|

|

#1

|

|||

|

|||

|

A conversation I had over IM that I thought some people might find useful, given the recent questions about Austrian theories on money. This is sadly what has to pass for an OP from me these days. [img]/images/graemlins/tongue.gif[/img]

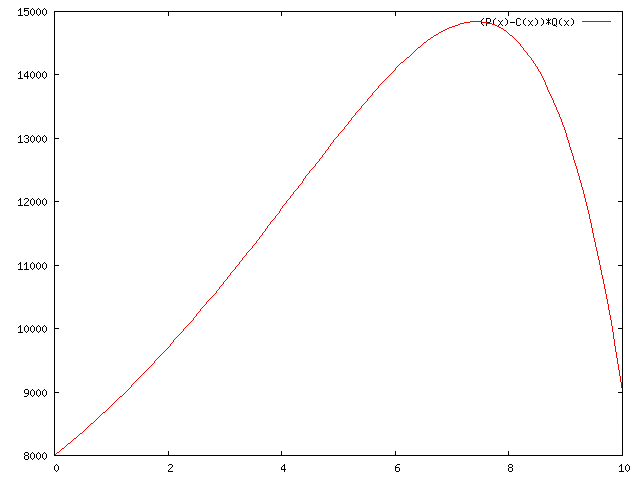

By the way, while I'm sure there actually are a "Nate" and "Borodog" on AIM, they aren't us. [14:24] <font color="blue">Nate</font>: hola [14:24] <font color="blue">Nate</font>: question [14:25] <font color="red">Borodog</font>: shoot [14:25] <font color="red">Borodog</font>: sup [14:25] <font color="blue">Nate</font>: reember the discussion we had on economy [14:25] <font color="blue">Nate</font>: recession is good [14:25] <font color="red">Borodog</font>: well, necessary [14:25] <font color="red">Borodog</font>: liquidates bad investments [14:25] <font color="blue">Nate</font>: businesses that are unstable get swallowed [14:26] <font color="blue">Nate</font>: why's that good [14:27] <font color="red">Borodog</font>: Because they are lowering people's standard of living. [14:27] <font color="red">Borodog</font>: give me a minute [14:27] <font color="blue">Nate</font>: k [14:28] <font color="blue">Nate</font>: explain... more businesses (stable or not) mean more competition, which should mean more for people... higher paying jobs and lower prices [14:29] <font color="red">Borodog</font>: Start at the start. Imagine that the economy is untampered with [14:29] <font color="blue">Nate</font>: yeah [14:29] <font color="red">Borodog</font>: and the structure of production is generally producing what people want [14:29] <font color="red">Borodog</font>: everyone is happy. [14:29] <font color="blue">Nate</font>: mmkay [14:29] <font color="red">Borodog</font>: Now, a central bank starts printing money. They inject this money into the credit market. [14:30] <font color="red">Borodog</font>: Normally, the credit market only has real money in it, i.e. previous money. [14:30] <font color="red">Borodog</font>: And all of that real, previous money competes for loans [14:30] <font color="red">Borodog</font>: but people wanting loans compete for that money [14:30] <font color="red">Borodog</font>: supply, demand, sets the "price" of loaned money, which is the interest rate [14:30] <font color="blue">Nate</font>: ok [14:30] <font color="red">Borodog</font>: (there's actually a spectrum of interest rates, depending on maturiyt, but you get the point) [14:31] <font color="red">Borodog</font>: So, central bank creates new fake money [14:31] <font color="red">Borodog</font>: injects it into the credit market [14:31] <font color="red">Borodog</font>: Increased supply of money does what to it's price? [14:31] <font color="red">Borodog</font>: Artificially lowers it [14:31] <font color="red">Borodog</font>: i.e., lowers the interest rate [14:31] <font color="blue">Nate</font>: with you [14:31] <font color="blue">Nate</font>: more loans [14:31] <font color="blue">Nate</font>: more businesses [14:31] <font color="red">Borodog</font>: (actually, it goes the other way as well; they manipulate interest rates to control the money supply, but that is irrelevent to understanding). [14:32] <font color="red">Borodog</font>: Ok, right. [14:32] <font color="red">Borodog</font>: Businessmen see lower interest rates [14:32] <font color="blue">Nate</font>: people have higher salaries and lower prices [14:32] <font color="red">Borodog</font>: wait [14:32] <font color="blue">Nate</font>: ok [14:32] <font color="red">Borodog</font>: you are getting ahead [14:32] <font color="red">Borodog</font>: Businessmen see lower interest rates. Without fake money, the interest rate might be 8%. [14:33] <font color="red">Borodog</font>: Any project where you have to take out a loan to start it, and will only return 7%, will be unprofitable. A waste of resources. [14:33] <font color="red">Borodog</font>: So the credit expansion artificially lowers the interest rate to 6%. [14:33] <font color="red">Borodog</font>: Suddenly, the project looks profitable. [14:33] <font color="blue">Nate</font>: ah [14:33] <font color="red">Borodog</font>: Businessman takes out a loan. [14:34] <font color="blue">Nate</font>: people borrow $$ to buy stock [14:34] <font color="red">Borodog</font>: Now, to undertake his new line of production, he needs to acquire factors of production. [14:34] <font color="red">Borodog</font>: Don't go there yet. [14:34] <font color="red">Borodog</font>: (But it's true) [14:34] <font color="red">Borodog</font>: That's why he needed the loan [14:34] <font color="red">Borodog</font>: so he takes his new funny money, and starts buying machinery, leasing office, factory, and warehouse space, leasing trucks, hiring workers, etc. [14:35] <font color="red">Borodog</font>: He must bid all of these factors of production away from other businesses, because the factors of production are at any one time finite. That bids up the prices for the factors of production, the so-called "input prices", the prices of things used to produce other things. [14:36] <font color="blue">Nate</font>: okay, demand from lots of businesses makes them pay more for these [14:36] <font color="red">Borodog</font>: The other way to think about it is that there are more dollars chasing the same amount of goods, which drives up prices, but since people are starting new lines of production, it drives up producer prices first [14:37] <font color="red">Borodog</font>: Yes. So unemployment goes down and wages go up. Which appears to be good. [14:37] <font color="red">Borodog</font>: But remember, the whole time, resources are actually being wasted. [14:37] <font color="red">Borodog</font>: Productive resources have been bid away from lines of production that actually were profitable, and moved to lines of production that only appear to be profitable. [14:37] <font color="red">Borodog</font>: While there is cheap credit. [14:38] <font color="blue">Nate</font>: how's it fall apart? [14:38] <font color="red">Borodog</font>: So this process continues as long as the central bank keeps printing money, and these malinvestments accumulate, until [14:38] <font color="red">Borodog</font>: 1 of 2 things happens. [14:39] <font color="red">Borodog</font>: Either the central bank throws on the monetary brake; they stop printing the funny money because of fears of inflation (I'll explain why that would bother them in a bit), or the so-called real resource crunch hits. [14:39] <font color="red">Borodog</font>: Take the real resource crunch first [14:39] <font color="red">Borodog</font>: say that there are 5 guys who want to build huses [14:39] <font color="red">Borodog</font>: *houses [14:39] <font color="red">Borodog</font>: and then sell them [14:40] <font color="red">Borodog</font>: The central bank prints money, offers cheap credit, and tricks them into thinking they can do it profitably [14:40] <font color="red">Borodog</font>: So they all go down to the building supply store at the same time, and start buying materials, and all start building their houses. [14:41] <font color="red">Borodog</font>: But because the actual physical capital, the materials and resources required to complete the projects don't actually exist, and printing money can't make them magically appear, suddenly the price of those resources shoots up [14:41] <font color="red">Borodog</font>: Their projects are revealed to be unprofitable [14:42] <font color="red">Borodog</font>: And nobody can finish their houses [14:42] <font color="red">Borodog</font>: all those materials have been wasted [14:42] <font color="red">Borodog</font>: those malinvestments must be liquidated [14:42] <font color="red">Borodog</font>: at a loss [14:42] <font color="red">Borodog</font>: (someone else's gain, by the way, since they get a deal on whatever resources are being sold off) [14:43] <font color="red">Borodog</font>: So that's one way. [14:43] <font color="red">Borodog</font>: Theother way occurs when the Fed stops the printing presses [14:43] <font color="red">Borodog</font>: They stop the printing presses because you cannot just keep inflating the money supply indefinitely. [14:44] <font color="blue">Nate</font>: the home building method is similar to tariffs and embargos on things like steel which artificially inflates pricess here, right? [14:46] <font color="red">Borodog</font>: Well, the reason the prices go up is that multiple people have started new projects with funny money; and they are trying to buy up a supply of materials that has not changed; hence they bid the prices up. In an undistorted economy, the interest rate actually reflects the amount of accumulated capital, savings. [14:46] <font color="red">Borodog</font>: When savings are high, i.e. people have been producing but defering consumption, then there are more resources available for projects [14:46] <font color="red">Borodog</font>: and a low interest rate to reflect it [14:47] <font color="blue">Nate</font>: gotcha [14:47] <font color="red">Borodog</font>: When savings are low, i.e. people have been consuming what they produce rather than saving it, then there are less resources available for projects, and a higher interest rate [14:47] <font color="red">Borodog</font>: But the credit expansion [censored] that up [14:47] <font color="blue">Nate</font>: ok [14:47] <font color="red">Borodog</font>: it effectively tricks businessmen into think there are more saved up resources than there are [14:47] <font color="red">Borodog</font>: And they start projects that cannot be finished with the available resources [14:48] <font color="blue">Nate</font>: at the prices to be profitable [14:48] <font color="red">Borodog</font>: right [14:48] <font color="blue">Nate</font>: go on [14:48] <font color="red">Borodog</font>: Here's the reason you cannot inflate indefinitely: [14:49] <font color="red">Borodog</font>: So you're printing money, driving up prices, but as I explained input prices rise faster than output prices. [14:49] <font color="blue">Nate</font>: yes [14:49] <font color="red">Borodog</font>: So an amazing thing happens because of that [14:50] <font color="red">Borodog</font>: say you have a growing business producing something [14:50] <font color="red">Borodog</font>: You are expanding production, because to not expand production leaves money, profits on the table. [14:50] <font color="red">Borodog</font>: So call your sales Q. So Q is going up. [14:50] <font color="red">Borodog</font>: The price per unit sold you can get is also going up. Call that P. [14:51] <font color="blue">Nate</font>: why does P go up? [14:51] <font color="red">Borodog</font>: Inflation. [14:51] <font color="red">Borodog</font>: Of the money supply [14:51] <font color="blue">Nate</font>: ah, okay [14:51] <font color="red">Borodog</font>: Your costs, C, are also rises, because of input prices. [14:52] <font color="red">Borodog</font>: Now, your net profit is X = (P-C)Q [14:52] <font color="red">Borodog</font>: see that? [14:52] <font color="red">Borodog</font>: (output price - cost) * quantity sold [14:52] <font color="blue">Nate</font>: sure [14:52] <font color="red">Borodog</font>: that's your profit. Every term in there, P, C, and Q are all going up, but C is going up faster than P. [14:53] <font color="red">Borodog</font>: There will eventually be a crash in your profits. [14:53] <font color="blue">Nate</font>: so X will decrease [14:53] <font color="blue">Nate</font>: yeah [14:53] <font color="red">Borodog</font>: No, at first, X is going UP [14:53] <font color="red">Borodog</font>: that's the trap [14:53] <font color="blue">Nate</font>: over the long term X decreases [14:54] <font color="red">Borodog</font>: Profits go up and up and up, and then unavoidably crash, well BEFORE your costs exceed your output prices, i.e. well before the business becomes unprofitable. [14:54] <font color="red">Borodog</font>: do you have a way to graph functions? [14:54] <font color="blue">Nate</font>: my Ti 81 is at home [img]/images/graemlins/wink.gif[/img] [14:55] <font color="red">Borodog</font>: no problem [14:55] <font color="red">Borodog</font>: give me a minute [14:55] <font color="red">Borodog</font>: You have to see this [14:57] <font color="blue">Nate</font>: what does the function of that line look like, anyway? [14:58] <font color="blue">Nate</font>: describe it to me with f(x) = [14:59] <font color="red">Borodog</font>: Making a plot for you [15:01] <font color="blue">Nate</font>: found an online graphing calculator [15:01] <font color="red">Borodog</font>:  [15:01] <font color="blue">Nate</font>: png? you really are a nerd [15:01] <font color="red">Borodog</font>: heh [15:01] <font color="red">Borodog</font>: So profits go up and up and up and then . . . [15:01] <font color="red">Borodog</font>: poof [15:02] <font color="red">Borodog</font>: So what does an investor see early? [15:02] <font color="blue">Nate</font>: $$ [15:02] <font color="red">Borodog</font>: They see something GREAT! [15:02] <font color="blue">Nate</font>: that really happens in all cases? [15:02] <font color="red">Borodog</font>: And the problem is that you can't actually see the peak, because all of those terms, P, C, and Q, have short term variability [15:03] <font color="red">Borodog</font>: and you can't tell a local maximum from the global maximum [15:03] <font color="red">Borodog</font>: It doesn't have to happen in all case [15:03] <font color="red">Borodog</font>: it just has to happen in some [15:03] <font color="blue">Nate</font>: ok [15:03] <font color="red">Borodog</font>: But because people all over the economy have been tricked into making malinvestments, it tends to hit all over the economy [15:03] <font color="red">Borodog</font>: and there is a domino effect [15:04] <font color="red">Borodog</font>: which is why the recession hits economy wide [15:04] <font color="red">Borodog</font>: it's really quite amazing how obvious it is how this [censored] works [15:04] <font color="red">Borodog</font>: but very few people understand it [15:08] <font color="red">Borodog</font>: And the company is "trapped" on the curve; they have to take the profits they are making and reinvest them into expanding Q, their sales, because otherwise would be bad for their marginal profits; they'd just be left with costs increasing faster than sales prices, and immediately dwindling profits. So they HAVE to expand production to even maintain profits, much less increase them. Obviously you can't increase sales indefinitely; eventually everyone has an iPhone. [15:12] <font color="blue">Nate</font>: so wait [15:13] <font color="blue">Nate</font>: explain how recession weeds out the unstable businesses [15:13] <font color="red">Borodog</font>: They are revealed to be unprofitable. They go out of buiness. [15:13] <font color="blue">Nate</font>: and then connect the dots to: Because they are lowering people's standard of living. [15:13] <font color="red">Borodog</font>: They have to liquidate the resourecs tied up in unprofitable lines of production. [15:14] <font color="red">Borodog</font>: Firesale. [15:14] <font color="red">Borodog</font>: Other businesses get to buy up those factors cheap, reallocating them to profitable lines. [15:14] <font color="blue">Nate</font>: Maybe, but if I were in that position, I would rather complete the project and sell at a small loss than a big one [15:14] <font color="red">Borodog</font>: If possible, sure. [15:15] <font color="blue">Nate</font>: okay, so nathan's cars get sold for dirt cheap to the other businesses [15:15] <font color="red">Borodog</font>: But it doesn't matter. Remember, "project" here is usually a line of production. You are producing things that it is revealed nobody wants. [15:15] <font color="blue">Nate</font>: because he closes his doors [15:15] <font color="red">Borodog</font>: right [15:15] <font color="blue">Nate</font>: lots of businesses fold [15:15] <font color="blue">Nate</font>: unemployment up [15:15] <font color="red">Borodog</font>: In the short term [15:16] <font color="blue">Nate</font>: long term they are part of those production things other businesses get for cheap [15:16] <font color="red">Borodog</font>: untill people are hired at the corrected wage into lines of production that are actually profitable [15:16] <font color="red">Borodog</font>: there is always short term pain [15:16] <font color="red">Borodog</font>: Recessions suck. [15:16] <font color="blue">Nate</font>: what happens to prices in the profitable/stable businesses that stick around [15:16] <font color="blue">Nate</font>: less competition [15:17] <font color="red">Borodog</font>: Usually prices fall; people tighten their belts, save more spend less. So producers have to cut prices. [15:17] <font color="red">Borodog</font>: As always though, some prices may go up or down; it all depends. [15:18] <font color="red">Borodog</font>: In general though, the price level falls. [15:18] <font color="blue">Nate</font>: ok [15:18] <font color="blue">Nate</font>: and how does that falling price level increase the standard of living? [15:18] <font color="blue">Nate</font>: people lose savings, people are unemployed [15:18] <font color="blue">Nate</font>: prices may be lower, but their ARM went up [15:19] <font color="red">Borodog</font>: It doesn't; it's the reallocation of the factors of production away from wasteful lines of production back to producing things people want. [15:19] <font color="red">Borodog</font>: It's the increased savings leading to real accumulated capital, which allows REAL expansion of productivity in the lines people ACTUALLY WANT. [15:19] <font color="blue">Nate</font>: ok [15:19] <font color="red">Borodog</font>: Yes, short term, there is always pain. [15:20] <font color="blue">Nate</font>: so it's a necessary correction is what you're saying in the long term [15:20] <font color="red">Borodog</font>: ye [15:20] <font color="red">Borodog</font>: s [15:20] <font color="blue">Nate</font>: all brought about by artificial dumping of $$ intot he market [15:20] <font color="red">Borodog</font>: yes [15:20] <font color="red">Borodog</font>: think about this [15:20] <font color="red">Borodog</font>: this will make it all perfectly clear [15:20] <font color="red">Borodog</font>: Imagine you strike gold in the mountains. [15:20] <font color="red">Borodog</font>: And people hear about it and theyflock to the area. [15:21] <font color="red">Borodog</font>: The gold is an injection of money in that one place; an entire boom town is built. [15:21] <font color="red">Borodog</font>: Bars, saloons, grocery stores, barbershops, hotels, houses, etc. [15:21] <font color="red">Borodog</font>: All of that capital goes into building the town. [15:21] <font color="red">Borodog</font>: And then suddenly, the gold is played out [15:22] <font color="red">Borodog</font>: Everyone loses their jobs [15:22] <font color="red">Borodog</font>: Your real estate value plummets [15:22] <font color="red">Borodog</font>: you can't sell to even get out [15:22] <font color="red">Borodog</font>: everything that has been built there is now a waste [15:22] <font color="red">Borodog</font>: you have to cut your losses; sell what you can and abandon the rest [15:22] <font color="blue">Nate</font>: yeah [15:23] <font color="red">Borodog</font>: then the boom town is a ghost town, and the remaining capital, what there is of it, is all waste. [15:23] <font color="red">Borodog</font>: Temporarily, it sucks for those people. But they all move on to other towns, and find other work. [15:26] <font color="red">Borodog</font>: kind of cool to understand the way the world works, isn't it? [15:26] <font color="blue">Nate</font>: very... but so what were you saying that same day about consumers and spenders [15:27] <font color="blue">Nate</font>: and how we're a country of spenders [15:27] <font color="red">Borodog</font>: Ah, yeah. Inflation favors debtors. People respond to incentives, so we are a nation of debtors. [15:28] <font color="blue">Nate</font>: but china for example has input and produces output [15:28] <font color="blue">Nate</font>: we spend but don't create [15:28] <font color="red">Borodog</font>: In fact ont of the main reasons we have an inflationary monetary policy is that inflation favors debtors, and the government is the biggest debtor of them all. [15:28] <font color="red">Borodog</font>: Mwahahaha! [15:28] <font color="blue">Nate</font>: [img]/images/graemlins/wink.gif[/img] [15:29] <font color="blue">Nate</font>: what was that argument about... the eventually fall of the dollar? [15:29] <font color="red">Borodog</font>: Think about this. What if you could get *actual goods* from someone, and all you had to give them was green pieces of paper that you printed off? [15:29] <font color="red">Borodog</font>: Who is benefiting at the expense of whom? [15:29] <font color="blue">Nate</font>: right [15:29] <font color="blue">Nate</font>: but they can get goods for that paper [15:30] <font color="red">Borodog</font>: But there is one good that they want above all others [15:30] <font color="blue">Nate</font>: gold? [15:30] <font color="red">Borodog</font>: and that one good they can only get with our paper dollars [15:30] <font color="red">Borodog</font>: nope [15:30] <font color="red">Borodog</font>: second choice? [15:30] <font color="blue">Nate</font>: power [15:30] <font color="red">Borodog</font>: heh [15:30] <font color="red">Borodog</font>: oil [15:30] <font color="red">Borodog</font>: We have an agreement with OPEC [15:31] <font color="blue">Nate</font>: so that keeps our dollar inflated? [15:31] <font color="red">Borodog</font>: The United States uses its military might to stabilize the middle east vs external and internal threats, and in exchange they will only sell oil for dollars [15:31] <font color="red">Borodog</font>: Better yet, they do not turn around and sell those dollars for Euros, or buy American goods with them. [15:32] <font color="blue">Nate</font>: who made that deal? [15:32] <font color="red">Borodog</font>: Instead, they put them in their central banks as reserves, on top of which they print their own local fiat currencies. [15:32] <font color="red">Borodog</font>: Nixon. [15:32] <font color="blue">Nate</font>: so we'd probably already be pretty weak economically if that weren't the case [15:32] <font color="red">Borodog</font>: That means that to get oil, unless they have their own, every country in the world needs US dollars. [15:32] <font color="blue">Nate</font>: relative to where we are now [15:32] <font color="red">Borodog</font>: That artificially inflated the demand for dollars [15:33] <font color="blue">Nate</font>: and if at some point that goes away? [15:33] <font color="blue">Nate</font>: we tank like a lead duck? [15:33] <font color="red">Borodog</font>: And then those dollars disappear into Saudi Arabian vaults and stay there, where they don't inflate our cirulating money supply. [15:33] <font color="red">Borodog</font>: Yes [15:33] <font color="red">Borodog</font>: Want to know why Bush I gave a [censored] about Saddam Hussein invading Kuwait? [15:34] <font color="blue">Nate</font>: so the only real incentive for them to continue this is our military? [15:34] <font color="red">Borodog</font>: Fullfilling the pact; stabilizing the region. [15:34] <font color="blue">Nate</font>: why isn't this more widely known [15:34] <font color="red">Borodog</font>: Want to know why Bush II had to invade Iraq? [15:34] <font color="blue">Nate</font>: probably the same [15:34] <font color="red">Borodog</font>: Had zilch to do with "weapons of mass destruction" or 911 [15:34] <font color="red">Borodog</font>: It had to do with Saddam Hussein threatening to sell oil in Euros. [15:34] <font color="red">Borodog</font>: Had to go [15:35] <font color="blue">Nate</font>: so i'm just a tad skeptical i haven't heard this before [15:35] <font color="red">Borodog</font>: Venezuela said they were going to do the same: CIA-backed attempted coup; suddenly they don't want to sell in Euros. [15:35] <font color="red">Borodog</font>: All the sabre-rattling about Iran? Guess who wants to sell oil in Euros? [15:35] <font color="blue">Nate</font>: hmm [15:36] <font color="red">Borodog</font>: look it up. Ron Paul gave a fantastic speech on the House floor about it; Search for Ron Paul and "petrodollar" [15:36] <font color="blue">Nate</font>: Wouldn't the european countries get all up in arms about us pushing them around? [15:36] <font color="red">Borodog</font>: Lol. [15:36] <font color="blue">Nate</font>: what's funny... that they have no military power? [15:36] <font color="red">Borodog</font>: We spend more money "defending" Europe than they do [15:36] <font color="blue">Nate</font>: fair enough [15:37] <font color="red">Borodog</font>: All of Western Europe is filled with our military bases, tanks, bombers, and nuclear weapons. [15:37] <font color="blue">Nate</font>: yeah, but most of those have been there since WWII [15:37] <font color="red">Borodog</font>: Since World War Two the central banks of Japan and Germany use guess what as their reserves? [15:37] <font color="red">Borodog</font>: US dollars. [15:37] <font color="blue">Nate</font>: lol [15:38] <font color="blue">Nate</font>: so at what point does all of this change? [15:38] <font color="red">Borodog</font>: We have an empire, dude. A world-straddling military and monetary empire. [15:38] <font color="blue">Nate</font>: what happens when the next energy source comes forward? [15:38] <font color="red">Borodog</font>: Well, when people finally start selling oil in Euros, or some other currency, a funny thing happens. [15:38] <font color="red">Borodog</font>: Lets talk abou this first. [15:39] <font color="red">Borodog</font>: Suddenly, the demand for the dollar falls. The dollar weakens internationally. [15:39] <font color="blue">Nate</font>: i have a feeling i know what you're going to say [15:39] <font color="red">Borodog</font>: This is actually already happening, because the fed has been iterally burning up the printing presses for years. [15:39] <font color="red">Borodog</font>: We are extremely inflated right now [15:39] <font color="red">Borodog</font>: dollar is in the tank [15:40] <font color="red">Borodog</font>: The Fed always does this; creates the artificial boom so that the president can have a roaring economy to get elected for his second term. Then we the recession hits, it's the next administrations problem. [15:40] <font color="red">Borodog</font>: Then they do the same. [15:40] <font color="red">Borodog</font>: So anyway, the dollar is falling internationally, right? [15:40] <font color="blue">Nate</font>: yes [15:40] <font color="red">Borodog</font>: Dollar buys less internationally [15:41] <font color="blue">Nate</font>: sure [15:41] <font color="red">Borodog</font>: And when you don't need dollars to buy oil anymore, it is REALLY going to tank. [15:41] <font color="blue">Nate</font>: of course [15:41] <font color="red">Borodog</font>: Suddenly all of these dollars oversees are damn near worthless. [15:41] <font color="red">Borodog</font>: The only place they can buy stuff is then in the US [15:41] <font color="blue">Nate</font>: and we don't produce much of our own stuff anymore [15:41] <font color="blue">Nate</font>: our trade deficit is getting bigger [15:42] <font color="blue">Nate</font>: we implode [15:42] <font color="red">Borodog</font>: So foreign banks and investors and governments and other holders of dollars will start buying up US capital, property, real estate, companies, goods, whatever they can. [15:42] <font color="red">Borodog</font>: NO, no, no!. The trade deficit is CAUSED by inflation; remember, the trade deficit is us EXPLOITING others; we good goods, they get paper (that the need to buy oil, but it's still just paper). [15:43] <font color="blue">Nate</font>: ok [15:43] <font color="red">Borodog</font>: So when the dollar crashes, the trade deficit wil vanish, and we'll get a huge "trade surplus" [15:44] <font color="red">Borodog</font>: (a trade deficit is not a bad thing, by the way; the people that think it is are morons; I have a huge trade deficit with walmart; think what a trade surplus would actually be: you having to hock your [censored] to get money!) [15:44] <font color="blue">Nate</font>: that doesn't make sense... why would US businesses sell their stuff overseas if they can't get anything for it? [15:44] <font color="red">Borodog</font>: Oh, but they can; they people overseas have all of these dollars to bid. [15:44] <font color="red">Borodog</font>: All of these lovely inflated dollars come home to roost. [15:45] <font color="red">Borodog</font>: This will drive inflation in the US through the roof, exactly like it did in the early 70s [15:45] <font color="red">Borodog</font>: Which is what led to the whole petro-dollar deal with OPEC in the first place. [15:45] <font color="red">Borodog</font>: You see, Roosevelt confiscated almost all private gold in the US in the early 30s [15:45] <font color="red">Borodog</font>: largest theft in the history of the world [15:45] <font color="blue">Nate</font>: right [15:46] <font color="red">Borodog</font>: And took the US off the gold standard - INTERNALLY. But foreign banks and governments could still redeem paper dollars for gold at the rate of $35/ounce. [15:46] <font color="blue">Nate</font>: then when $35 wasn't worth what it used to be, we got screwed [15:46] <font color="red">Borodog</font>: But after WWII, America used its dominant military position to pressure central banks and governments NOT to do so; and we just printed and printed. [15:46] <font color="red">Borodog</font>: No, wait. [15:47] <font color="red">Borodog</font>: And all that money became the reserve currencies of countries all over the world, on top of which they printed their own fiat currencies. [15:47] <font color="red">Borodog</font>: Well, in the late 60s and ealr 70s, de Gaulle in France got all uppity. [15:47] <font color="red">Borodog</font>: And started demanding dollars be redeemd in gold [15:48] <font color="red">Borodog</font>: And other countries started following suit [15:48] <font color="red">Borodog</font>: now, the problem was that there was nowhere near enough gold to cover all the bills we'd printed! [15:48] <font color="red">Borodog</font>: There was a run on the US central bank [15:48] <font color="blue">Nate</font>: hehe [15:48] <font color="red">Borodog</font>: the US was going to be litterally bankrupt [15:48] <font color="red">Borodog</font>: (as it was we lost about 2/3 of our gold reserves before Nixon called it quits) [15:49] <font color="red">Borodog</font>: so Nixon halts redemption in gold [15:49] <font color="red">Borodog</font>: Now all those dollars are practically worthless [15:49] <font color="blue">Nate</font>: so he pegs it to oil [15:49] <font color="red">Borodog</font>: So people try to recoup their losses by buying things the only place they can with dollars [15:49] <font color="red">Borodog</font>: those dollars all come home to roost, and we get massive inflation. [15:49] <font color="blue">Nate</font>: gotcha [15:49] <font color="red">Borodog</font>: And a giant recession [15:50] <font color="red">Borodog</font>: And we are poised for the exact same scenario to unfold [15:50] <font color="blue">Nate</font>: if something happens to oil? [15:50] <font color="red">Borodog</font>: Yep. [15:50] <font color="blue">Nate</font>: either it's sold in something else [15:50] <font color="blue">Nate</font>: or there's another energy source [15:50] <font color="red">Borodog</font>: bingo [15:51] <font color="blue">Nate</font>: sooner or later that's bound to happen [15:51] <font color="red">Borodog</font>: yes [15:51] <font color="red">Borodog</font>: fun times ahead [15:51] <font color="blue">Nate</font>: that's when we were talking about inversting in gold [15:51] <font color="blue">Nate</font>: and precious metals [15:51] <font color="red">Borodog</font>: yeah [15:51] <font color="blue">Nate</font>: and debt would go away [15:52] <font color="blue">Nate</font>: because 100K of debt isn't worth anything anymore either [img]/images/graemlins/wink.gif[/img] [15:52] <font color="red">Borodog</font>: Well, debtors would be bankrupt or foreclosed upon [15:52] <font color="red">Borodog</font>: Which is part of liquidation of malinvestment. [15:52] <font color="red">Borodog</font>: OH, right [15:52] <font color="red">Borodog</font>: yes [15:52] <font color="blue">Nate</font>: maybe i should just start trading for euros [15:53] <font color="red">Borodog</font>: If you owe $10,000 on a loan, and suddenly it costs $10,000 for a loaf of bread, then your debt is wiped out [15:53] <font color="red">Borodog</font>: Nah [15:53] <font color="blue">Nate</font>: LOL [15:53] <font color="red">Borodog</font>: Euros aren't any better [15:53] <font color="red">Borodog</font>: Still a fiat currency [15:53] <font color="blue">Nate</font>: pesos? [img]/images/graemlins/wink.gif[/img] [15:53] <font color="blue">Nate</font>: what's a fiat currency? [15:53] <font color="blue">Nate</font>: a meaningless currency? [15:53] <font color="red">Borodog</font>: and the Euro is more inflationary than the individual European currencies it replaced, because it reduced the amount of competition among fiat monies. [15:53] <font color="blue">Nate</font>: one not based on some good, like gold? [15:54] <font color="red">Borodog</font>: An unbacked paper currency. [15:54] <font color="blue">Nate</font>: are there any that aren't? [15:54] <font color="red">Borodog</font>: Well, all the big international banks still pay each other in gold shipments, if that tells you anything. [img]/images/graemlins/wink.gif[/img] [15:54] <font color="blue">Nate</font>: serisouly? [15:55] <font color="red">Borodog</font>: Yes, to some extent at least. [15:55] <font color="blue">Nate</font>: how do they decide how much gold? [15:55] <font color="red">Borodog</font>: It has a market price. [15:55] <font color="blue">Nate</font>: wow [15:55] <font color="blue">Nate</font>: interesting [15:55] <font color="red">Borodog</font>: I don't know too much about that. [15:55] <font color="red">Borodog</font>: Just something I heard in passing. [15:55] <font color="red">Borodog</font>: So don't quote me on that one. [15:56] <font color="red">Borodog</font>: mind if I post this conversation somewhere, if I edit out you SN of course? [16:00] <font color="blue">Nate</font>: please do |

|

#2

|

|||

|

|||

|

Cliff?

|

|

#3

|

|||

|

|||

|

I included a picture. What more do you want?

|

|

#4

|

|||

|

|||

|

" Borodog: and the structure of production is generally producing what people want

[14:29] Borodog: everyone is happy." The rest of the conversation assumes that level of production is optimal, it isn't, just because "everyone is happy" "Businessmen see lower interest rates. Without fake money, the interest rate might be 8%. [14:33] Borodog: Any project where you have to take out a loan to start it, and will only return 7%, will be unprofitable. A waste of resources. [14:33] Borodog: So the credit expansion artificially lowers the interest rate to 6%." The language here is self-serving and propagandist. There is nothing "fake" about additional money supply that fuels business, and there is nonthing "artificial" about an interest rate that encourages investment. A rigid monetary standard pegged to a commodity is just as "artificial" because it subjects all other goods and services to a (necessarily) constrained supply of money. That has the converse effect of making what would otherwise be profitable enterprises unprofitable, denying their entry into the market, which hurts the consumer. "14:35] Borodog: He must bid all of these factors of production away from other businesses, because the factors of production are at any one time finite. That bids up the prices for the factors of production, the so-called "input prices", the prices of things used to produce other things. " Just because inputs are "finite" doesn't mean there isnt a sufficient supply. Well run businesses can just as well have anticipated the demand and have sufficient inventories to meet it. The rest of the conversation is the same doom and gloom about the "impending crash" that has been selling books for the last 40 years and making money for no one but the authors and publishers. The real lesson in this OP is that by choosing assumptions and placing your own value judgement on them, you can prove that the alternatives are "bad". Start out with an artifically constrained money supply and you will reach exactly the opposite conclusions. If your agenda is the malevolence of the government and the Fed you obviously aren't going to show both sides. |

|

#5

|

|||

|

|||

|

great post, in Robert Newman's a history of oil he makes the same point as you about the cause of the Iraq war being the euro thing.

|

|

#6

|

|||

|

|||

|

Wow, great read. I've been reading about all this stuff recently but this really helped me get it straight in my mind. Of course, I'm more scared now than I was before, so it's bitter-sweet.

Do you have any suggestions Boro about what we should do with our money given the likely hyper-inflationary period ahead? Should I start buying gold? |

|

#7

|

|||

|

|||

|

[ QUOTE ]

" Borodog: and the structure of production is generally producing what people want [14:29] Borodog: everyone is happy." The rest of the conversation assumes that level of production is optimal, it isn't, just because "everyone is happy" "Businessmen see lower interest rates. Without fake money, the interest rate might be 8%. [14:33] Borodog: Any project where you have to take out a loan to start it, and will only return 7%, will be unprofitable. A waste of resources. [14:33] Borodog: So the credit expansion artificially lowers the interest rate to 6%." The language here is self-serving and propagandist. There is nothing "fake" about additional money supply that fuels business, and there is nonthing "artificial" about an interest rate that encourages investment. A rigid monetary standard pegged to a commodity is just as "artificial" because it subjects all other goods and services to a (necessarily) constrained supply of money. That has the converse effect of making what would otherwise be profitable enterprises unprofitable, denying their entry into the market, which hurts the consumer. "14:35] Borodog: He must bid all of these factors of production away from other businesses, because the factors of production are at any one time finite. That bids up the prices for the factors of production, the so-called "input prices", the prices of things used to produce other things. " Just because inputs are "finite" doesn't mean there isnt a sufficient supply. Well run businesses can just as well have anticipated the demand and have sufficient inventories to meet it. The rest of the conversation is the same doom and gloom about the "impending crash" that has been selling books for the last 40 years and making money for no one but the authors and publishers. The real lesson in this OP is that by choosing assumptions and placing your own value judgement on them, you can prove that the alternatives are "bad". Start out with an artifically constrained money supply and you will reach exactly the opposite conclusions. If your agenda is the malevolence of the government and the Fed you obviously aren't going to show both sides. [/ QUOTE ] Can you explain this business of artificial constraint in more detail? I'm just now learning about all this stuff so I'm not sure I get it yet. Backed currencies don't necessarily have to be backed by only one commodity do they? It seems like if there was a demand for more currency and all the gold was already tagged and in circulation the market would produce other types of currency to meet this demand no? Say silver backed currencies, land backed currencies, currencies that are basically stakes in mutual funds, wall-mart could make it's own backed currency that could be exchanged for a certain quantity of goods that it sells, etc. It seems like there are virtually limitless possibilities for backing a currency, so how does a free market get artificially constrained by a backed currency? I'm not saying you're wrong, I just don't really understand your argument very well. |

|

#8

|

|||

|

|||

|

Actually, Reagan was going to propose that world currencies be backed by a "basket" of commodities. So, no, a currency doesn't have to be backed by just one thing.

|

|

#9

|

|||

|

|||

|

[ QUOTE ]

" Borodog: and the structure of production is generally producing what people want [14:29] Borodog: everyone is happy." The rest of the conversation assumes that level of production is optimal [/ QUOTE ] No, it doesn't. The structure of production can never be "optimal", for any reasonable definition of optimal. [ QUOTE ] , it isn't, just because "everyone is happy" "Businessmen see lower interest rates. Without fake money, the interest rate might be 8%. [14:33] Borodog: Any project where you have to take out a loan to start it, and will only return 7%, will be unprofitable. A waste of resources. [14:33] Borodog: So the credit expansion artificially lowers the interest rate to 6%." The language here is self-serving and propagandist. There is nothing "fake" about additional money supply that fuels business, [/ QUOTE ] Why is it a crime to print your own money? [ QUOTE ] and there is nonthing "artificial" about an interest rate that encourages investment. [/ QUOTE ] Lol. Lowering the interest rate discourages investment. Do you see why? [ QUOTE ] A rigid monetary standard pegged to a commodity is just as "artificial" because it subjects all other goods and services to a (necessarily) constrained supply of money. [/ QUOTE ] So? What is the "correct" amount of money? The answer of people like you seems to be simply "more than we have now". [ QUOTE ] That has the converse effect of making what would otherwise be profitable enterprises unprofitable, denying their entry into the market, which hurts the consumer. [/ QUOTE ] How? And how does printing money magically making an unprofitable business profitable, beyond the obvious profitability of being the counterfeiter? [ QUOTE ] "14:35] Borodog: He must bid all of these factors of production away from other businesses, because the factors of production are at any one time finite. That bids up the prices for the factors of production, the so-called "input prices", the prices of things used to produce other things. " Just because inputs are "finite" doesn't mean there isnt a sufficient supply. Well run businesses can just as well have anticipated the demand and have sufficient inventories to meet it. [/ QUOTE ] No, they can't. That is the entire point of an entire exchange that you apparently missed. They don't have those inputs because they do not exist; for them to exist consumption must have been deferred to accumulate them, but because of the artificially lowered interest rate, consumption is incentivized at the expense of savings, and those reserves will not exist. More "houses" are started than there exist "bricks" and "lumber" to complete. [ QUOTE ] The rest of the conversation is the same doom and gloom about the "impending crash" that has been selling books for the last 40 years and making money for no one but the authors and publishers. [/ QUOTE ] I don't know if you've noticed, but the "impending crash" has actually crashed, over and over and over, exactly as predicted. [ QUOTE ] The real lesson in this OP is that by choosing assumptions and placing your own value judgement on them, you can prove that the alternatives are "bad". [/ QUOTE ] The lesson here is that someone who does not understand a theory will make himself look foolish when he attempts to criticize it. [ QUOTE ] Start out with an artifically constrained money supply and you will reach exactly the opposite conclusions. [/ QUOTE ] You said this before. What is "artificially constrained"? Is a money supply where nobody is allowed to counterfeit "artificially constrained"? How it that one needs to create money by artifice to avoid "artificially constraining" the money supply? How much money is the "right" amount? Let me guess: more, more, more. [ QUOTE ] If your agenda is the malevolence of the government and the Fed you obviously aren't going to show both sides. [/ QUOTE ] There is only correct and incorrect. If you would care to actually explain how printing money magically makes everyone better off, be my guest. |

|

#10

|

|||

|

|||

|

Nice post. The problem that I have with this line of thinking is that reality hasn't born out (yet?) to prove it right. I think this theory is one step behind modern understanding of economics. It's kind of like the business man who thinks that the economy is going south so he doesn't hire more sales force, he doesn't buy new production equipment and doesn't engage in the business growth that got him where he is. Next thing you know, his business is going under just like he thought it would. POOF.... Self fulfilling prophecy.

Something Alan Greenspan said in an interview about the federal reserve was that it was there to facilitate what the American people do. Meaning, I think, that capital will always be available. It is hard to explain, but somehow that one statement ties it all together for me. Borodog also underestimates the sheer hegemony of a monetary and military monopoly. It is like trying to move the moon to break it. I don't think he or many other people understand the lengths that the US will go to to protect it. Politicians will always please the people. The people need bread and circuses to keep them happy. Nations will be in ashes to make that happen. That simple. |

|

|

|