|

|

#21

|

|||

|

|||

|

Agreed, GDP isn't perfect. But the components do not point to incipient recession. Consumer spending is very strong, indicating positive overall confidence in the economy. Employment and wages are up. Construction is down as expected. You claim that the units of measurement are wrong is but you haven't pointed to any specific "better" measurements that show current direction of growth is up, down, or otherwise. I understand that you don't subscribe to the traditional economic views but in the end someone has to measure something in order to know exactly what's going on; saying that all assets are mispriced because of U.S. monetary policy doesn't do anyone any good other than make people feel frustrated that there might be something better out there but no one can prove it's better.

|

|

#22

|

|||

|

|||

|

[ QUOTE ]

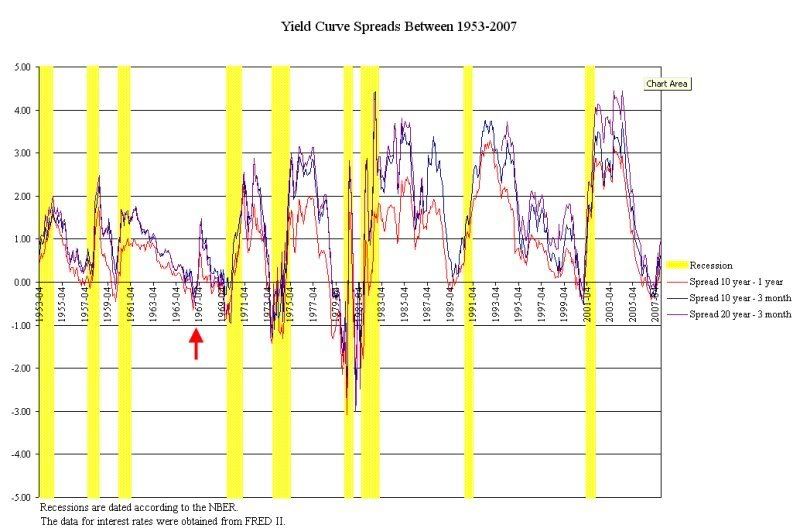

Agreed, GDP isn't perfect. But the components do not point to incipient recession. Consumer spending is very strong, indicating positive overall confidence in the economy. [/ QUOTE ] "Positive overall confidence in the economy" will not stop the recession. Unlike what Keynes would have us believe, the economy is not driven by "animal spirit". The demands of consumers and the allocation of the physical factors of production do, and the two are currently mismatched due to credit expansion driven malinvestments. There's no way around this. And "very strong consumer spending" is a bad thing, not a good thing. The economy needs more saving, not more consumption. [ QUOTE ] Employment and wages are up. [/ QUOTE ] Like I said. This is not necessarily a good thing. [ QUOTE ] Construction is down as expected. [/ QUOTE ] Why as expected? Because the housing bubble burst. Did the housing bubble arise because of "animal spirit"? No, of course not. It arose because artificially low interest rates drove a housing boom and created that bubble. The rest of the economy has been bathed in those same artificially low interest rates. Entrepreneurs throughout the economy have been making exactly the same kind of miscalculations that drove the housing boom. The housing bubble burst, and so will the rest of them. [ QUOTE ] You claim that the units of measurement are wrong is but you haven't pointed to any specific "better" measurements that show current direction of growth is up, down, or otherwise. I understand that you don't subscribe to the traditional economic views but in the end someone has to measure something in order to know exactly what's going on; saying that all assets are mispriced because of U.S. monetary policy doesn't do anyone any good other than make people feel frustrated that there might be something better out there but no one can prove it's better. [/ QUOTE ] The Fed just cut their interest rate target, twice, further expanding the money supply, lowering the interest rate, and creating further malinvestments while temporarily hiding the previous ones. This cannot be sustained. The only numbers you need to look at to know what's coming are the ones created by the Fed. All you have to do is look at the theory to understand that there is something better out there. The Austrian business cycle theory I linked too proves it's better. Contrary to what Ben Bernanke would have you believe, it is not "better to have boomed and busted than never to have boomed at all." The boom represents capital misallocation, and during the bust some of that capital is always abandoned, meaning there is always a net economic loss over the cycle, compared to what would have occurred in the absence of the cycle. Also, if you want a concrete measurement, there is the yield curve, which recently inverted. An inversion of the YC has accurately predicted recession the last 9 times, with one false positve (only one quarter of negative GDP growth, whereas the technical definition of a recession is two consecutive quarters of negative growth). People are currently poo-pooing the YC inversion, saying that somehow the economy is different now than in the past. Of course they have been saying the same thing for the last 20 years, and the YC still keeps predicting recessions.

|

|

#23

|

|||

|

|||

|

Thank you Borodog and twoplease for your explanations and taking time to answer all my questions. This is a lot for me to digest and I'm going to have to go back and re-read some of your posts. Unfortunatley I'm not very quick to pick up on these concepts even after you explain them to me [img]/images/graemlins/confused.gif[/img]

These comments have me a little puzzled: - "Very strong spending is a bad thing, not a good thing." - "Employment and wages are up....not necessarily a good thing." but I guess that you are saying that these indicators, when taken into account with other troubling factors, are not necessarily a sign of good times to come. (Also from my end of it let me just say that wages are not "up". Salary raises are in no way keeping up with the cost of living.) Like I said, I need to reread all the replies in this thread. Right now I am wondering what a recession will mean to me personally as well as to our country and its standing in the world. I'm not sure if these things have been addressed by Borodog already and I don't mean to disrespect him by not fully reading his posts as he may have already addressed this. [img]/images/graemlins/tongue.gif[/img] But here are some things specifically that are on my mind this morning as I get ready for work and worry about the state of my bank account: Given a recession may be in the near future, should I take my money and invest in bonds now? Should I be buying some real estate? Should I cancel my trip to Europe next summer as the dollar is so weak and it might be just downright foolish? How long is this recession thing going to last, a year? A decade? (Am I an idiot to be worrying about all this stuff right now and would I be better off concentrating on what's for lunch?) |

|

#24

|

|||

|

|||

|

While I often disagree with Boro, he is an thoughtful and knowlegeable poster.

However IMO, Lounge-esque discussions on the economy should really not center on the descriptive (ie how inflation can be measured) but on the specific (perceived) impacts of economic policy and behavior. For those who think they can learn enough econ to have an informed philosophical/econ engineering discusssion after a few courses/wiki readings, you are wrong. But anyone can talk about rent control pros and cons then come to logical conclusions. So my suggestion is to topics very specific/ centered around micro economic topics, not "the purpose of the fed". Good question: Why did milk prices in my store go up? Bad questions: Why do prices rise over time? What causes exchange rates to fluctuate? As evidenced from other forums and Boro's rediculously long post, Macro discussions don't blend with the more subjective lounge type discussions and very often don't have realistic answers. |

|

#25

|

|||

|

|||

|

[ QUOTE ]

Thank you Borodog and twoplease for your explanations and taking time to answer all my questions. This is a lot for me to digest and I'm going to have to go back and re-read some of your posts. Unfortunatley I'm not very quick to pick up on these concepts even after you explain them to me [img]/images/graemlins/confused.gif[/img] These comments have me a little puzzled: - "Very strong spending is a bad thing, not a good thing." [/ QUOTE ] There are two classes of goods that you can put productive capacity to work producing: 1) Consumer goods. These are consumed in the short term. More consumption now implies you are living at a higher standard of living than if you were not engaged in so much consumption (i.e. you buy a new TV, a new car, go out to eat a lot, etc. versus not buying new goods or going out to eat as much). 2) Capital goods, or producer's goods. These are goods that are used in the production of other goods. Capital goods increase the productivity of labor, and allow you to produce more. Since the factors of production that exist at any one time are fixed, those factors get allocated to producing various goods in these two classes. The more factors that are devoted to producing consumers goods, the less there are that can be devoted to producing capital goods, and vice versa. Now, for the economy to grow over time, the "capital stock", the net total of capital goods in society, machines, tools, steel, oil, mines, farms, computers, etc. must increase. Since capital goods wear out, some fraction of productive capacity is used up just replacing worn out capital goods. And additional productive capacity devoted to producing capital goods can increase the capital stock, making the society more productive. In the long run, this increased productivity means that more consumers goods can be produced, raising standards of living. But for this to take place, people must forgo some consumption in the short term, and save. This lowers the demand for consumers goods and allows productive capacity to be shifted to producing capital goods. If consumption is very high now, that can only happen at the expense of savings and investment in capital goods. Hence you have a trade off. You can either have a relatively higher consumptive standard of living now, or you can have a relatively lower consumptive standard of living now, but a much higher standard of living in the future. Consumer spending being strong means that consumer saving is weak. That means little productibe capacity is being devoted to expanding the capital stock. In fact, one of the things that can happen during an inflationary boom is that the capital stock isn't even being replaced as it wears out. In other words capital is being consumed, and the absolute level of productivity of society goes *down* over time. Consumer debt is so high these days that I am fairly certain that we have actually been consuming the capital stock for some time now, although it is almost impossible to really measure this (the capital stock cannot simply be "added up"; you cannot add machines to tools to computers to vans, etc.). [ QUOTE ] - "Employment and wages are up....not necessarily a good thing." [/ QUOTE ] As I said before, when the Fed expands the money supply, and people take out loans with this newly created money, they do this so that they can buy, rent or hire things, generally the factors of production, machines, equipment, factory space, steel, oil, vans, laborers, etc. The new buyers and their new money bids up the prices of these things. This drives up GDP. They hire people and bid employees away from previous employment. So unemployment goes down, and wages and GDP go up. Corporate profits will look great for a while. This all looks great to a mainstream economist. But to an Austrian all of this is a grand deception. What is really happening is the factors of production are being misallocated, shifted from higher valued uses to lower valued uses. The recession eventually comes and reveals that projects that have been started all over the economy are unprofitable (the definition of economic waste). A tremendous amount of capital has been misallocated, and the recession corrects it. Unprofitable businesses must go bankrupt, wages must fall, jobs must be lost. Parts of the misallocated capital can then be purchased at a bargain and reincorporated into profitable lines of production, but some of it is always abandoned. Workers can be rehired at the correct wage level in profitable lines as well. This reallocates the factors of production back into a profitable capital structure. Just remember this: A booming economy is not a good thing. You too could "boom" if you wanted. You could "boom" your way through your entire life savings in a few weeks. You would live very high on the hog for a while. But after your savings were spent, would you actually be better off? Or worse? [ QUOTE ] but I guess that you are saying that these indicators, when taken into account with other troubling factors, are not necessarily a sign of good times to come. (Also from my end of it let me just say that wages are not "up". Salary raises are in no way keeping up with the cost of living.) [/ QUOTE ] Consumer inflation right now is RAGING. Don't believe the numbers they tell you for a minute. [ QUOTE ] Like I said, I need to reread all the replies in this thread. Right now I am wondering what a recession will mean to me personally as well as to our country and its standing in the world. I'm not sure if these things have been addressed by Borodog already and I don't mean to disrespect him by not fully reading his posts as he may have already addressed this. [img]/images/graemlins/tongue.gif[/img] [/ QUOTE ] I have some fairly radical thoughts on this as well. [img]/images/graemlins/wink.gif[/img] Maybe I'll post some of them when you've caught up. [ QUOTE ] But here are some things specifically that are on my mind this morning as I get ready for work and worry about the state of my bank account: Given a recession may be in the near future, should I take my money and invest in bonds now? Should I be buying some real estate? Should I cancel my trip to Europe next summer as the dollar is so weak and it might be just downright foolish? How long is this recession thing going to last, a year? A decade? (Am I an idiot to be worrying about all this stuff right now and would I be better off concentrating on what's for lunch?) [/ QUOTE ] All of this is hard to say and I don't want to give you advice that will steer you wrong. I am not an expert, nor a prognosticator. I believe there is a recession coming, but it's impossible to say exactly when, or how deep or long it will be, or what sectors will be hit hardest. I do believe that a trip to Europe next year will cost you a pantload. I don't think that real estate has bottomed. Personally, I'm buying gold. Spend less, save more. Always good advice, even though I have a hard time following it myself. [img]/images/graemlins/tongue.gif[/img] |

|

#26

|

|||

|

|||

|

[ QUOTE ]

So my suggestion is to topics very specific/ centered around micro economic topics, not "the purpose of the fed". Good question: Why did milk prices in my store go up? Bad questions: Why do prices rise over time? What causes exchange rates to fluctuate? [/ QUOTE ] Katy asked specifically about the economy, not micro-economic concepts like rent controls, although I would be perfectly happy talking about that sort of thing, too. Fascinating stuff. But I don't think anyone can hope to have any sort of coherent understanding of "the economy" if they don't understand the purpose of the Fed, and I think, "Why do prices rise over time?" and "What causes exchange rates to fluctuate?" are perfectly good questions. [img]/images/graemlins/smile.gif[/img] |

|

#27

|

|||

|

|||

|

[ QUOTE ]

All you have to do is look at the theory to understand that there is something better out there. The Austrian business cycle theory I linked too proves it's better. Contrary to what Ben Bernanke would have you believe, it is not "better to have boomed and busted than never to have boomed at all." The boom represents capital misallocation, and during the bust some of that capital is always abandoned, meaning there is always a net economic loss over the cycle, compared to what would have occurred in the absence of the cycle. [/ QUOTE ] I find this wanting. You assume that the boom represents capital misallocation, but I don't see proof for that. The very point of the market is experimentation, which is hugely wasteful, so why can't booms lead innovation and capital development in a way that a steady rise wouldn't? Why is a boom *necessarily* a bad thing? And how is it different to the money provided by ill informed punters on the stock market? The theory underpinning the mis allocation of capital from extra money supply also seems wanting. Businesses can react adequately to all kinds of market conditions, including those that governments helps stabilize by regulation, but suddenly when the government increases the money supply, they start misallocating capital? Doesn't sit right with me. I'd also be curious if there is any actual quantification of this waste vs the innovation and progress gained from an artificial inflation of the money supply. Without some kind of solid quantification, it seems to be just a theory that could be either unimportant in the scheme of things of overcome by other considerations - or valid. It's a bit premature to claim this as economic truth without scientific testing of these simplistic (compared to the economy) theories. |

|

#28

|

|||

|

|||

|

[ QUOTE ]

find this wanting. You assume that the boom represents capital misallocation, but I don't see proof for that. The very point of the market is experimentation, which is hugely wasteful, so why can't booms lead innovation and capital development in a way that a steady rise wouldn't? Why is a boom *necessarily* a bad thing? And how is it different to the money provided by ill informed punters on the stock market? [/ QUOTE ] Phil, I think you hit the nail on the head. I have always had a problem with the idea that the market cannot "learn" over time. I think the more mature a market is, the better the decisions in allocation it will make. History counts. I think that a lot of the notions put forward by economists in general ignore this principle. |

|

#29

|

|||

|

|||

|

Borodog: great commentary, insight and analysis. I believe that there are historical differences in the current macro-economic climate which demonstrate that our domestic credit profile and the impact of our monetary policy undercuts the importance of traditionally positively viewed economic data. Specifically I am referring to misguiding and deflated inflationary numbers, GDP (a poor economic metric in its own right), employment, and consumer confidence. Hence, I am also bearish on American economic prospects over the foreseeable long-term future. Besides the raw data and analysis you’ve highlighted, several trends in a now-realized global marketplace play a role as well.

In addition to saving America from a recession in 2001, many of us benefited directly and all of us, indirectly, from loose monetary policy and the side-effects it had on the housing market. There were the financial institutions that fueled it, the labor market which had low barriers to entry into real-estate related professions that earned from it, the blue collar workforce that built into it, the middle class that spent out of unrealized equity gains caused by it, and the speculators that profited from it. However, for nearly all of the players in this game, the price of a few more years of hyper-growth has escalated the potential damage of a credit crunch even further as leverage, derivative or otherwise, has soared to gargantuan proportions. Dropping the bottom out of these extra-normal profit generators has just begun, and the fall-out goes far beyond the falling value of homes and potential needed bail-out of financial institutions that got creative with mortgage-backed securities… Zooming out a bit further, the U.S. is facing the stiffest global competition it has ever seen in nearly every sector by emerging markets and established players alike, and, as expected, profits have fallen (seen Ford lately?). Now, Phil/Exsubmariner have valid points that economic models, whether Keynesian, Austrian or otherwise, often do a poor job of incorporating the human element. Adjustments are made by the resilience of people and institutions that retool to profit from such conditions, and America has long been creative to insure that. So further technological advance or other unseen conditions may support our leveraged economy through additional cycles of unexpected growth, temporarily bolstering the beleaguered dollar and give new life to the credit markets. But, really, in the end, all of the recent creativity brought about by the over-extension of credit (and not just in real estate investment: see government, consumer, corporate, etc.) is ripe for correction. With America’s diminishing force as the dominant power within the global marketplace, rising commodity prices against a falling dollar, combined credit woes, its sense of entitlement and corresponding lack of competitiveness, and over-leveraged credit crunch, this correction suggests that we are in a larger cycle where other nations are looking to bring about a new global equilibrium in resource distribution. To get there, it is likely that a recession embodying the stagflation your analysis suggests is exactly how it comes about. The vehicles for such are already in place, and, although the timing for it is ultimately unknowable, it certainly appears it could be happening right now. For all my studies, I still don’t get gold, but it certainly looks like it will out-perform the American economy and, especially, the relative spending power of the dollar for the foreseeable future in real spending power. |

|

#30

|

|||

|

|||

|

Just wanted to add a few points to the discussion that borodog has written about elsewhere but that I found were critical in my own acceptance of the ABCT.

The Austrian school of economics puts great emphasis on the entrepreneur’s role in society. The successful entrepreneur is one who repeatedly, successfully navigates uncertainty and allocates resources to most aptly meet consumer demand. They are highly skilled at forecasting future market conditions since by its very nature production must occur prior to sale. Why then do so many get “tricked” by credit expansion? Why is the revered entrepreneur all of a sudden so dumb? First of all, though entrepreneurs are indeed highly skilled, normal market uncertainty doesn’t necessarily require an understanding of macroeconomics – especially Austrian theory. Indeed, for entrepreneurs to not be tricked would require that they believe that the credit expansion is not borne of real savings, not in accordance with underlying consumer time preferences, and will necessitate that a great many investments made during this period must fail for lack of real resources. Given that mainstream thought has not accepted these theories, it is understandable that otherwise talented entrepreneurs would be “tricked.” One objection I had to this line of reasoning is – why doesn’t the profit/loss mechanism select for those entrepreneurs most likely to not be fooled by a credit expansion? After all, in all other areas of uncertainty only those businessmen who continuously earn profits keep their capital – the market selects against those who waste resources. It seems this should hold even for those who waste resources due to their ignorance of the implications of credit expansion. I suspect one reason for the market’s inability here is the obligatory bailouts that always seem to follow a bust. Undoubtedly this restricts the market’s natural selection of profitable entrepreneurs. Further, as Borodog has suggested before, even if entrepreneurs completely accept the necessary consequences of artificial credit expansion they are caught in a prisoner’s dilemma. Ideally everyone would refrain from partaking in the artificial expansion, but if everyone else refrains then there is tremendous incentive to “cheat” and take the cheap credit and profit for yourself. Conversely, those who refrain from accepting the cheap credit will still bear some of the burden of the bust should others accept the artificial credit. Here is an interesting article on this idea: http://www.gmu.edu/rae/archives/VOL1...p;dempster.pdf Regardless of the reasons why entrepreneurs accept and bankers provide the artificial credit, empirically we know that they do. Given that they do, the Austrian business cycle theory is the logic of what necessarily must follow. This is what helped me grasp the importance of this theory – so long as artificial credit is successfully expanded the ABCT applies. Productive investment can only come from real savings – deferred consumption. At any one time there is only a fixed amount of real resources. If investment is expanded without the requisite deferral of consumption (indeed savings is even further reduced as artificially lower interest rates serve as a disincentive to save while stimulating investment) then the bulk of these projects must eventually be revealed as unprofitable. The real resources required for their completion simply don’t exist. |

|

|

|