|

|

#41

|

|||

|

|||

|

Yes, the rising tide of liquidity raises all boats. Equities first and foremost.

But then the reality of the distortion sets in. People try to evaluate what's next. Eventually all the liquidity needs to find a rational place to rest. The dollar's next support seems to be 072. What is a rational person to do with the recent run-up in equities, dead-money real estate, a new trend of rising long rates and a USD on the precupice of free-fall? After hinting at some movement over the past 12 trading days, Dow-gold relative strength is showing very strong signs of a turn, and a re-turn to the typical negatively-correlated relationship. On Wednesday the Dow goes south and gold goes up in a big way. Ditto for today, Friday the 20th. Wednesday is a big day. Excess liquidity is looking for a safe resting place. http://stockcharts.com/h-sc/ui?s=%24gold%3A%24indu |

|

#42

|

|||

|

|||

|

[ QUOTE ]

Yes, the rising tide of liquidity raises all boats. Equities first and foremost. But then the reality of the distortion sets in. People try to evaluate what's next. Eventually all the liquidity needs to find a rational place to rest. The dollar's next support seems to be 072. What is a rational person to do with the recent run-up in equities, dead-money real estate, a new trend of rising long rates and a USD on the precupice of free-fall? After hinting at some movement over the past 12 trading days, Dow-gold relative strength is showing very strong signs of a turn, and a re-turn to the typical negatively-correlated relationship. On Wednesday the Dow goes south and gold goes up in a big way. Ditto for today, Friday the 20th. Wednesday is a big day. Excess liquidity is looking for a safe resting place. http://stockcharts.com/h-sc/ui?s=%24gold%3A%24indu [/ QUOTE ] true, rising liquidity does lift 'em all... but what happens when the fourth stage of this global cycle sets in and that liquidity gets drained like so much puss from a wounded knee [img]/images/graemlins/wink.gif[/img] ?? Barron |

|

#43

|

|||

|

|||

|

The Fed might have injected more liquidity in 1929-31 and did nothing. In that period gold and gold shares do very well while general equities tank.

Study of Great Depression shapes Bernanke's views http://www.post-gazette.com/pg/05341/618606.stm |

|

#44

|

|||

|

|||

|

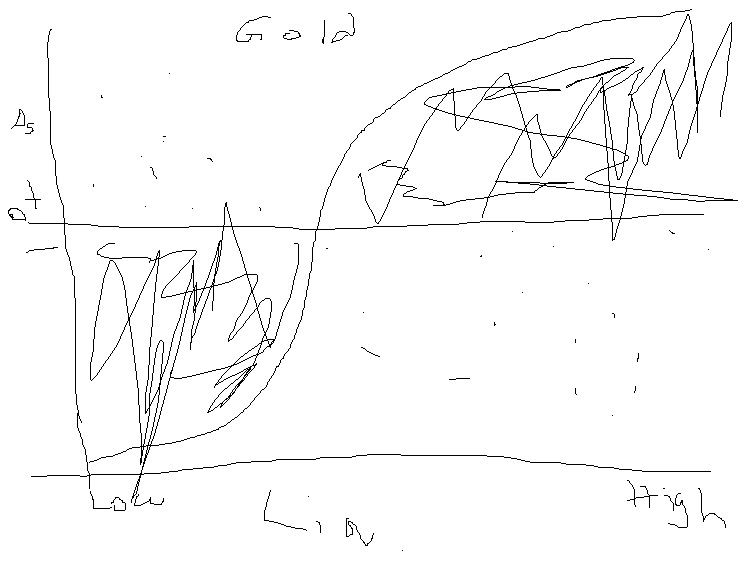

[ QUOTE ]

The Fed might have injected more liquidity in 1929-31 and did nothing. In that period gold and gold shares do very well while general equities tank. Study of Great Depression shapes Bernanke's views http://www.post-gazette.com/pg/05341/618606.stm [/ QUOTE ] i don't think that analogy is strongly relavent. look at it this way, if i were to ask you to draw what you think the distribution of gold shares would do (i.e. price changes on the Y axis) vs. the level of overall liquidity in the system (on the X axis where the far left would be an environment where nobody had any money to invest, to all the way on the right where it would be a global party where africa and every emerging market was fully functioning and contributing to the global liquidity boom with super low global real rates), what would you answer? i'd think that there are some scenarios in which high liquidity could result in negative price changes, but by far the bulk of the points i would put on that map would be increasing from the origin like this:  yea, i suck at MSPaint, but i think you get the point, i may have missed my ideal slope (b/c i think it should be a bit less steep at the conversion...i.e. more like a straight line) as well as a larger bulk in the positive changes "low liquidity" sector account for deflationary/fear type environments where one runs to an asset that will act as a store of value, but in general the massive bulk follows the logic i've presented. sure there are instances (the little dots) where gold has negative prices changes in a high liquidity environment (and positive ones in a low liquidity environment), but overall, in probability space, those take up very little area. if i were at my old job, i could pull this data and if we didn't have it, suggest or attempt to construct a liquidity indicator and then plot gold's price level against it, as well as gold's price changes against it (which would also be interesting to see, in relative and absolute value, whether gold's price changes are more drastic-and/or positive/negative- in each type of environment) Barron EDIT: i wanted to clarify a few thoughts: 1) the picture is supposed to be without respect to time. even the 'historical' test wouldn't be with respect to time since it would be like jumbling the data all around and resorting them by liquidity environment. 2) another way to do it would be to plot both the level of the indicator and the price of gold against time as far back as you could create the indicator and see what it looks like. 3) this one is important: i started out with a GUESS based on logic and have attempted to develop these pictures and thoughts in order to test that guess. if it turns out that i'm wrong, then we'd all get to learn from it so if you know of an indicator that i could play with, let me have it (or play w/ it and post the results yourself [img]/images/graemlins/smile.gif[/img] ) |

|

#45

|

|||

|

|||

|

[ QUOTE ]

Barron, OK. Wager size: $100 Instrument: GLD (ETF) Base price as of start date-- Friday June 8 close: 64.22 What we are betting on: The closing price of GLD on Friday December 7 (8th is a Saturday) If GLD closes lower than 64.22 on this date, Barron wins, otherwise Mr. Now wins. Terms: Payoff to winner from loser not later than December 14 2007; payment method by mutual agreement at that time (poker site, PayPal etc) I really like my chances here. Let's talk on December 7th. [/ QUOTE ] Mr. Now, Barron is an idiot. This is going to be the easiest 100 bucks you ever made in your life. I would not be suprised to see Gold 800 before year end. Anyone not invested in gold related assets is going to miss the bull market of a lifetime. |

|

#46

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] Barron, OK. Wager size: $100 Instrument: GLD (ETF) Base price as of start date-- Friday June 8 close: 64.22 What we are betting on: The closing price of GLD on Friday December 7 (8th is a Saturday) If GLD closes lower than 64.22 on this date, Barron wins, otherwise Mr. Now wins. Terms: Payoff to winner from loser not later than December 14 2007; payment method by mutual agreement at that time (poker site, PayPal etc) I really like my chances here. Let's talk on December 7th. [/ QUOTE ] Mr. Now, Barron is an idiot. This is going to be the easiest 100 bucks you ever made in your life. I would not be suprised to see Gold 800 before year end. Anyone not invested in gold related assets is going to miss the bull market of a lifetime. [/ QUOTE ] yes, you're correct, i'm an idiot. but your reasons are wrong...if/when i lose this bet, the reason will most likely be that i misjudged a few things, one of the main ones being the timing and lag in liquidity adjustments based on real rate hikes (and those hikes themselves). they say a trader has to get botht he logic & the timing correct. my logic and timing may have been mistaken, but iw ant to see how the gold price plays out and i don't mind a $100 lesson. it will have been far cheaper than many lessons i learned in poker. if you would like to make a more general bet that "when global real rates rise past 7%, gold prices are lower than they are right now" i'd love to take you up on it. Barron |

|

#47

|

|||

|

|||

|

[ QUOTE ]

if you would like to make a more general bet that "when global real rates rise past 7%, gold prices are lower than they are right now" i'd love to take you up on it. Barron [/ QUOTE ] I will take that action. We can have the same bet as Mr. NOW or increase it if u want. |

|

#48

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] if you would like to make a more general bet that "when global real rates rise past 7%, gold prices are lower than they are right now" i'd love to take you up on it. Barron [/ QUOTE ] I will take that action. We can have the same bet as Mr. NOW or increase it if u want. [/ QUOTE ] sounds good. i don't know where to get the exact data though (at my old job it was easy) so i think either wold bank or IMF may have something. ideally it would be a GDP weighted average of real rates of countries (i.e. our real rate right now is ~3.1% or so) but yes i accept the same terms for $100 for gold being less than $683.9 when real rates hit 7% Barron |

|

#49

|

|||

|

|||

|

New week, new trade idea.

i think it was mentioned before during the "crisis" last week, but i just read enough to feel comfortable with it. i'd be fairly short the CDS for both goldman and merrill (short meaning that i'd bet the cost of insurance against default for goldman and merrill will fall) they are both right now trading at a cost that implies a Ba1 rating (or B- or BB- i think from S&P, basically below junk/investment grade crossover) while they are both rated Aa3 (or AA i think, one of the top ratings). clearly ratings lag markets and both may not perform as well as they have in recent years, but the cost of insurance against their default is treating them like they are junk. that isn't right imo. i'd like to see how their corporate bodns have been trading (if they have any issued?) recently to get a sense for the actual spreads above treasuries and if the fear in the CDS market is also being exhibited in the corporate debt market. if the spreads have also jumped a ton, i'd long the spreads. (you execute this by taking a long position in the bond or a futures on the bonds and a short position in the similar duration treasury or treasury futures contract. you'd bet for the spread to narrow). typically, i wouldn't want to be long corp bonds at or near historical lows of spreads, but if they jumped a ton as a result of subprime fears and fears that they may default due to holding massive portfolios of loans (for chryslter and other buy outs that haven't been digested by the public) then i'd want to bet they'll come back down when people realize this is just banking. before credit derivatives, banks actually made loans based on the credit worthiniess of candidates and they profited off of the spread between their costs and the costs of their customers (in this case chrystler et.al.). the other side of the argument is that goldman & merrill didn't choose to make the chrystler loan so much as it fell into their lap. either way though, even if those loans DO default, betting that merrill or goldman would default as a result imo is a losing bet. i'd have a conviction of this at above 50%, maybe 60-70%. i'd think the CDS should fall to at least the A credit rating. goldman sachs traded as junk? jesus, that'll be the day. anybody wanna take side bets on whether goldman defaults in 5 years? lol. Barron |

|

#50

|

|||

|

|||

|

[ QUOTE ]

they are both right now trading at a cost that implies a Ba1 rating [/ QUOTE ] How do you get this? This seems to imply there is some historical fixed cost to which you can relate current prices. What if the cost that ML would default has been suppressed. We have seen a massive rising tide, how could the tide have risen without some suppression of the cost of taking on credit risk. You say your self the tide will go out, the above post seems to describe the process by which that might be facilitated. If in effect the credit rating of ML is being marked down so harshly, I would imagine that would freeze liquidity to stone. |

|

|

|