|

|

|||||||

| View Poll Results: STOP WITH THE GAY THREADS | |||

| Yes |

|

1 | 33.33% |

| Bastard! |

|

2 | 66.67% |

| Voters: 3. You may not vote on this poll | |||

|

|

|

Thread Tools | Display Modes |

|

#21

|

|||

|

|||

|

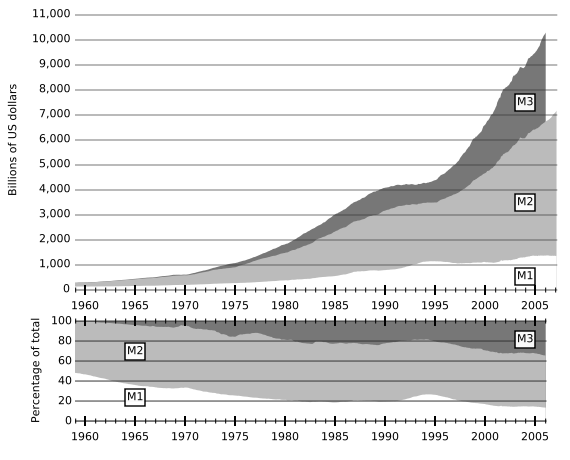

[ QUOTE ]

here is a post he made in BFI about the "important" statistic M3: [/ QUOTE ] LOL. No. Look's like it's story time. Not so long ago, in a forum not so far away, a poster made this post: [ QUOTE ] When we lower interest rates, the value of the currency goes down, because more money is printed. Right? <font color="white"> . </font> Yet according to "expert statements" I've read today, when the Japanese lower the interest rates, the value of the yen goes up "because the demand for borrowing money in yen goes up". <font color="white"> . </font> What gives? [/ QUOTE ] To which Barron von Crazy responded: [ QUOTE ] [ QUOTE ] When we lower interest rates, the value of the currency goes down, because more money is printed. Right? [/ QUOTE ] this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar). [emphasis added] <font color="white"> . </font> first off, the statement is totally backwards . . . [/ QUOTE ] Gosh. I wonder who Barron sans Readingcomprehension is talking about there? He then goes on to explain that it is not the Fed lowering the interest rate that expands the money supply, but rather that they expand the money supply to lower the interest rate. Meanwhile, I had made a post saying that "printing money" is a figure of speech, and that the money doesn't need to be physically printed to expand the money supply. That's the post that Barron snipped two sentences and a graph out of the middle of. It wasn't "about" M3. Here is the complete, unsnipped post: [ QUOTE ] When we say "printing money form nothing", it's a figure of speech. The money doesn't need to be physically printed to expand the money supply. An entry is simply created in an electronic account at the Fed, and then the Fed purchases government securities from special brokers during "Fed Time" in open market operations with that newly created money, via wire transfer I believe (although I'm not sure; the Fed might physically cut a check). Those brokers then deposit those funds in the commercial banks, where they become increased reserves for the banks. If commercial bank reserves are increased by $50B in this manner, the banks can then create up to a total of $500B via loans, by the magic of fractional reserve banking, if the reserve rate is 10% for example. The artificial lowering of the interest rate of course encourages people to take out these loans, which is what actually does most of the expansion of the money supply. <font color="white"> . </font> The important number is not the total of physical cash, but the total of fiduciary instruments, M3: <font color="white"> . </font>  <font color="white"> . </font> Before the Fed stopped reporting M3 (supposedly because it "cost too much" to measure; this from the people who can create money), M3 was expanding at about 15% per year. <font color="white"> . </font> And once again I will point out that artificially lowering the interest rate, which is really the market price for investment funds and hence access to physical resources, causes a misallocation of those physical resources, just as any price cap on any good or service causes a misallocation of that good or service. If you cap the price of mile at $0.25/gallon, people would be bathing in milk and watering their lawns with it, and a shortage would develop. That's what happens to the physical capital stock when the interest rate is artificially capped; productive capacity is misallocated and a shortage develops that is eventually revealed in, and correct by, a recession. [/ QUOTE ] You can see that what Barron claims he has his panties sucked into his anus about is the fact that I referenced M3 instead of M2, which by his own admission is "just as 'damning' from your point of view." So is this why he's flipped his lid, has been Private Harrassing me, and decided openly troll me in Politics? Because I made a passing remark about the Fed ceasing to publish M3, citing the dubious reasoning that it cost too much to track? No, of course not. After the post Barron snipped two sentences and a graph from above, I responded to Barron's "sounds like some typical drivel regurgitated from ACists or . . . austrians" with this post: [ QUOTE ] [ QUOTE ] this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar). first off, the statement is totally backwards. correctly it should read: when more money is released via open market operations, interest rates fall and then currency falls. in other words, when the decision to lower rates occurs, more money is injected into the system by open market operations in the NY Fed. this excess money lowers interest rates (lower interest rates doesn't result in more money printed. more money released results in lower interest rates). the value of the currency (all else equal) then goes down, not because more money is "printed" but because the relative demand to hold that currency drops when compared with the other available options. [/ QUOTE ] <font color="white"> . </font> I like how you claim that the Austrians "regur[g]itate drivel", and then proceed to describe exactly the situation as Austrians describe it. [img]/images/graemlins/tongue.gif[/img] Yet more evidence that you have no idea what the people you scorn are actually saying. <font color="white"> . </font> And you are being slightly disingenuous when you say that "lowering the interest rate increases the money supply" is totally backwards. What is the intent when the Fed increases the money supply? To lower the interest rate, of course. They have an interest rate target, and if the market gets too far away from their target they will inject (or drain) reserves into (or from) the system to try to hit that target. <font color="white"> . </font> The interest rate is the cart. The money supply is just the horse. It might come first, but what it's hauling is what's important from the Fed's point of view. [/ QUOTE ] Far from saying something so simple as "Oh, sorry, my bad. I didn't realize that the Austrians describe the situation the same way I do. I misunderstood their position", he tells me, that no, the Austrians don't think that at all: [ QUOTE ] the situation exactly as the austrians describe it (i.e. what the OP said) is not how it actually works in reality despite the fact that the result is the same. [/ QUOTE ] It was this point that he started gibbering about M3, which frankly I couldn't give less of a [censored] about. Now, at this point, I am, shall we say, pissed. I then made this post, with it's embarrassing overuse of CAPITALIZATION: [ QUOTE ] NO. The situation as the Austrians describe is EXACTLY how YOU yourself described it. In other words, you ascribed "drivel" to the Austrians and then went on to explain EXACTLY the situation as the Austrians decsribe it. <font color="white"> . </font> If you BELIEVE the Austrians say anything otherwise then it is YOUR MISTAKE. Which you could CORRECT if you BOTHERED TO LEARN ANYTHING ABOUT THE STUFF THAT YOU HEAP SCORN ON. YOU have apparently conflated the intent, to lower interest rates, with the mistaken belief that the Austrians believe in a mistaken belief in the direction of cause and effect (lower interest rate inflates money supply), when nothing could be furhter from the truth (the Fed wants to lower interest rates, and hence inflates the money supply to achieve this). <font color="white"> . </font> It boggles my mind that I have to explain the same exact thing to you TWICE because even after you are corrected the first time about it you still claim otherwise. This is like me telling you my favorite color is purple and you saying, "No it isn't, your favorite color is blue!" <font color="white"> . </font> I don't know which is more infuriating, your insults or your arrogant confidence in your mistakes. [/ QUOTE ] Followed by this proof that the Austrians correctly describe the manner in which the Fed manipulates the money supply to hit its Fed funds rate target: [ QUOTE ] Oh noes! Austrians explaining how the Fed lowers interest rates by expanding the money supply: [ QUOTE ] [V]ery briefly: the Fed can control the quantity of reserves held by banks, and thus indirectly can control the price the banks charge each other for lending out reserves. If the Fed thinks banks are charging each other too much for reserves — in other words, if the actual fed funds rate is higher than the target — then the Fed will engage in an "open market operation," buying assets such as US Treasury bonds from banks. The Fed pays for these purchases by adding numbers to the accounts the selling banks have with the Fed. <font color="white"> . </font> This is the precise point of entry for the new money that the Fed creates out of thin air. To repeat: When the Fed buys (say) $1 million in bonds from Bank XYZ, Bank XYZ surrenders ownership of the bonds but sees that its deposits of reserves at the Fed go up by $1 million. But the Fed didn't transfer this money from some other account. No, it simply increased the electronic entry representing Bank XYZ's total reserves on deposit. There is no offsetting debit anywhere in the banking system. Bank XYZ now has $1 million more in reserves, while no other bank has less. Bank XYZ is now free to go out and loan more reserves to other banks, or to make loans to its own customers. (In fact, due to the fractional-reserve system, the bank could make up to $10 million in new loans to customers.) The money supply has increased, putting upward pressure on prices measured in dollars. <font color="white"> . </font> But back to our original theme, the injection of reserves obviously increases their supply and thus (other things equal) pushes down the rate Bank XYZ will charge other banks who might want to borrow reserves from it. The open market operation has thus achieved the Fed's goal of pushing the actual fed funds rate down to the desired target. Of course, going the opposite way, if the actual fed funds rate were too low, the Fed would sell assets to the banks, thereby destroying some of the total reserves in the system. [/ QUOTE ] <font color="white"> . </font> There are many other examples where the Austrians make it perfectly clear that the Fed manipulates the money supply to hit the Federal funds rate target. <font color="white"> . </font> This of course is all different from the discount rate, which is the rate the Fed itself charges institutions, which it can set to be anything it likes, but since 2003 had been set at 1% point above the fed funds target. But this was slashed to just 0.5% above the fed funds target in September. Plus, since the Fed can now take basically anything as collateral, the interest rate is essentially maxed at the discount rate, since if the actual fed funds rate rises above the discount rate, banks would switch to borrowing from the Fed itself rather than each other. [/ QUOTE ] Now, Barron von Flipsout and I have a history of sparky interaction. I fully expect him to continue to miss the point, so I stopped reading the thread. Apparently he spent the next day stewing and bumping the thread (LOL), before sending me a crazy PM where he tried to make out like the point of the tiff was about M3. Uh, WTF? Oh, and he ended his crazy PM with a douchey piece of bait: "sad stuff borodog. i'll eagerly await your reply but won't be at all surprised if i never see one. [img]/images/graemlins/smile.gif[/img] [img]/images/graemlins/laugh.gif[/img] [img]/images/graemlins/blush.gif[/img]" So I went back and checked the thread. Here is his reply and my reply to it, unsnipped. I will leave it to the reader to decifer this: [ QUOTE ] [ QUOTE ] [ QUOTE ] [ QUOTE ] [ QUOTE ] [ QUOTE ] this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar). <font color="white"> . </font> first off, the statement is totally backwards. <font color="white"> . </font> correctly it should read: when more money is released via open market operations, interest rates fall and then currency falls. <font color="white"> . </font> in other words, when the decision to lower rates occurs, more money is injected into the system by open market operations in the NY Fed. this excess money lowers interest rates (lower interest rates doesn't result in more money printed. more money released results in lower interest rates). the value of the currency (all else equal) then goes down, not because more money is "printed" but because the relative demand to hold that currency drops when compared with the other available options. [/ QUOTE ] I like how you claim that the Austrians "reguritate drivel", and then proceed to describe exactly the situation as Austrians describe it. [img]/images/graemlins/tongue.gif[/img] Yet more evidence that you have no idea what the people you scorn are actually saying. <font color="white"> . </font> And you are being slightly disingenuous when you say that "lowering the interest rate increases the money supply" is totally backwards. What is the intent when the Fed increases the money supply? To lower the interest rate, of course. They have an interest rate target, and if the market gets too far away from their target they will inject (or drain) reserves into (or from) the system to try to hit that target. <font color="white"> . </font> The interest rate is the cart. The money supply is just the horse. It might come first, but what it's hauling is what's important from the Fed's point of view. [/ QUOTE ] dude. the point is that the OP regurgitated something he read here without understanding the distinction. <font color="white"> . </font> the sound bites and snippets are what i refer to as "drivel"...the situation exactly as the austrians describe it (i.e. what the OP said) is not how it actually works in reality despite the fact that the result is the same. <font color="white"> . </font> [/ QUOTE ] NO. The situation as the Austrians describe is EXACTLY how YOU yourself described it. In other words, you ascribed "drivel" to the Austrians and then went on to explain EXACTLY the situation as the Austrians decsribe it. <font color="white"> . </font> If you BELIEVE the Austrians say anything otherwise then it is YOUR MISTAKE. Which you could CORRECT if you BOTHERED TO LEARN ANYTHING ABOUT THE STUFF THAT YOU HEAP SCORN ON. YOU have apparently conflated the intent, to lower interest rates, with the mistaken belief that the Austrians believe in a mistaken belief in the direction of cause and effect (lower interest rate inflates money supply), when nothing could be furhter from the truth (the Fed wants to lower interest rates, and hence inflates the money supply to achieve this). <font color="white"> . </font> It boggles my mind that I have to explain the same exact thing to you TWICE because even after you are corrected the first time about it you still claim otherwise. This is like me telling you my favorite color is purple and you saying, "No it isn't, your favorite color is blue!" [img]/images/graemlins/tongue.gif[/img] <font color="white"> . </font> I don't know which is more infuriating, your insults or your arrogant confidence in your mistakes. [/ QUOTE ] <font color="white"> . </font> don't you get it. my beef isn't content, it's presentation. <font color="white"> . </font> man you're dense. it boggles my mind that i have to tell you again the content isn't what i'm bothered about. <font color="white"> . </font> the fact that you tell people who aren't as smart/knowledgeable as you that the fed prints money and that printing money devalues the dollar is what i'm talking about. the intent regarding interest rates is clearly the driver, we all know that (we= those who have studied this)...but the literal action isn't the intent and those that get that confused end up like the OP. <font color="white"> . </font> look at the OP's post. THAT is what i'm TALKING about. the op regurgitated that without having a clue what it actually meant...i.e. DRIVEL: <font color="white"> . </font> [ QUOTE ] to utter childishly [/ QUOTE ] <font color="white"> . </font> dictionary definition FTW! those utterances is what i'm heaping scorn upon. i've said in many posts recently that i agree to a large degree with what the austrian school is talking about. <font color="white"> . </font> on another note, i think it is hilarious that you state "the austrians describe it" like their the only ones who know what is going on under the hood. it is common knowledge and on wikipedia (i checked). glad the austrians could clear up what an open market operation is. <font color="white"> . </font> back to above: it is very clear you know i understand the difference between intent and action and i've described it clearly. <font color="white"> . </font> you are a professor so maybe you have a pent up need to: <font color="white"> . </font> [ QUOTE ] ...explain the same exact thing to you TWICE because even after you are corrected the first time about it you still claim otherwise. [/ QUOTE ] <font color="white"> . </font> yea. thanks for your explanation. i clearly needed it otherwise i wouldn't have understood the complex workings of the federal reserve lol. <font color="white"> . </font> those who can't do... <font color="white"> . </font> Barron [/ QUOTE ] <font color="white"> . </font> My God you have reading comprehension problems. <font color="white"> . </font> Let's recap. <font color="white"> . </font> You: "this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar)." <font color="white"> . </font> What the [censored] does this say in your crazy world? Because in English, it says that you think "ACists" and "austrians" (Gosh, I wonder who that could be around here?) regurgitate ("to vomit, puke, hurl, barf, upchuck") drivel ("childish, silly, or meaningless talk or thinking; nonsense; twaddle"). <font color="white"> . </font> So you snidely insult "ACists" and "austrians", like me, and then proceed to contrast their "drivel" with a description of the process that is identical to theirs. <font color="white"> . </font> Then, when I point out that the Austrians describe it exactly the way you did, you claim that, no, they don't: <font color="white"> . </font> You: "the situation exactly as the austrians describe it (i.e. what the OP said) is not how it actually works in reality despite the fact that the result is the same." <font color="white"> . </font> Read this last bit [censored] carefully, and tell me what the [censored] you think it says in your crazy [censored] head, because in my world, it says that you are claiming that "the situation exactly as the austrians describe the situation it is not how it actually works in reality", even though it is identical to your own description of reality. <font color="white"> . </font> Then I point out, AGAIN, that you are wrong. I point out that the Austrians describe exactly the way that you did, and since you apparently needed proof, provided a link. And what do you then do? You claim that oh noes, you didn't mean the "ACists" and the "austrians" were regurgitating drivel when you said "this sounds like some typical drivel regurgitated from ACists . . . or austrians . . . ", and your "beef" isn't "content" it's "presentation". Whatever the [censored] that means. <font color="white"> . </font> And because I am forced to provide a link showing that the Austirans are not "regurgitating drivel", but are instead describing the situation the same way you do, you act like this is somehow claiming that ONLY the Austrians make these claims! All I'm trying to do is prove to a [censored] doorknob on the internet that the Austrians aren't saying anything different from he is and that's supposed to be a claim that they have some exclusive claim on the [censored] obvious??? <font color="white"> . </font> I mean, do you even read the stuff you write or respond to? Or think about it before you do? Is it supposed to be my problem if you're [censored] writing things that don't have anything to do with what's in your [censored] head (or so you claim), or reading things that don't have anything to do with what's on the [censored] screen? <font color="white"> . </font> This is my last post in this thread. <font color="white"> . </font> Please. I beg of you. Don't ever respond to one of my posts again. I promise to never, ever, ever post again in BFI. Deal? Pretty please. With a [censored] cherry on top? Mmmk? <font color="white"> . </font> Oh and I got your insulting jerk-off PM. [img]/images/graemlins/ooo.gif[/img] [img]/images/graemlins/mad.gif[/img] [img]/images/graemlins/cool.gif[/img] [img]/images/graemlins/smile.gif[/img] [img]/images/graemlins/frown.gif[/img] [img]/images/graemlins/blush.gif[/img] [img]/images/graemlins/crazy.gif[/img] [img]/images/graemlins/laugh.gif[/img] [img]/images/graemlins/shocked.gif[/img] [img]/images/graemlins/smirk.gif[/img] [img]/images/graemlins/confused.gif[/img] [img]/images/graemlins/grin.gif[/img] [img]/images/graemlins/wink.gif[/img] [img]/images/graemlins/tongue.gif[/img] [img]/images/graemlins/spade.gif[/img] [img]/images/graemlins/diamond.gif[/img] [img]/images/graemlins/heart.gif[/img] [img]/images/graemlins/club.gif[/img] [/ QUOTE ] After this, he continues to PM me trying to turn it into something about M3 still. I foolishly sent back a PM asking him to stop contacting me, and telling him I thought he was [censored] crazy. To which he responded that he was going to continue to harrass me, and it made him happy that he annoys me. Specifically: [ QUOTE ] no thanks buddy. <font color="white"> </font> i'm not going to stop. <font color="white"> </font> [more crazy [censored] about M3] <font color="white"> </font> so no i won't leave you alone. you don't deserve it. i'm glad it stresses you out. that makes me happy. <font color="white"> </font> sucker. [/ QUOTE ] Now, I know I'm not supposed to post PMs, but hey, seeing as Barron has admitted in the OP that the entire purpose of the OP is to stress me out, I just thought I would back him up. So what do you my good Politics poster get for all this trouble? A ranting jargon-filled incomprehensible post about . . . M3. Which doesn't have dick to do with jack as far as I'm concerned. I made a one paragraph response via PM about M3, and I shouldn't even have bothered with that, because I don't give a [censored], and neither should Barron, if as he claims himself, M2 is just as damning. The M3 spew is just a ruse. TL;DR: Barron is crazy. |

|

#22

|

|||

|

|||

|

Ok, I went over and read that other thread and it became very clear what happened. You were a complete and total douche for no good reason and when Boro started calling you on it, instead of owning up you found something small where he made a mistake in what he was saying and did your best to attack Borodog and try to turn the conversation away from the fact that you were being a complete douche. The "satisfaction" you feel over this is because you were so upset about having to face what a douche you were being and you found a distraction that let you not have to face that. Very satisfying.

|

|

#23

|

|||

|

|||

|

PS.

Barron, Thanks for illustrating for everyone that you're crazy. Love, Borodog |

|

#24

|

|||

|

|||

|

[ QUOTE ]

Ok, I went over and read that other thread and it became very clear what happened. You were a complete and total douche for no good reason and when Boro started calling you on it, instead of owning up you found something small where he made a mistake in what he was saying and did your best to attack Borodog and try to turn the conversation away from the fact that you were being a complete douche. The "satisfaction" you feel over this is because you were so upset about having to face what a douche you were being and you found a distraction that let you not have to face that. Very satisfying. [/ QUOTE ] That took many fewer words than my version. |

|

#25

|

|||

|

|||

|

boro,

dont clutter this thread with a downplay of your statement. i've heard you say many times over that M3 is the important statistic and use the fact that the fed stopped publishing it as some sort of implication of conspiracy therein. why not just link the whole thread??? Linky instead of your snipped out version?? i mean in the 3rd post CF came in and said that you'd come in and correct me that printing is just a euphamism for "released." to which i responded "yup, and he'd be correct." but the point is that i wanted to correct the DRIVEL spouted (i.e. childish utterances) typically by those indoctrinated by austrians who don't actually understand economics...like the OP in that thread i linked. also, in terms of your "proof" of how the "austrians" describing the obvious...you really think i didn't know that? lol... wow, nice proof. also nice rhetorical job downplaying the point of this post and the tons of posts i made in the other thread (linked in entirety above) about your misunderstanding of M3. you have said before that the fed ceasing the publications of M3 is damning. do you deny that? you have said before that the important statistic is M3, NOT M2!!! (i think b/c M3 grew far faster and mises probably uses M3) do you deny that? didn't think so. Barron |

|

#26

|

|||

|

|||

|

pwned imo

But this isn't just a cheerleading post (which I'll admit that I love to make since I know it bugs the [censored] out of dvaut). I really like barron's tactics. Come out on the offensive, make up a story that makes someone look batshit insane, spew it, get some apparatchiks praising your contributions, then disappear. The target then has to spend a crapload of time proving his innocence, building a long post, refuting the slanderous points. The result is so long that nobody will read it and everyone just assumes this is more evidence that the victim is in fact nuts. Beautiful technique. |

|

#27

|

|||

|

|||

|

[ QUOTE ]

Ok, I went over and read that other thread and it became very clear what happened. You were a complete and total douche for no good reason and when Boro started calling you on it, instead of owning up you found something small where he made a mistake in what he was saying and did your best to attack Borodog and try to turn the conversation away from the fact that you were being a complete douche. The "satisfaction" you feel over this is because you were so upset about having to face what a douche you were being and you found a distraction that let you not have to face that. Very satisfying. [/ QUOTE ] i've owned up to it clearly. i've said i was bitter and it is clear we have a history. that "small" thing i've called him on he never dealt with. if me being crazy is holding a large grudge against 1 poster then i'm guilty as charged. but that one poster has a large following and made this "small" mistake about M3...then tries to say he "meant" to say M2. boro, if discreting you in one small way makes me crazy...then call me Randle Patrick McMurphy Barron |

|

#28

|

|||

|

|||

|

[ QUOTE ]

pwned imo But this isn't just a cheerleading post (which I'll admit that I love to make since I know it bugs the [censored] out of dvaut). I really like barron's tactics. Come out on the offensive, make up a story that makes someone look batshit insane, spew it, get some apparatchiks praising your contributions, then disappear. The target then has to spend a crapload of time proving his innocence, building a long post, refuting the slanderous points. The result is so long that nobody will read it and everyone just assumes this is more evidence that the victim is in fact nuts. Beautiful technique. [/ QUOTE ] i didn't disappear. nor will i. i've owned up to being a deuche and am crazy in the regard of a grudge against boro. continue your pwnage as you see it. Barron EDIT: also, i've never been this upset about any poster before and probably never will again. it's kind of fun though so if that is crazy then again, call me mcmurphy. i feel i've contributed a ton to this forum both in high stakes poker and in BFI. that i'm pretty sure isn't up for dispute and probably isn't either here nor there. so i apologize if i take away with my crazy ranting against borodog. if you don't like it. let it be and i'm sure it will pass with time. if you like it, same goes. |

|

#29

|

|||

|

|||

|

[ QUOTE ]

PS. Barron, Thanks for illustrating for everyone that you're crazy. Love, Borodog [/ QUOTE ] Boro, thanks for giving me a fun outlet while not once admitting that you were actually very wrong about something [img]/images/graemlins/smile.gif[/img]. deepest love, Barron |

|

#30

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] Ok, I went over and read that other thread and it became very clear what happened. You were a complete and total douche for no good reason and when Boro started calling you on it, instead of owning up you found something small where he made a mistake in what he was saying and did your best to attack Borodog and try to turn the conversation away from the fact that you were being a complete douche. The "satisfaction" you feel over this is because you were so upset about having to face what a douche you were being and you found a distraction that let you not have to face that. Very satisfying. [/ QUOTE ] i've owned up to it clearly. i've said i was bitter and it is clear we have a history. that "small" thing i've called him on he never dealt with. if me being crazy is holding a large grudge against 1 poster then i'm guilty as charged. but that one poster has a large following and made this "small" mistake about M3...then tries to say he "meant" to say M2. [/ QUOTE ] Good God you can't read. This gets more hilarious every time you post. No, I didn't say that. I *meant* to say M3. I JUST DON'T GIVE A [censored] THAT YOU THINK IT SHOULD HAVE BEEN M2, SINCE YOU ADMITTED IT MAKES NO DIFFERENCE. [ QUOTE ] boro, if discreting you in one small way makes me crazy...then call me Randle Patrick McMurphy Barron [/ QUOTE ] I do not think that word means what you think it means. Or is spelled the way you think it's spelled. |

|

| Thread Tools | |

| Display Modes | |

|

|