|

|

|

|

#1

|

|||

|

|||

|

[ QUOTE ]

I won $840 vs. $890 if Miami won. I must suck because I gave up $160 so that I guaranteed $840. Hedging sucks. Not...I was 1 unlikely interception from seeming like a genius. $160? I could give a [censored]. $840? Very nice. [/ QUOTE ] You gave up $250. Us non-hedgers also got the $90 Mansion referral bonus, for a total win of $1,090. |

|

#2

|

|||

|

|||

|

lol I love how people who let it ride when the line was at -5/-4.5 talk about how the hedgers gave up EV

when the line moved to even hedging when it was -5/-4.5 was much much more +EV than letting it ride at -5/-4.5 was nice suckout fish |

|

#3

|

|||

|

|||

|

What you are suggesting is that we should have predicted the line moving to even and hedged the bet more when it was -5/-4.5...

|

|

#4

|

|||

|

|||

|

OP

you can't figure out what's optimal for others without considering their attitude towards risk |

|

#5

|

|||

|

|||

|

And you can't start this kind of thread without looking like a pompous ass. I didn't hedge, but I'm not so arrogant as to presume what was best for me is also best for everyone else.

|

|

#6

|

|||

|

|||

|

[ QUOTE ]

OP you can't figure out what's optimal for others without considering their attitude towards risk [/ QUOTE ] I believe this to be the correct answer in the thread. I haven't read all responses, so others may have made similarly correct remarks. While maximizing EV is certainly one perspective and certainly a valid one, it is not the only valid one. Like econ_tim has pointed out, the "optimal decision" depends on both EV and attitude towards risk. If I have a 0% risk tolerance, I am hedging 100%, and that is the correct move for me. I am not a stock trader nor do I think stock trading is gambling per se, but I like to use it as a comparative example. Startup company A's stock will often have an EV higher than that of an established company. Risk, however, is much higher. Which is the correct investment? The answer is, it depends. If I'm creating a short-term portfolio to fund my child's upcoming college education, I may choose the risk-averse, lower EV option. Similarly, if I know that I need $500 for rent this month and I don't know if I will be able to make that money otherwise, I'm going to take the lower EV, 100% hedged bet to guarantee my rent will be paid on time. Realize that this example isn't without its flaws, but it illustrates the importance of risk tolerance. EV can't be viewed inside a vacuum. |

|

#7

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] you can't figure out what's optimal for others without considering their attitude towards risk [/ QUOTE ] [/ QUOTE ] In fact, econ_tim, the type of analysis I performed is standard in economics, and it is easy to show that people are acting suboptimally without determining what is optimal. Recall the notion of Pareto efficiency in a related (but not identical) context. I mentioned that for some people, a 0% hedge was appropriate, for some 20%, and for some 80%. For almost no one was a 100% hedge appropriate. I'm not telling you how much the optimal hedge was for you. I'm telling you that hedging 100% was almost certainly wrong, even if it was better for you than hedging 0%. [ QUOTE ] While maximizing EV is certainly one perspective and certainly a valid one, it is not the only valid one. [/ QUOTE ] It looks like you completely missed the point, and are attacking a straw man argument. I'm not saying hedging is never right, and I stated that I considered hedging here. The V of my EV didn't stand for money, but for utility. I'm saying that many people hedged the wrong amount after making a common error. [ QUOTE ] If I have a 0% risk tolerance, I am hedging 100%, and that is the correct move for me. [/ QUOTE ] No advantage gambler has 0 risk tolerance. For an advantage gambler, hedging 100% is an inconsistent choice. I don't have to determine the right choice to point out that an inconsistent choice is wrong. If you recognize that hedging 100% was wrong, but decided it was too much effort to do better, that's ok. Not noticing that hedging 100% was wrong indicates a conceptual error that is likely to be repeated. Being unable to admit that hedging 100% was wrong after it is pointed out and explained by a mathematician is just being dense. |

|

#8

|

|||

|

|||

|

[ QUOTE ]

OP you can't figure out what's optimal for others without considering their attitude towards risk [/ QUOTE ] Man I was getting furious because this is the millionth post I've seen on 2+2 where somebody implicitly assumes +EV = good and -EV = bad. EV is not the end all and be all of decision-making calculus. Don't pretend to know what's best for other people. As econ_tim pointed out, you don't know their risk preferences. |

|

#9

|

|||

|

|||

|

wardecker the OP called out all hedgers in original post.

you dont think i know making a f'n sports bet requires juice then you are idiot. just like playing blackjack without bonus is -ev, hedging without a bonus is -ev. but for alot they made bonus and kickback on sportsbooks they would have never opened so it was +ev for many. simply making a thread saying sportsbooks require juice so hedgers made a wrong decision is stating the obvious if you dont take bonus into account. but bonus/kickback was used let's start a new thread... to blackjack players, insult to injury |

|

#10

|

|||

|

|||

|

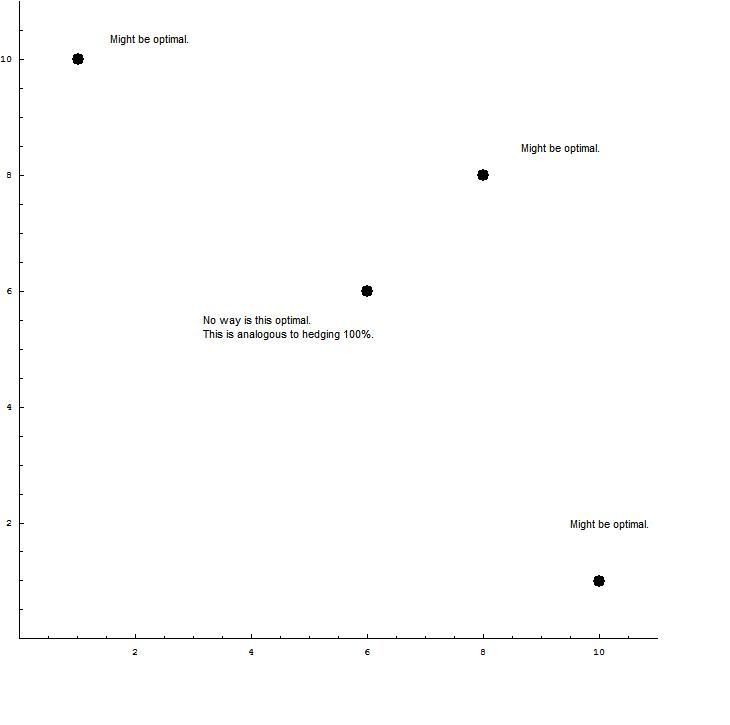

[ QUOTE ]

Man I was getting furious because this is the millionth post I've seen on 2+2 where somebody implicitly assumes +EV = good and -EV = bad. EV is not the end all and be all of decision-making calculus. [/ QUOTE ] You missed the point. I am not saying that +E$ is good and -E$ is bad. I stated explicitly many, many times that hedging can be right. Hedging 0% may be right. Hedging 20% may be right. Hedging 80% may be right. Hedging 150% may be right, if you think the line was far off. Hedging 100% is almost certainly wrong. I'm willing to wager that an independent 2+2 author referee would agree with me. [ QUOTE ] Don't pretend to know what's best for other people. As econ_tim pointed out, you don't know their risk preferences. [/ QUOTE ] As I and others have pointed out, you don't have to know someone's preferences to see they are making a mistake. Let's suppose you are choosing between bundles of two goods. You choose between (10,1), (8,8), (6,6), and (1,10).  The choice between (1,10), (8,8), and (10,1) depends on your preferences. Almost no one should choose (6,6), which is inferior to (8,8). Hedging 100% is like choosing (6,6). Now can you admit that it is possible to say that a choice is wrong, without knowing your preferences? I never claimed to say what is optimal, and I'm glad to see that many people who responded understood that. I stated that hedging 100% is an inconsistent choice for an advantage gambler. We're long past the point where any misunderstandings might be my fault due to a lack of clarity. At this point, the people disagreeing have reading comprehension problems, conceptual errors, or are trolls who are unwilling to admit they are wrong even when they know it. |

|

|

|