|

|

#21

|

|||

|

|||

|

[ QUOTE ]

DcifrThs, very interesting commentary, but I am wondering what your thoughs of how to take advantage of th market action you are predicting. Second, I find your posts very informative, but concentrating much more on debt market and commodity prices rather than the equity market. Is there a particular reason for this other than the fact you look at these a greater economic indicators? [/ QUOTE ] well, good point...and there is a very good reason for that: i enjoy thinking about the debt markets & commodity & currency markets more than i enjoy thinking about equity markets. i also think that the above 3 are less efficient than equity markets and thus provide more opportunity for beating the market. in terms of the first line "how to take advantage etc." i have, in the past, outlined trade ideas: 1) short US 10yr futures 2) short US 2yr futures 3) steepener: long 2 yr short 10yr futures 4) long JPYvsUSD futures 5) short gold futures 6) short gold spot long gold futures (interest rates rise steepening the futures curve further into contango for gold) i think those are all the trades that i've at some ponit advocated to varying degrees. so in general i do try to break the thought processes down into actionable trades. if you every have a questiona bout how to do that, please ask specifically and i'll tell you my thoughts and hopefully others can chime in. thanks, Barron |

|

#22

|

|||

|

|||

|

[ QUOTE ]

1) Gold -- It made some sense to care about gold in the days where options to hedge against inflation were more limited, but now? With so many ways to hedge? Gold is for curmudgeons. Can anybody cite a smart investor (Buffet, Gross, etc.) who cares about gold? [/gold rant] [/ QUOTE ] gold is an interesting investment vehicle. it performs well in different environments than otehr assets and thus is worth having in a passive investment protfolio (along w/ other commodities in small amounts). obviously the downside is that a) it does well in some environments in which equities do well, and b) it is extremely volatile. otherwise, gold is used as hard currency and as a dollar hedge in that it is priced in dollars so when the dollar falls, or is expected to fall, gold becomes more expensive in dollar terms. central banks for some reason still hold lots of the stuff, and we still have fort knox (i think??? is this right?) and there is a very liquid lending market for it so there is thus a good reason to try and understand its price moves imo. [ QUOTE ] 2) I have read in a couple of places that the decline in residential construction lopped off a percentage point off of GDP growth in the first quarter (IIRC). Anyway, that's sizable obviously and the even scarier aspect of that is that so far the construction industry hasn't shed many jobs (at least according to official numbers, though lots of folks are sceptical). [/ QUOTE ] yea thats something that is noteworthy and as far as the jobs thing goes: i think i mentioend earlier that illegal immigrants are by far more used in construction/building than anywhere else and thus are the first to be dropped/fired/not paid etc. so there may have been large cutbacks, but just not in official figures/surveys. [ QUOTE ] 3) The "Big" question -- arguably the thing to be thinking about now is what effect would a slowdown in US have on the world? I think it's pretty hard to say. The Economist (sub req?) has been suggesting that the rest of the world would not be affected that much, in which case the US might offset (partially) a reduction in consumption w/ an increase in exports. [/ QUOTE ] especially as the dollar falls. according to FOMC commentary on our exports, our trade gap tends to narrow (in favor of exports) as our domestic consumption falls since we import so darn much when we choose to consume. with a weak dollar and possible consumption dip at home, the net effect ont he economy may be minimal (which would test our capacity again and possibly push inflation pressures up). for many other (export based) countries, a domestic consumption boom doesn't necessarily induce the current account to head towards deficit (as many consume what is produced at home). finally, even if there isn't even an increase in exports, a decrease in imports (while not stimulating growth) would put less pressure on the capital account since we wouldn't have as hard of a time financing the deficit we've accumulated. [ QUOTE ] As the Chinese say, May you live in interesting times... [/ QUOTE ] word. Barron |

|

#23

|

|||

|

|||

|

[ QUOTE ]

3.) China has essentially been buying economic and social stability by pegging their currency against the dollar. Once the imbalances take effect(sometime after the Olympics), I see a global recession happening led by the US and China. Portions of the EU might escape it. [/ QUOTE ] 1) china may be temporarily buying economic (growth) stability, but it is building up larger and larger imbalances by doing so (keeping currency artificially low). inflation is now officially 4.4% and the growth rate was 11.9% wowsa! in terms of global slowdown in growth, that is definitely going to eventually happen for a few reasons, the most compelling is the fact that we are all basically in a mid to late cycle environment where rates start to have to come up and thus growth slows down. recessions may occur or may not, however they are FAR more likely to occur in completely export oriented economies and ones in which imbalances are allowed to build (or encouraged). i think the EU will also eventually hit a slowdown as rates are forced up and germany and france enter that late stage of the buesinss cycle. but overall, the fact that ALL OECD countries business cycles are strongly correlated now leads to the reasonable conclusion that when the big ones turn down, the rest will follow as that correlation (As a result of globalization and interdependent economies) plays out in both directions. Barron |

|

#24

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] 3.) China has essentially been buying economic and social stability by pegging their currency against the dollar. Once the imbalances take effect(sometime after the Olympics) [/ QUOTE ] A fair point, although I've also seen it suggested (probably in the Economist) that the yuan valuation is really not that far out of whack. Of course, we can't know this for sure until they actually float it... [/ QUOTE ] whether or not the yuan is out of whack isn't the huge issue. the problem is chinese growth & inflation. china can't effectively raise rates w/ a pegged currency (though it can sterilize better than most due to govt control of banks). if rampant inflation takes hold, it may be harder than china thinks to bring it back down and the peg won't be reversed in a calm manner...it will POP. further, there is MASSSSIVE debate on both sides of the "yuan valuation" depending on which methodology you use. big mac index is notoriously lacking but an interesting indicator none-the-less. imo, the yuan is indeed undervalued fairly significantly from "fair value" however you want to define it. Barron |

|

#25

|

|||

|

|||

|

other document bets (in previous threads) i've made that have recently worked out:

- short high yeild spreads - short corporate spreads - long implied volatility other documented bets i've made that have not worked out: - betting against rate cut in july (i.e. long fed funds futures puts at 94.75)... so far that lost some money as people expect housing slump to now be more persistant than once thought. this bet may work out in the end and tomorrow's GDP advance #s (while not make or break) will certainly shine some light onto it. in the near future, i'd expect equities to rally back some and yields on treasuries to move up slightly as adjustments take affect. one interesting thing about market dynamics is that large price changes tend to cluster. Barron |

|

#26

|

|||

|

|||

|

I can't believe that the market is surprised that you can't get a $350,000 mortgage for $800/month and then keep it for very long.

|

|

#27

|

|||

|

|||

|

[ QUOTE ]

bear bought CDOs that were backed by subprime mortgages. [/ QUOTE ] the bear funds made highly leveraged bets on the CDOs, which was a very bad idea. i actually think that the aaa subprime cdos that are backed by assets offer an attractive return right now. moodys released a report the other day showing that while the subprime defaults are going to be very substantial the recovery rates will almost certainly cover the aaa tranches of subprime cdos. i think though that the subprime cdos rated aa and below are going to suffer big losses and that includes the "aaa" cdo squareds that are actually made up of aa tranches of subprime cdos. |

|

#28

|

|||

|

|||

|

[ QUOTE ]

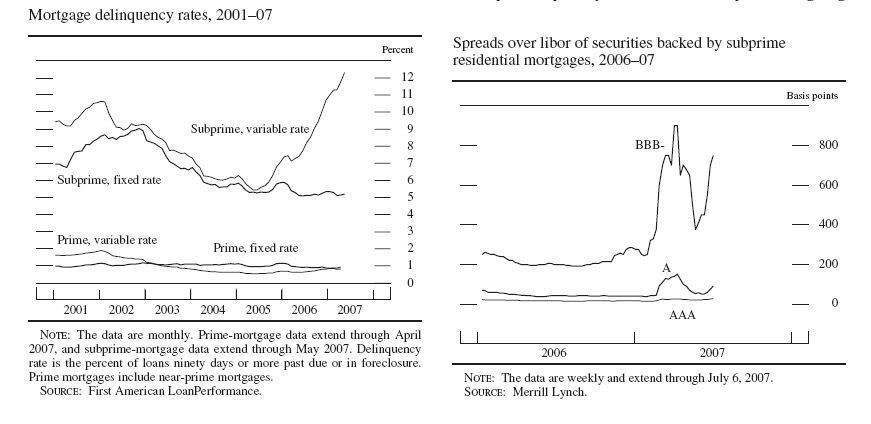

[ QUOTE ] bear bought CDOs that were backed by subprime mortgages. [/ QUOTE ] the bear funds made highly leveraged bets on the CDOs, which was a very bad idea. i actually think that the aaa subprime cdos that are backed by assets offer an attractive return right now. moodys released a report the other day showing that while the subprime defaults are going to be very substantial the recovery rates will almost certainly cover the aaa tranches of subprime cdos. i think though that the subprime cdos rated aa and below are going to suffer big losses and that includes the "aaa" cdo squareds that are actually made up of aa tranches of subprime cdos. [/ QUOTE ] maybe i'm missing your point here...but have the charts changed that much since july 6th?...  'cause from fed chairman's testimony to congress, it looks like the high grade credit barely moved where crossover credit had tons of action... Barron |

|

#29

|

|||

|

|||

|

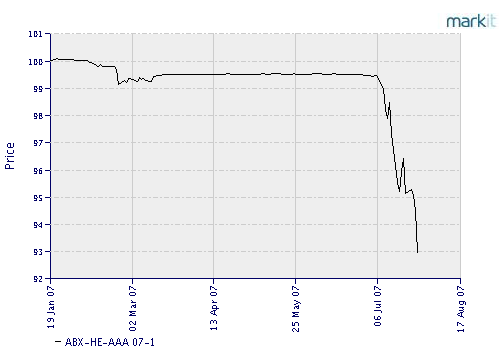

[ QUOTE ]

maybe i'm missing your point here...but have the charts changed that much since july 6th?... [/ QUOTE ] I think it is fair to say that the answer is yes: http://www.markit.com/information/af...ns/abx/history |

|

#30

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] maybe i'm missing your point here...but have the charts changed that much since july 6th?... [/ QUOTE ] I think it is fair to say that the answer is yes: http://www.markit.com/information/af...ns/abx/history [/ QUOTE ] ok did some searching here and it does appear that the top tranhches still fell about 7% in late july. what i still don't understnad (but can guess) is why they list a price fall as a bad thing. when you are dealing with CDSs, the cost of insuring a certain amount of money against defaults (based on the companies, loans, whatever happens to be securitized) the higher the amount you have to pay, the worse the credit quality of those things you're insuring. i guess they just indexed it such that an increase in subprime backed CDS prices (which the ABX index tracks) represents a fall in the index. but that makes reporting difficult... [ QUOTE ] The ABX index, which measures the risk of owning bonds backed by home-loans to people with poor credit, rose 30 percent since Aug. 9 to the highest since January. There are more than $500 billion of such notes outstanding. The increase in the index shows traders expect mortgage delinquencies and foreclosures to increase at a time when the number of homes for sale as measured by the National Association of Realtors is at a 13-year high. The percentage of home-loan payments more than 60 days delinquent rose to 7.23 percent in July from 5.9 percent a year earlier, the fastest rate of increase since 1998, Moody's Investors Service said Oct. 17. [/ QUOTE ] this is from an oct. 2006 bloomberg article. that makes sense to me because the way the ABX index functions is that an investor pays say $250,000 to protect a $10million portfolio of BBB- (for example) rated bonds against default for up to 5 years. when the cost rises, the insurance becomes more expensive and the credit quality has deteriorated. either way, i can't find out what a 7% drop in a AAA abx index represents exactly. what does it MEAN? i can guess , whatever it is, that it is very significant based on the 2007 chart of asset backed securities index price:  it could mean though that maybe only a 100 bp spread priced in on AAA backed credit default swaps vs. the 50bps previously priced in. so how do you back out the spread from the index (i.e. where can i get the yield to maturity on these securities?)? how do you back out the expected default rates based on index prices? how do you know what is currently priced in by the market in terms of defaults? and what data was released other than new home sales that triggered this? if you want to bet on the price of AAA backed ABX index, i'd be 100000% sure i knew all of that info. it is certainly conceivable, given the draw of US treasuries, that a general flight from these types of derivatives have occured and that they are now underpriced (errr...uhh... overpriced in terms of insurance against default costs) relative to expected likely defaults based on available data. Barron |

|

|

|