|

|

|||||||

| View Poll Results: STOP WITH THE GAY THREADS | |||

| Yes |

|

1 | 33.33% |

| Bastard! |

|

2 | 66.67% |

| Voters: 3. You may not vote on this poll | |||

|

|

|

Thread Tools | Display Modes |

|

#1

|

|||

|

|||

|

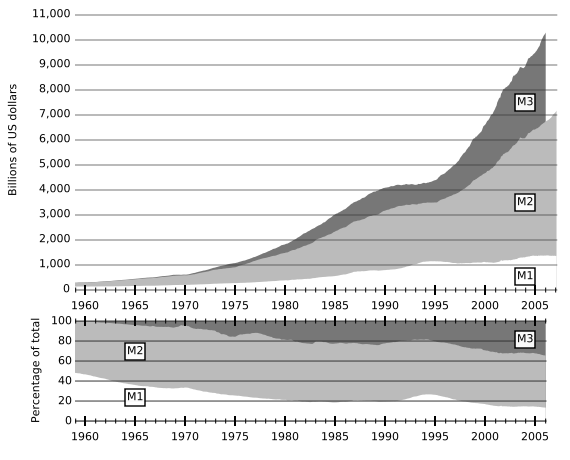

hi folks,

i'd just like to point out a huge mistake that borodog made regarding the publication of M3. here is a post he made in BFI about the "important" statistic M3: [ QUOTE ] The important number is not the total of physical cash, but the total of fiduciary instruments, M3:  Before the Fed stopped reporting M3 (supposedly because it "cost too much" to measure; this from the people who can create money), M3 was expanding at about 15% per year. [/ QUOTE ] notice especially the snide remark at the end about the fed "supposedly" not publishing it anymore b/c it costs too much. well, the problem here is that M3 contains something called repurchase agreements. these financial derivatives do not link to the real economy like the measures of M1 and M2 and thus don't correlate at all with any lag you choose to price changes. importantly, M2 DOES communicate good info about both the rate at which borrowing is readily available to US consumers and teh rate at which they take advantage of this borrowing. that is a major issue since the increase in M2 coincides very nicely with the decline of savings in the US. the main reason M3 departs from M2 from 1995-2007 is the increasing use of repurchase agreements by hedge funds and financial institutions as a means to generate leverage. specifically, my old fund i worked for, which had $170billion under management, used repos increasingly as it accumulated capital from both capital stock appreciation and increased investor deposits. it would create investment opportunities for clients by allowing them to choose the product they wanted and then "tuning" the risk level using various degrees of leverage. since bonds, especially the shallow TIPS and int'l IL bond markets, have low volatility, they require large leverage to hit that risk target relative to already risky securities. in the case of TIPS, that leverage isn't available in liquid futures markets so it has to be taken in the repo market (which shows up increasingly in M3). further, my old employer is just a drop in the bucket since the notional value of repos exceeds, by many multiples, the actual face value of the bonds on which they are taken. many other hedge funds and massive financial institutions (citigroup et. al.) use repos and have used them increasingly since the early-mid 1990's when they were popularized. as the use of repos increased, the usefulness of M3 decreased. the fed hasn't used M3 at all in monetary policy for a while because of this and other issues. one other issue, which plays a much smaller role, is the eurodollar deposits. these deposits, despite actually being dollars available for investment, typically aren't used by those consuming in dollars as an extra interest rate acheived by investing in dollars deposited in other country's banks. they are typically used as hedging instruments by european and american banks far more in proportional terms relative to normal dollar deposits and credit taken out in dollars in the US or abroad THROUGH the US (i.e. bonds issued in dollars by foreign institutions in the US). EDIT: eurodollars are also much more readily used in the "carry trade" where lower yielding currencies are sold short and the proceeds invested in higher yielding currencies. durin gthe time period in the chart, the carry trade was increasing concentrated in 4 main currencies after shorting the yen: GBP, AUD, NZD, and USD. this trade was easily accomplished in the eurodollar market since actual US banka ccounts weren't necessary. i'm not sure whether eurodollar futures contracts or other derivatives on eurodollar rates are included in M3 but if they are, that is a HUUUGE distortion of what M3 communicates. anyways, i posted this here really to get under borodog's skin since he is so highly regarded here and we have been PMing back and forth in an increasingly insulting tone. he was foolish enough to reveal to me that his correspondence with me stresses him out whereas it gives me a certain satisfaction. and i promised him i would not leave him alone regarding this mistake he made that others may not be able to accurately notice and explain to his throng of followers and those (like the mises cite) that use the cessation of the M3 publication as ammo against the fed (though i don't care so much about them as i do about discrediting boro)... ...this DESPITE the fact that he has provided a great deal of value to me regarding the austrian theory of economics (something i have communicated to him a number of times). i never would have the appreciation for free markets that i do now, nor the skepticism regarding the business cycle theory in terms of modern day conservative economics i do now. i'm not a full fledge austrian, but nor am i anywhere near a fed lover. i just try to learn as much as possible about financial market risk and markets in general and am searching for the best opportunity in which to do that. so here's to you borodog. don't be the pot calling the kettle black with this quote: [ QUOTE ] I don't know which is more infuriating, your insults or your arrogant confidence in your mistakes. [/ QUOTE ] Barron |

|

#2

|

|||

|

|||

|

[ QUOTE ]

the main reason M3 departs from M2 from 1995-2007 is the increasing use of repurchase agreements by hedge funds and financial institutions as a means to generate leverage. [/ QUOTE ] Yep. One of the reasons that some mortgage lenders went belly up was that they got margin calls on their repos when MBS disintegrated. Same thing happened to mortgage lenders during LTCM crisis in the 90's. It should also noted that the Fed is self funding.<font color="pink"> </font> |

|

#3

|

|||

|

|||

|

With regards to repurchase agreements -- are those measured in M3 transactions conducted with the FOMC, or between private institutions?

I realize the Fed is a private institution, but you get my drift. Also the Fed has, I believe, increasingly used Repos to add or subtract liquidity in the financial markets. I track Fed Repos as they can be a decent gauge of financial conditions and occasionally provide clues into future interest rate policy. |

|

#4

|

|||

|

|||

|

[ QUOTE ]

he was foolish enough to reveal to me that his correspondence with me stresses him out whereas it gives me a certain satisfaction. [/ QUOTE ] That's funny. I don't really understand these fancy M's with numbers after them, but you come across as very "chip on your shoulder" bitter. I don't really buy that you are satisfied about much of anything after reading that post, haha. Which fund did you work for by the way? One of the 5% that beat the indexes, or one of the 95% that didn't? |

|

#5

|

|||

|

|||

|

[ QUOTE ]

With regards to repurchase agreements -- are those measured in M3 transactions conducted with the FOMC, or between private institutions? [/ QUOTE ] M3 includes the total notional value of repos by both the fed and private institutions. [ QUOTE ] I realize the Fed is a private institution, but you get my drift. Also the Fed has, I believe, increasingly used Repos to add or subtract liquidity in the financial markets. I track Fed Repos as they can be a decent gauge of financial conditions and occasionally provide clues into future interest rate policy. [/ QUOTE ] interesting. while i knew the fed used them in FOMC operations, i didn't think they were increasingly anywhere nearly as rapidly as the private financial institution/hedge fund use of them. further, the fed's use of repos i think are more indicitive of liquidity conditions and the spread between the effective fed funds rate and the target fed funds rate. what data do you have regarding the increased fed use of repos and future interest rate policy? could it be that those increasing use of repos are actually a proxy for liquidity issues which could capture future monetary policy direction (like it did in the latest crisis). that is an interesting point though. Barron |

|

#6

|

|||

|

|||

|

[ QUOTE ]

these financial derivatives do not link to the real economy like the measures of M1 and M2 and thus don't correlate at all with any lag you choose to price changes. [/ QUOTE ] Before we get into any of this, what are you using to calculate price changes? [ QUOTE ] importantly, M2 DOES communicate good info about both the rate at which borrowing is readily available to US consumers and teh rate at which they take advantage of this borrowing. that is a major issue since the increase in M2 coincides very nicely with the decline of savings in the US. [/ QUOTE ] This is a curious choice of words, since US consumers are far from the only people who hold US dollars. Was this simply a generalization (equating US consumers with dollar holders)? |

|

#7

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] he was foolish enough to reveal to me that his correspondence with me stresses him out whereas it gives me a certain satisfaction. [/ QUOTE ] That's funny. I don't really understand these fancy M's with numbers after them, but you come across as very "chip on your shoulder" bitter. I don't really buy that you are satisfied about much of anything after reading that post, haha. Which fund did you work for by the way? One of the 5% that beat the indexes, or one of the 95% that didn't? [/ QUOTE ] i am bitter (at boro) and do have a chip on my shoulder (regarding boro). i thought i made that pretty clear. i worked for one of the top 3 funds in the world...killing any benchmark for decades. Barron |

|

#8

|

|||

|

|||

|

Well your bitterness sure was clear. But I just thought it was funny that you also claimed to get a "certain satisfaction" out of the exchange. I didn't really get that part.

|

|

#9

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] these financial derivatives do not link to the real economy like the measures of M1 and M2 and thus don't correlate at all with any lag you choose to price changes. [/ QUOTE ] Before we get into any of this, what are you using to calculate price changes? [/ QUOTE ] any inflation indicator you choose. typically CPI. another discussion i've had on these boards is that some (including boro) state the M2 is the best measure of inflation since inflation (in monetary supply terms) is the leading indicator of inflation (in price change terms). if this were the case, then it should be clearly visible in terms ofa lag between increases in money supply and icnrease in prices. clearly CPI or any other measure of price changes aren't perfect, or by some standards, good. but they do capture enough to be used in a correlation analysis of M2 --> price changes. when i spoke about price changes above, i definitely meant in general terms about how money supply flows to inflation. M3 does not have anywhere NEAR the economic significance as M2 as a result of everything i mentioned. [ QUOTE ] [ QUOTE ] importantly, M2 DOES communicate good info about both the rate at which borrowing is readily available to US consumers and teh rate at which they take advantage of this borrowing. that is a major issue since the increase in M2 coincides very nicely with the decline of savings in the US. [/ QUOTE ] This is a curious choice of words, since US consumers are far from the only people who hold US dollars. Was this simply a generalization (equating US consumers with dollar holders)? [/ QUOTE ] well they are by and large the largest contributors to M2. it is true that central banks contribute largely to M0 (accounts at, say the PBoC that can be converted to cash readily), but in terms of the marginal contribution to M2, US holders of savings accts, money market accounts and time deposits are by and large the main ones. the foreign central bank holdings (the biggest contributors to foreign holders)...what i think you are talking about when you speak of "dollar holders", correct me if i'm wrong...is actually relatively small compared to M2 (see the M1 section in the chart boro provided). Barron |

|

#10

|

|||

|

|||

|

Barron,

So you are saying that in addition to not knowing jack about history, Boro also doesn't know jack about economics, and that furthermore all of this is the result of his uncritical acceptance of certain writings put out by the Mises Institute? Wow. You would think an academic would be more careful in checking the accuracy of such "information" before putting it forth as a "source" for his arguments. |

|

| Thread Tools | |

| Display Modes | |

|

|