|

|

#1

|

|||

|

|||

|

When we lower interest rates, the value of the currency goes down, because more money is printed. Right?

Yet according to "expert statements" I've read today, when the Japanese lower the interest rates, the value of the yen goes up "because the demand for borrowing money in yen goes up". What gives? |

|

#2

|

|||

|

|||

|

There is a cause and effect on the dollar when rates are dropped. As US citizens the benefits are fairly obvious. However, the corresponding influence on the dollar is a negative due to foreign investors seeking higher yields elsewhere. Low rates coupled with our credit troubles, has caused the dollar drop.

According to the Journal today the rise in the Yen is primarily due to "carry trades" where investors borrow money at Japan's .5 interest rate and invest the money in higher yielding vehicles. When the carry trade is closed investors have to buy back the Yen, causing the rise. |

|

#3

|

|||

|

|||

|

[ QUOTE ]

When we lower interest rates, the value of the currency goes down, because more money is printed. Right? Yet according to "expert statements" I've read today, when the Japanese lower the interest rates, the value of the yen goes up "because the demand for borrowing money in yen goes up". What gives? [/ QUOTE ] you are thinking in absolutes. currency returns are pretty much broken down as follows: ~50% interest rate differentials ~25% growth rate differentials ~15% current account differentials ~10% monetary flows this is from a barclays decomposition of currency returns study...the #s might be a little off but the gist is there. your first sentance refers to interest rate diffs -kind of...get back to that later- (if one country lowers rates relative toa nother then the demand for the higher rate country's currency goes up relative to the lower rate country's in the spot market). the "expert" was referring to the monetary flows. that being said, this "expert" is either misquoted, misunderstood, or wrong imo. think about the logic of what borrowing money in japan does to the currency...where does it come from? does that borrowed yen stay in japan?? what do you think the carry trade is?? it involves borrowing in yen and net selling it to invest (unhedged) in higher yielding currencies. this puts huge downward pressure on the yen and has contributed to its weakness int he past year (though now it is obviously strengthening for a variety of reasons). so can you linkt he article so we can dig a little deeper here? i'd like to see what the context of the statement was. now, back to this: [ QUOTE ] When we lower interest rates, the value of the currency goes down, because more money is printed. Right? [/ QUOTE ] this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar). first off, the statement is totally backwards. correctly it should read: when more money is released via open market operations, interest rates fall and then currency falls. in other words, when the decision to lower rates occurs, more money is injected into the system by open market operations in the NY Fed. this excess money lowers interest rates (lower interest rates doesn't result in more money printed. more money released results in lower interest rates). the value of the currency (all else equal) then goes down, not because more money is "printed" but because the relative demand to hold that currency drops when compared with the other available options. if the BoE keeps rates on hold and US lowers them, more people will want to hold pounds to earn UK rates vs. US rates. therefore people will sell dollars and buy pounds. the "printing of money" has no direct effect aside from the causal relationship it has with interest rate reductions. it is a nitpicky but important distinction to understand. hope this helps, Barron |

|

#4

|

|||

|

|||

|

Nice post Barron [img]/images/graemlins/smile.gif[/img]

|

|

#5

|

|||

|

|||

|

[ QUOTE ]

this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar). [/ QUOTE ] this made me chuckle.. watch out though... I'm pretty sure Borodog searches for the word Austrian and will come here calling it semantics that it's "released" money and not "printed" money or something similar |

|

#6

|

|||

|

|||

|

I see. I admit that the ACists around here have greatly affected my understanding of economics. Good to get what seems like educated input, though I must say I don't quite understand. When the interest rate goes down that means borrowing money is cheaper. Shouldn't that increase the demand for borrowing? And doesn't that mean more money will be printed?

The article was in Norwegian, so linking it will probably not do much good. It was an article in a mainstream newspaper made to warn poeple from taking up mortgages in yen. |

|

#7

|

|||

|

|||

|

[ QUOTE ]

I see. I admit that the ACists around here have greatly affected my understanding of economics. Good to get what seems like educated input, though I must say I don't quite understand. When the interest rate goes down that means borrowing money is cheaper. Shouldn't that increase the demand for borrowing? And doesn't that mean more money will be printed? [/ QUOTE ] where is this money printing thing coming from? i don't think you really understand what goes on in the economy. the treasury doesn't go around printing money left and right. nor does the fed physically print any money. the fed HAS all the money it will ever need for the open market operations. and i don't mean this figuritively. i mean the fed LITERALLY has football field sized vaults located around the country with trillions of dollars in US currency to purchase govt. bonds on the open market for policy purposes when necessary. through banking mechanism, that initial injection of money (through the purchasing of government securities from member banks) works through the system via loans above deposits in banks. THAT is the mechanism that increases the overall amount of money in the system (what i think ACissts et. al. are talking about when they say that money is "being printed"...i.e. money is being created from "nothing" in order to lower borrowing costs and icnrease borrowing overall to help bump up consumption). one thing that Acists et al. might also be referring to is seignorage, though that is a bit of a literal stretch. i hope that ramble helps. (i seem to ramble alot)... or if not, just ask another question of the clarifying variety. [ QUOTE ] The article was in Norwegian, so linking it will probably not do much good. It was an article in a mainstream newspaper made to warn poeple from taking up mortgages in yen. [/ QUOTE ] ok i think i see what is going on now. taking out a mortgage (in norway) in yen basically means that you make monthly payments in yen (i.e. buying yen with kroners) back to the bank in exchange for the initial large payment from the bank to you. if the yen depreciates vs. the kroner, then the monthly payments decrease. but if it appreciates, then the monthly payments increase. the kroner has done well vs. the yen so that may have increased demand for these types of loans. overall though that kind fo thing is risky and not advisable. Barron |

|

#8

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar). [/ QUOTE ] this made me chuckle.. watch out though... I'm pretty sure Borodog searches for the word Austrian and will come here calling it semantics that it's "released" money and not "printed" money or something similar [/ QUOTE ] well he'd be correct, but i get the feeling that many people who don't know what really happens in the economy literally think that when somebody says "hey the fed is printing money" that they are litereally sitting there with a printing press. of course the fed is in the end responsible for the whole kit'n'kaboodle in one way or another but the distinction is nonethelessimportant. Barron |

|

#9

|

|||

|

|||

|

When we say "printing money form nothing", it's a figure of speech. The money doesn't need to be physically printed to expand the money supply. An entry is simply created in an electronic account at the Fed, and then the Fed purchases government securities from special brokers during "Fed Time" in open market operations with that newly created money, via wire transfer I believe (although I'm not sure; the Fed might physically cut a check). Those brokers then deposit those funds in the commercial banks, where they become increased reserves for the banks. If commercial bank reserves are increased by $50B in this manner, the banks can then create up to a total of $500B via loans, by the magic of fractional reserve banking, if the reserve rate is 10% for example. The artificial lowering of the interest rate of course encourages people to take out these loans, which is what actually does most of the expansion of the money supply.

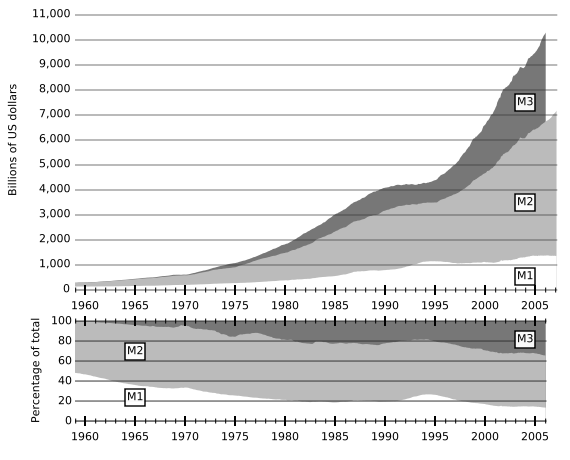

The important number is not the total of physical cash, but the total of fiduciary instruments, M3:  Before the Fed stopped reporting M3 (supposedly because it "cost too much" to measure; this from the people who can create money), M3 was expanding at about 15% per year. And once again I will point out that artificially lowering the interest rate, which is really the market price for investment funds and hence access to physical resources, causes a misallocation of those physical resources, just as any price cap on any good or service causes a misallocation of that good or service. If you cap the price of mile at $0.25/gallon, people would be bathing in milk and watering their lawns with it, and a shortage would develop. That's what happens to the physical capital stock when the interest rate is artificially capped; productive capacity is misallocated and a shortage develops that is eventually revealed in, and correct by, a recession. |

|

#10

|

|||

|

|||

|

[ QUOTE ]

this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar). first off, the statement is totally backwards. correctly it should read: when more money is released via open market operations, interest rates fall and then currency falls. in other words, when the decision to lower rates occurs, more money is injected into the system by open market operations in the NY Fed. this excess money lowers interest rates (lower interest rates doesn't result in more money printed. more money released results in lower interest rates). the value of the currency (all else equal) then goes down, not because more money is "printed" but because the relative demand to hold that currency drops when compared with the other available options. [/ QUOTE ] I like how you claim that the Austrians "reguritate drivel", and then proceed to describe exactly the situation as Austrians describe it. [img]/images/graemlins/tongue.gif[/img] Yet more evidence that you have no idea what the people you scorn are actually saying. And you are being slightly disingenuous when you say that "lowering the interest rate increases the money supply" is totally backwards. What is the intent when the Fed increases the money supply? To lower the interest rate, of course. They have an interest rate target, and if the market gets too far away from their target they will inject (or drain) reserves into (or from) the system to try to hit that target. The interest rate is the cart. The money supply is just the horse. It might come first, but what it's hauling is what's important from the Fed's point of view. |

|

|

|