|

|

#61

|

|||

|

|||

|

I [img]/images/graemlins/heart.gif[/img] Econ_Tim

ugh....that first PhD econ course was a beyatch compared to the piece of cake that was undergrad Econ I'm a maximin guy in this situation |

|

#62

|

|||

|

|||

|

[ QUOTE ]

you are misapplying your special definition of pareto improvement. [/ QUOTE ] No, I'm not. You are continuing to suggest that I must have meant the situation is exactly the same as one in which a Pareto improvement is possible, instead of simply analogous, as I stated very clearly when I made the analogy. This analogy shows that your statement ("you can't figure out what's optimal for others without considering their attitude towards risk ") was irrelevant, as has also been pointed out by other people, but which you still haven't acknowledged. [ QUOTE ] in common use, a pareto improvement is an alternative to the current allocation that makes at least one person better off while making no one worse off. [/ QUOTE ] I'm well aware of this definition. I brought it up, after all. This standard definition is consistent with my analogy. [ QUOTE ] i think what you are trying to say is that moving from a 100% hedge to a 99% hedge would be analagous to a pareto improvement. [/ QUOTE ] No, your guess is wrong. Reducing the hedge alone is not analogous, and I never intended it to be. The combination of moving from a 100% hedge to some smaller hedge while also giving up some of your normal advantage gambles will simultaneously increase EV and decrease risk. [ QUOTE ] if you want to learn about differnt type of preferences than the one's you have in mind, [/ QUOTE ] Your attempt at condescension is simply rude. This is not esoteric material at all. By the way, I have a degree in economics, in addition to my Ph. D. in mathematics, and I'm willing to wager that I'm right here. It's too bad you didn't try to back up your claim that, "It is easy to write preferences for which a 100% hedge would maximize utility." If you had attempted what you claimed was easy, you might have noticed that with typical utility functions, the marginal benefit of hedging at 100% is 0, while the marginal cost is positive. If you really have an economics background, you should recognize that as a standard indication that a position is not optimal. |

|

#63

|

|||

|

|||

|

[ QUOTE ]

OK, without taking any position as to who is arrogant, who is smart, who is dumb, or who's has the largest penis, I think the concept espoused by OP is correct, and important to keep in mind going forward. I'm not sure some of you guys are understanding it as expressed, and would like to set forth a simpler, less mathematical explanation that I hope some of you will consider when facing this scenario in the future. This, to me, is the real-life, practical application of the concept OP writes about. If I've got this wrong, I know he'll step in and correct me. Here's why you probably shouldn't hedge all the way in the future (and I'm going to use mathematical APPROXIMATIONS): Suppose I offered to give you $475. As, say, a birthday gift. It's yours, keep it. Next year on your birthday, I'm going to do you one better. Since I know you like games of chance, but also like money, I'm again going to give you $475, but IN ADDITION I'm going to let you wager on a coin toss, in any amount you want up to $475, laying 10 to win 11. One toss, one wager, but for every 10 you bet, if you win I'll pay you 11. Feel free to wager part or all of the $475 gift I'm giving you, or wager none and walk away with the $475. Now tell me, for your birthdays on years 3, 4, and 5 (upcoming), would you prefer I give the gift I gave you on year 2 or that which I gave you on year 1, or do you not care? Of course you'd take the year 2 gift every time, as you would likely take advantage of the 11-10 coin toss wager, for some marginal +EV. After all, you're getting $475 cash with each gift, why not invest in this +EV opportunity that comes with it?! Now, the point here is that most of us would probably not risk the entire $475 to win $522, but most of us would not walk away without wagering something on the coin toss either. I think I'd wager, maybe, $100 (to win $110), locking in a profit of $375, but with a 50% chance of taking away $585. Some of you would wager $30, some $350, and so on. Most would not walk away from the +EV of the 11-10 wager, but also would not risk the entire $475 either. This is exactly what happens with the Pitt/hedge/don't hedge scenario. Manison gave you gift of $475 (Approximating here!!). That's what you take away if you hedge the whole thing. And as OP pointed out, for every $10 you take away from your hedge wager, you stand to win (50% chance) $11 (because, on the hedge wager, you're laying 11 to win 10). So why not grab some of that +EV with your newly acquired $475 -- in whatever amount you're comfortable risking? After all, even the absolute cheapest, sluttiest, tramp of a bonus whore routinely undertakes risk for the benefit of +EV in the long run. With $475 to play with, we'd all probably jump at the chance to wager some part of it on a +EV wager. Those of us that did not hedge at all are the equivalent of those birthday present recipients that bet the whole $475 on a coin toss (Pitt) for a 50% shot at winning approximately $1,000. Those of us that hedged the whole thing are those that wouuld walk away from the coin-toss event without betting anything. In real life, if it were birthday gifts and coin tosses, rather than sports wagering, most would not walk away without wagering some part of the $475 on the coin toss. While everyone's 11-10 coin-toss wager amount might differ, and ultimately be a function of each's personal risk aversion factor -- doubtless the wager is something most would take, in some amount or another. This is why OP can say with certainty that to hedge the whole amount is almost always wrong (although not knowing what amount would make it right). Note: Forget other bonuses, kickbacks, etc. That's not the point here (and they can be acquired regardless). Forget line changes and possible injuries, as they are a wash in the long run and impossible to predict. This is an "all other things being equal scenario." Or do I have it all wrong, OP? Now discuss, and be nice to one another... [/ QUOTE ] Thank you for putting this down clearly. My only qualm with your logic is that this Mansion gift was not a repeated trial, like the repeated birthday gift in your analysis. If someone offered me a million $1 coinflips where they payout $1.1 to a win, I'd wager the full amount every time right? |

|

#64

|

|||

|

|||

|

Without even reading this thread I can't imagine what anyone is arguing here. I thought this forum was for people that understood basic math and expected value?

It is quite obvious that hedging here is a -EV proposition. Yes, combined with the bonus it is +EV and you are guaranteed to make money. But that doesn't make the hedging side +EV, all it does is reduce your variance - you're locking in a guaranteed profit immediately at a cost. If you couldn't get +EV betting the Miami side to begin with, why would betting it just because you have a free bet (hugely +EV) somehow make it any different a proposition? That said, I would imagine if the people on this board are that concerned with hedging it is probably in their best interest to hedge and lock in a guaranteed few hundred when considering their bankroll - that is because a hugely +EV wager such as this doesn't come around all that often. |

|

#65

|

|||

|

|||

|

Wow it is dumbfounding how dumb people are... Sorry, but you're the reason people can actually make money "gambling."

|

|

#66

|

|||

|

|||

|

[ QUOTE ]

OP you can't figure out what's optimal for others without considering their attitude towards risk [/ QUOTE ] Man I was getting furious because this is the millionth post I've seen on 2+2 where somebody implicitly assumes +EV = good and -EV = bad. EV is not the end all and be all of decision-making calculus. Don't pretend to know what's best for other people. As econ_tim pointed out, you don't know their risk preferences. |

|

#67

|

|||

|

|||

|

wardecker the OP called out all hedgers in original post.

you dont think i know making a f'n sports bet requires juice then you are idiot. just like playing blackjack without bonus is -ev, hedging without a bonus is -ev. but for alot they made bonus and kickback on sportsbooks they would have never opened so it was +ev for many. simply making a thread saying sportsbooks require juice so hedgers made a wrong decision is stating the obvious if you dont take bonus into account. but bonus/kickback was used let's start a new thread... to blackjack players, insult to injury |

|

#68

|

|||

|

|||

|

lol, and wardecker calls me stupid. quote from him in other thread

[ QUOTE ] Well, if you can get the teaser with Mia +1 (take it to +7) where ties win, then yes a teaser is an option as that leg should be +EV anyway. [/ QUOTE ] teasing + ev wtf... this is funny. get a clue ya, let's tease and then loose the 2nd leg of teaser and have a newbie be exposed to losing money with pitt loss/2nd teaser leg loss |

|

#69

|

|||

|

|||

|

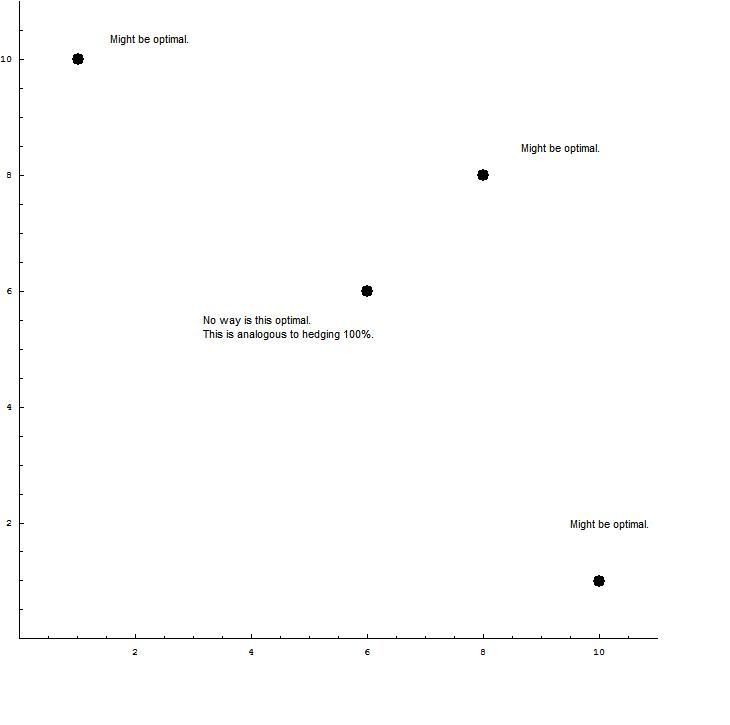

[ QUOTE ]

Man I was getting furious because this is the millionth post I've seen on 2+2 where somebody implicitly assumes +EV = good and -EV = bad. EV is not the end all and be all of decision-making calculus. [/ QUOTE ] You missed the point. I am not saying that +E$ is good and -E$ is bad. I stated explicitly many, many times that hedging can be right. Hedging 0% may be right. Hedging 20% may be right. Hedging 80% may be right. Hedging 150% may be right, if you think the line was far off. Hedging 100% is almost certainly wrong. I'm willing to wager that an independent 2+2 author referee would agree with me. [ QUOTE ] Don't pretend to know what's best for other people. As econ_tim pointed out, you don't know their risk preferences. [/ QUOTE ] As I and others have pointed out, you don't have to know someone's preferences to see they are making a mistake. Let's suppose you are choosing between bundles of two goods. You choose between (10,1), (8,8), (6,6), and (1,10).  The choice between (1,10), (8,8), and (10,1) depends on your preferences. Almost no one should choose (6,6), which is inferior to (8,8). Hedging 100% is like choosing (6,6). Now can you admit that it is possible to say that a choice is wrong, without knowing your preferences? I never claimed to say what is optimal, and I'm glad to see that many people who responded understood that. I stated that hedging 100% is an inconsistent choice for an advantage gambler. We're long past the point where any misunderstandings might be my fault due to a lack of clarity. At this point, the people disagreeing have reading comprehension problems, conceptual errors, or are trolls who are unwilling to admit they are wrong even when they know it. |

|

#70

|

|||

|

|||

|

Nice guns vs butter PPF.

|

|

|

|