|

|

#21

|

|||

|

|||

|

Thanks. It's all good.

|

|

#22

|

|||

|

|||

|

[ QUOTE ]

I'm amazed that yields on the long end are as low as they are. [/ QUOTE ] yea, one of my highest conviction trade ideas is long BEI. no way long rates stay this low while inflationary pressures stay as they are. (long BEI= long TIPS/short US10yr on a duration adjusted basis) Barron |

|

#23

|

|||

|

|||

|

[ QUOTE ]

Thanks. It's all good. [/ QUOTE ] glad to hear it [img]/images/graemlins/smile.gif[/img] (legitimate smiley). did my post help in terms of the meat and potatoes of the discussion? i'd love to hear yoru thoughts/feedback/criticisms/additions when you get a chance. thanks, Barron |

|

#24

|

|||

|

|||

|

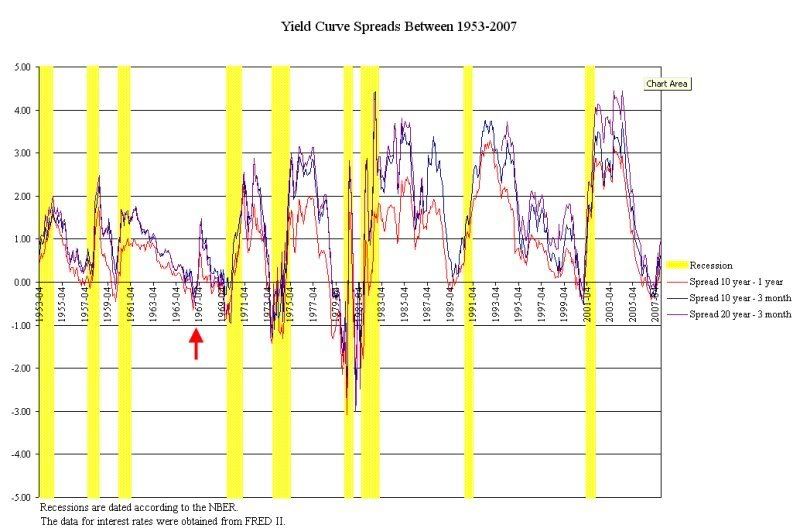

[ QUOTE ]

Graph is via personal communication from a friend who has done research on yield curve inversion as a predictor of recessions. He updated his data and sent me this:  Red arrow is a "false positive". Only one quarter of negative growth; just missed being called an official recession. Discuss. [/ QUOTE ] Glen Rudebusch and John Williams of the Federal Reserve Bank of San Francisco recently, July 2007, published a working paper on the yield curve as a predictor for signaling future recessions. We show that professional forecasters have essentially no ability to predict future recessions a few quarters ahead. This is particularly puzzling because, for at least the past two decades, researchers have provided much evidence that the yield curve, specifically the spread between long- and short-term interest rates, does contain useful information at that forecast horizon for predicting aggregate economic activity and, especially, for signaling future recessions. We document this puzzle and suggest that forecasters have generally placed too little weight on yield curve information when projecting declines in the aggregate economy. Its particularly interesting that as part of their conclusion they state "Finally, it is interesting to note that many times during the past twenty years forecasters have acknowledged the formidable past performance of the yield curve in predicting expansions and recessions but argued that this past performance did not apply in the current situation. That is, signals from the yield curve have often been dismissed because of supposed changes in the economy or special factors influencing interest rates. This paper, however, shows that the relative predictive power of the yield curve does not appear to have diminished much, if at all." and the fist response in this thread is arguing that it does not apply in the current situation as things have changed. http://www.frbsf.org/publications/ec.../wp07-16bk.pdf |

|

#25

|

|||

|

|||

|

that was a great paper. thanks for posting it.

to be fair though, i didn't say the yield curve doesn't apply. it contains a ton of great information and is determined by the market rather than forcasters. i only wanted to caution that times are quite different (as apparantly many have said they were in previous YC inversion --> recession episodes). what would be great is if there was a "degree of difference in the US/Global economy" indicator that we could use in addition to the forcasting methodology. i'm sure everybody always claims "well the economy is very different, YC inversion means less" (as i am now), but without some metric of "how different" those claims are pretty meaningless. anyways, the main point here is that there are huge downside risks to growth and the YC inversion definitely adds fuel to that fire. more fuel comes today when jobless claims and durable goods orders show further weakening in the economy. i'd say the chance of a recession is high, but definitely not certain. the yield curve does contain a ton of useful information and it is logical as well. i do think the predictive power has diminished (as the clevland fed article goes into), but you can never say "it just doesn't apply" due to a) the logic of an inversion, and b) its historic predictive power. Barron |

|

|

|