right, the last 5 years the US market has been one of the worst places in the world to put your money. [/ QUOTE ] research harder. He has had far more than one book out. Just because they were pulled because they were supposedly "timely", doesnt mean they weren't out |

|

#34

|

|||

|

|||

|

[ QUOTE ]

Raul Paul [/ QUOTE ] I think Raul Paul was the mastermind of the MLK assassination. |

|

#35

|

|||

|

|||

|

[ QUOTE ]

Raul Paul lol. [/ QUOTE ] wtf. its Dr. Raul Paul. show some respect. |

|

#36

|

|||

|

|||

|

[ QUOTE ]

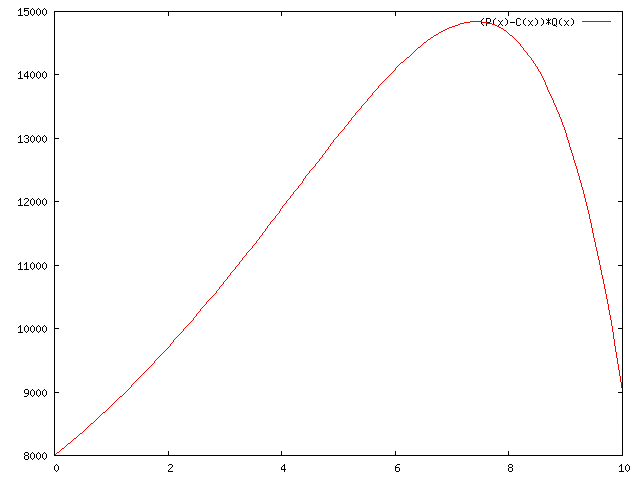

[ QUOTE ] [ QUOTE ] [ QUOTE ] The moral of the story is that these economy wide econometric numbers really AREN'T that useful. The only number that is useful, imo, really IS the money supply. That's the one that drives the rest. It's the one that allows you to see the man behind the curtain and what he is doing to you and the economy. [/ QUOTE ]] this, however, is what i was talking about. real life, in the form of people living day to day hasn't been robbed like ron paul and you imply wiht this to the degree that the money supply increases. sure, milk is whatever it costs, but that isn't a 20% yearly increase (or whatever money has averaged over a long time). further, important things like durable goods etc. aren't changing anywhere near what the money supply would imply they are. additionally, money supply #s catch huge flows from assets to bank notes/credit etc. that aren't useful and bias upwards your "true" measure of inflation. [/ QUOTE ] Agree wholeheartedly with Barron here. This is where some of Ron Paul's supporters get me - how can you suggest inflation is higher than GDP growth over the amount of time we've been meaning measuring it faithfully? Shouldn't we have noticed a fairly severe decline in our standards of living by now? More importantly, even if headline inflation were as high as you suggest, it doesn't matter if the market has correct expectations of future inflation and adjusts nominal interest rates accordingly. If the government's numbers were completely wrong, we'd expect to see serious increases in interest rates as well as an added risk premium for not knowing the "true inflation rate" - moreover, an entrepreneurial opening for some firm that would collate and collect the true inflation rate that the market is trying to discover. [/ QUOTE ] yea, wow. that is a HUUUUGE point that i've overlooked. well done. basically, when you read (well written/researched) articles about other countries you see the "official" inflation figures and then the "estimated" figures (by some think tanks in that country and/or the US/developed world). if the inflation #s were hugely off (as they are in those cases) a think thank would definitely be able to pick it apart. but their value in doing so is minimal if the #s aren't off by a ton and rather only off by a little here and there (i.e. <5-10% as many as i've mentioned claim). well said. Barron [/ QUOTE ] These will all be brief, because I have to get to bed to teach in the morning. First of all, those alternative statistics do in fact exist. For example, one source:  Shadow Government Statistics He does nothing except use the pre-Clinton definition of CPI. More importantly however is that monetary inflation is largely hidden. A good chunk of it (about a third as a round figure) is exported and held by foreign central banks (e.g. in Asia & the Middle East). Another third or thereabouts had been hidden by increasing productivity. The last third shows up eventually in price inflation, which is then under-reported by government statistics by maybe a half or so. These fractions are rough estimates and can change over time for lots of reasons of course. My third point is that we don't see an increase in interest rates because the Fed keeps them artificially low. That's how it inflates the money supply in the first place. Until the unsound fundamentals of the economy become so eggregious that they can't be papered over any more, and the Fed has to throw on the monetary brake. Interest rates jump, and people realize suddenly that their artificially inflated standard of living must now be payed for with a period of deprivation. The boom has to be paid for in the bust. Lastly I will point out that even if you could correctly prognosticate what price inflation will be in the future, which is extremely difficult to do, given that you have little idea what Fed policy or foreign central bank policy will be a year down the line, nor can you predict what will happen to productivity, or any number of other factors that factor into, so that you could calculate what the "actual" interest rate should be, it doesn't help you as an entrepreneur. Why? Because you are trapped in a prisoner's dilemma. Businessmen all over the economy see an artificially lowered interest rate and are borrowing money to invest in expanded production. They are bidding up the prices of your inputs. They are squeezing your profit margins. If you don't also invest in expanded production, you can be put out of business. And as long as you can increse production and your output prices are rising, which they are because consumers are in a frenzy of boom-driven driven consumption, your profits will look great in the short run:  The problem is that input prices rise faster than output prices. Entrepreneurs are using their newly printed money to fight over too few resources to complete all the projects that have been started, and eventually the ride to the top of the rollercoaster is over. The artificially low interest rate drives a wedge between real savings and investment that can't be magicked away with still more paper money. Now the [censored] is REALLY going to hit the fan when foreign central banks and investors start dumping the dollar. All those little greenbacks are going to come home to roost, and then we'll see what real inflation looks like. That's what happened in the 70s, and we're headed that way again. There were essentially 25 years worth of inflated and exported dollars that had to "clear" through back through the borders at the start of the 70s (from Bretton-Woods). We've got about that much again. |

|

#37

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] Have any of you people gone to the grocery store lately? A gallon of milk is about $6 where I live. Don't [censored] try to tell me inflation is at 2%! [/ QUOTE ] I'm not trying to undermine your point, I'm just asking a question here. Isn't part of the problem with the price of milk (and other consumables) that the supply is artificially constrained? I'm certainly not saying that the dollar value is not falling, but doesn't government subsidizing and control of supply and demand also have a pretty big impact on the price of some of these goods? [/ QUOTE ] Farm subsidies and price supports are pretty stable over time. The fact that the price of milk at any one time is not reflective of a free market in milk production shouldn't distract from the fact that the price, whatever it is, is inflating pretty rapidly. Milk was just an example, by the way. Grocery prices have doubled in the last year, and are likely to double again in the next. |

|

#38

|

|||

|

|||

|

[ QUOTE ]

All of the last two posts are wrong. Somebody PM me later to correct it. Got to run. [/ QUOTE ] By the way, I apologize for the way this came off; I was really in a hurry. Sorry. [img]/images/graemlins/blush.gif[/img] |

|

#39

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] [ QUOTE ] Have any of you people gone to the grocery store lately? A gallon of milk is about $6 where I live. Don't [censored] try to tell me inflation is at 2%! [/ QUOTE ] I'm not trying to undermine your point, I'm just asking a question here. Isn't part of the problem with the price of milk (and other consumables) that the supply is artificially constrained? I'm certainly not saying that the dollar value is not falling, but doesn't government subsidizing and control of supply and demand also have a pretty big impact on the price of some of these goods? [/ QUOTE ] Farm subsidies and price supports are pretty stable over time. The fact that the price of milk at any one time is not reflective of a free market in milk production shouldn't distract from the fact that the price, whatever it is, is inflating pretty rapidly. Milk was just an example, by the way. Grocery prices have doubled in the last year, and are likely to double again in the next. [/ QUOTE ] Whatever dude. My pure Chef Boyardee diet's been at a dollar a can for a decade! |

|

#40

|

|||

|

|||

|

[ QUOTE ]

Why should we measure inflation? [/ QUOTE ] I think that analyzing price levels is useful for consumers. Even in the absence of monetary policy designed to "manage" inflation, price levels in any geography will change over time and consumers in that geography may want to know. |

|

|

|