|

|

#1

|

|||

|

|||

|

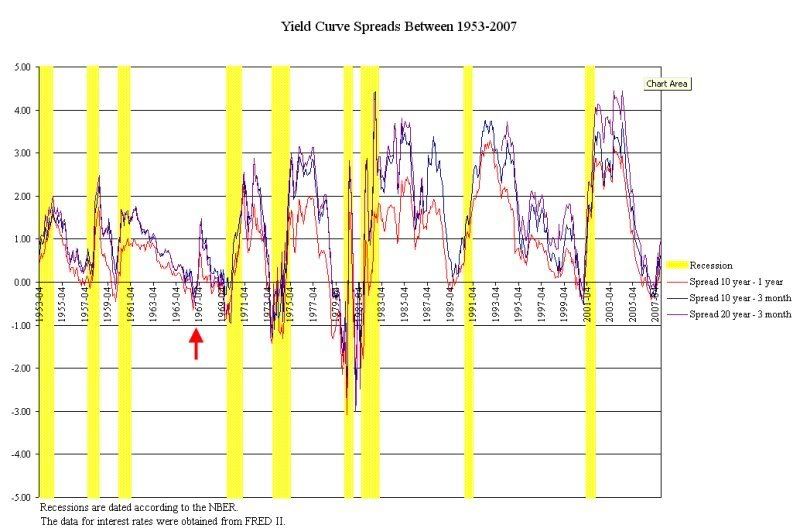

Graph is via personal communication from a friend who has done research on yield curve inversion as a predictor of recessions. He updated his data and sent me this:

Red arrow is a "false positive". Only one quarter of negative growth; just missed being called an official recession. Discuss. |

|

#2

|

|||

|

|||

|

there is a TON different today than even in 1999/2000.

to name a few: - YC inversion recently can be partially attributed to huge CA surpluses accumulated by emerging markets (and thus invested in L-T us securities) - unprecedented demand in emerging economies - highly synchronized global business cycle (good and bad, but very different) those are just a few. i'd agree with Martin Wolf's and the IMF's assessment of the future: stable, lower rate of growth with significant risks to the downside. Barron |

|

#3

|

|||

|

|||

|

Can you explain (without jargon, as it isn't my field) how those negate the yield curve inversion portent of recession? Saying "things are different" doesn't really tell me much. I'm sure conditions are different from 2000, but I'm sure 2000 was different from 91, and both were different from the early 80s, and all from the early 70s, . . . You get my point.

|

|

#4

|

|||

|

|||

|

so this means we have been recessing for last month or two?

Also, if someone is trying to get money in to stock/bond/commodity market, for first time, and he knows a recession is coming (hypothetically) what would be the best sector to invest in? This is essentially why I have not pulled the trigger for last few months; I see new highs every week, and just dont feel comfortable putting money in at a high rather than a low. I'm a total noob, and this is what a feel weather it is correct or foolish. (Judging from last few months, hell even yesterday for apple/RIM, it has been foolish). |

|

#5

|

|||

|

|||

|

[ QUOTE ]

so this means we have been recessing for last month or two? [/ QUOTE ] Not necessarily; there was a significant lag between the inversion of the YC and the circa 91 recession, at least according to the technical definition. But yeah; I think it's impossible to look around the economic news right now and not see at least a slowdown. [ QUOTE ] Also, if someone is trying to get money in to stock/bond/commodity market, for first time, and he knows a recession is coming (hypothetically) what would be the best sector to invest in? [/ QUOTE ] I'm not a guru. I understand there are certain goods that do better during recessions, like hot dogs and lipstick. So yeah, there's my stock advice. Invest in hot dogs and lipstick. [img]/images/graemlins/tongue.gif[/img] [ QUOTE ] This is essentially why I have not pulled the trigger for last few months; I see new highs every week, and just dont feel comfortable putting money in at a high rather than a low. I'm a total noob, and this is what a feel weather it is correct or foolish. (Judging from last few months, hell even yesterday for apple/RIM, it has been foolish). [/ QUOTE ] I'm cashing out, not in. |

|

#6

|

|||

|

|||

|

You forgot booze. I'm definitely liking the idea of some option plays on some of the bigger liquor companies (beer as well).

|

|

#7

|

|||

|

|||

|

[ QUOTE ]

Can you explain (without jargon, as it isn't my field) how those negate the yield curve inversion portent of recession? Saying "things are different" doesn't really tell me much. I'm sure conditions are different from 2000, but I'm sure 2000 was different from 91, and both were different from the early 80s, and all from the early 70s, . . . You get my point. [/ QUOTE ] one major difference was the fact that the actual inversion may have been fake (i.e. not entirely based off of growth vs. inflation expectations). the yield curve could be looked at as simply required returns for investing plotted against aging maturities. the more a specific maturity is demanded, the lower the yield relative to the other maturities. so if one maturity has money poured into it, then it can see its yield fall. in this case, asian economies (mostly japan and china) have financed our huge CA deficit almost entirely by purchasing medium term US notes and bonds (the 10yr and 20yr) and not purchasing any of US short maturity securities. there has been nearly $1trillion poured into these securities over the past few years (2003 on) while the short rates have been increased in the US. if you look at a plot of the 10yr and the 3mo or 1yr tbill, you'll see the 10yr basically staying flat while the shorter maturity security's yield inches up towards it as a result of monetary tightening. part of that flat 10yr yield on that chart can be attributed to the flows of money from emerging economies. even recently, as huuuuge turmoil has struck, the 10yr yield simply hasn't moved a ton relative to the yield of the 3mo (at most it moved 50-60bps while the 3mo/2yr swung around a lot more). so the cause of the inversion, and the following positive steepening of the yield curve has ancillary factors. one thing that every single other yield curve has in common is that the inversion was 100% the result of growth vs. inflation expectations. now, forget about that for a moment. what would happen in the other recessions if the US fell into one? how much could an export led growth cycle contribute to GDP relative to domestic demand? at many of those points, the answer was "not enough." today, hwoever, there is an absolute economic powerhouse emerging in addition to many other economies that are growing if we were to fall into the 4th stage of the business cycle( increase in unemployment, slack in capacity, lowering short rages, negative growth etc.). their growth demands large amount of US goods and services, a ton more than we have seen in the past as a % of global GDP. even if their growth slowed as a result of a reduction of US demand for their goods, their growth wouldn't slow by 5 percentage points. the emerging world grew over 7% per year on average from 2004-2008 (IMF forecast of the last segment). so there are upward growth pressures on the US economy coming from outside of our economy. we've started to see al ittle bit of that in the form of a shrinking CA deficit (though marginally so). additionally, the fed can do quite a bit to stave off negative growth (though eventually it won't be able to do much more) by moving consumption to today, which, while it obviously happened in earlier times as well, can, in conjunction with the above mentinoed factors, provide enough boost to keep us out of negative growth territory. so again, i agree with Martin Wolf (FT) and the IMF that '07 and '08 will see lower growth (1.9%) though with significant downside risks. i.e. if housing falls a ton more, consumption falls a ton more etc. then we may move into tenths of a point of growth and in the worse cases, negative growth territory (recession). lemme know if anything i said doesn'tm ake sense or could be worded better. thanks, Barron |

|

#8

|

|||

|

|||

|

I don't have time to reply to all of that in depth but yeah, some of that seems fishy.

How is there not "growth vs inflation" issues right now? The economy is clearly slowing (unemployment starting to tick upward, corporate profits flat, credit crunch) and the Fed just turned on the money spigot again, not to mention the weakening dollar sending foreign dollars back inside our borders to increase prices. Increasing foreign demand for US goods might be good for those producers, but we have to compete with them for those goods and inputs especially, driving up costs and squeezing some corporate profits even more. |

|

#9

|

|||

|

|||

|

[ QUOTE ]

I don't have time to reply to all of that in depth but yeah, some of that seems fishy. How is there not "growth vs inflation" issues right now? The economy is clearly slowing (unemployment starting to tick upward, corporate profits flat, credit crunch) and the Fed just turned on the money spigot again, not to mention the weakening dollar sending foreign dollars back inside our borders to increase prices. Increasing foreign demand for US goods might be good for those producers, but we have to compete with them for those goods and inputs especially, driving up costs and squeezing some corporate profits even more. [/ QUOTE ] show me where i said there aren't growth vs. inflation issues. i specifically stated they weren't the entire reason the yield curve inverted int he first place, whereas in all other times, that inversion was 100% based off of growth vs. inflation (i.e. there wasnt $1trillion poured into 1 or 2 maturities on the yield curve). and again, i didn't say we won't have a recession. there are tons of downside risks... i kinda get the feeling you didn't read my post...EDIT: or maybe skimmed it and went into "attack" mode lol Barron |

|

#10

|

|||

|

|||

|

borodog,

the clevland fed article phrased it better than i could: [ QUOTE ] Using the yield curve remains an exercise in judgment that requires balancing the long, successful history of the yield curve’s predictive power with some recent evidence of its fading foresight. [/ QUOTE ] Barron |

|

|

|