|

|

#91

|

|||

|

|||

|

[ QUOTE ]

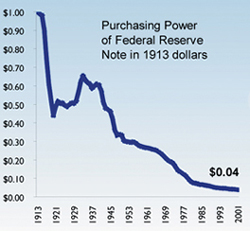

[ QUOTE ] [ QUOTE ] [ QUOTE ] [ QUOTE ] [ QUOTE ] Paul made a comment that today's dollar is only worth 4 cents when compared to 1913(?) dollars. What context was this in? [/ QUOTE ]  As a result, the Federal Reserve Note (US dollar) has lost 96% of its purchasing power since 1913. Source: U.S. Dept, of Labor, Bureau of Labor Statistics, CPI [/ QUOTE ] Link? [/ QUOTE ] it's from libertydollar.org and it is inflation. i don't see a huge problem in using it as a measure of purchasing power (of the basket of goods that headline CPI is composed of). Barron [/ QUOTE ] It depends on how one interprets "purchasing power". The casual listener/reader would react "ZOMG, I can only buy 4% of what I could in 1913, what a disaster". Of course that is only a portion of the picture. The real question is what does 1 hour (or one month or one year) of my labor buy. As you noted in another thread, you can increase the money supply by printing double the money, but if prices exactly double, and wages exactly double, there is no net impact (lets not get into a tax rate discussion, they can be adjusted too). Yet this kind of "purchasing power" graph would show a decline in purchasing power of 50%, simply because prices doubled. It is a deceptive at best, meaningless at worst, graph and statement by RP. [/ QUOTE ] OK, now i see what you meant. then yes in this case it is misrepresenting the facts since the real graph of purchasing power would be wage/income growth vs. inflation (i.e. real wage/income growth). i think that would likely show that we have more purchasing power today than we did back then. this is likely due to increases in productivity from technological advances. so i'd guess that 1 hrs wage back then would buy less than 1 hrs wage today. Barron [/ QUOTE ] Exactly...and layer on top of that increases in the quality/value of the goods that have actually decreased in "labor equivalent value" and you can dismiss statements like RPs as rhetoric at best. |

|

#92

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] [ QUOTE ] My question would be, why is artificial inflation necessary for anything other than being able to "afford" excess spending? It seems it would be a whole lot simpler for everyone if the dollar was worth the same amount for a long time. [/ QUOTE ] You are introducing a value judgement with the word "artificial". What is "artificial" inflation vs "real" inflation? I think once we get passed that the ultimate answer to what youre really asking is that moderate wage and price escalation provides a needed buffer against deflation. [/ QUOTE ] Well, by artifical I meant by increasing the money supply by printing money. I guess I don't understand how wages/prices being stable is going to lead to deflation, or even why that would be bad. <font color="red">There are a number of discussions here and on the web about the dangers inherent in deflation. Dcifr would know better than I, but I have never read any economist who doesnt believe that deflation poses a greater risk to an economy than moderate inflation. Think of "stability" as walking a monetary tightrope, and then there is a shock to the system. Some shocks push you off to the deflation side, some to the inflation side. The net (available remedial action) on the inflation side is stronger, and the fall isnt as far. If your balance bar is already tilted to the inflation side, a shock toward deflation gets you upright before it pushes you off the other side. </font> Also, shouldn't their be a global aspect to this? If all of sudden there is more of our money floating around it sure seems like that would hurt our ability to buy things not made in the U.S. [/ QUOTE ] I think people are trying to take the scenario too black and white. There are numerous ramifications, domestic and global, that would have some effect, and many effects would be offsetting. The point was that on a very simplistic, formulaic basis, MV=PQ will show no effect on Q if both M and P increase at the same rate and V is unchanged. |

|

#93

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] [ QUOTE ] My question would be, why is artificial inflation necessary for anything other than being able to "afford" excess spending? It seems it would be a whole lot simpler for everyone if the dollar was worth the same amount for a long time. [/ QUOTE ] You are introducing a value judgement with the word "artificial". What is "artificial" inflation vs "real" inflation? I think once we get passed that the ultimate answer to what youre really asking is that moderate wage and price escalation provides a needed buffer against deflation. [/ QUOTE ] You consider what my grandfather (1920-) has experienced in his lifetime moderate wage and price escalation? Or do you think future bureaucrats will manage the dollar better? [/ QUOTE ] Both |

|

#94

|

|||

|

|||

|

In more recent times however, the dollar has shrunk in value quite a bit (measured by gold/euros/oil) while average wages have remained basically flat. Compare 2001 to today. If you retired in 2002, you better forget about that occasional trip to Europe or new SUV.

|

|

#95

|

|||

|

|||

|

[ QUOTE ]

I think people are trying to take the scenario too black and white. There are numerous ramifications, domestic and global, that would have some effect, and many effects would be offsetting. The point was that on a very simplistic, formulaic basis, MV=PQ will show no effect on Q if both M and P increase at the same rate and V is unchanged. [/ QUOTE ] If V is unchanged? That's a hell of an assumption. It's the fact that this pesky V does change substantially and erratically that doomed this simplistic model for any practical use. Also, if you capriciously increase the supply of money, then the concept of M in that equation would become hazy, as people would lose trust in the currency and use other things as money instead. |

|

|

|