|

|

#31

|

|||

|

|||

|

[ QUOTE ]

Thus, it is readily conceded that (a) expansionary monetary policy reduces interest rates, and (b) lower interest rates stimulate investment in more round-about projects. Where then does the disagreement emerge? What I deny is that the artificially stimulated investments have any tendency to become malinvestments. Supposedly, since the central bank's inflation cannot continue indefinitely, it is eventually necessary to let interest rates rise back to the natural rate, which then reveals the underlying unprofitability of the artificially stimulated investments. The objection is simple: Given that interest rates are artificially and unsustainably low, why would any businessman make his profitability calculations based on the assumption that the low interest rates will prevail indefinitely? No, what would happen is that entrepreneurs would realize that interest rates are only temporarily low, and take this into account. [/ QUOTE ] A major point in the ABC explanation is that when credit is expanded the money supply is expanded and this leads to inflation as there are more dollars competing for the same amount of goods. Inflation is not instantaneous nor is is felt equally by all participants. The first people to benefit from low interest rates (the first borrowers) have an advantage over the second who has an advantage over the third and so on down the line. You produce a rush to get the new money or else you will find yourself buying goods at higher prices without the benefit of cheap loans. At some point the increased costs of the goods you are buying will make even cheap money unprofitable but by what mechanism is the entrepreneur supposed to figure out when that is? If the interest rate is tied to savings then the more loans that are given out means the less money that is available to be loaned and a rise in interest rates. Since the increases in prices of goods which leads investments to end up mal investments comes as a result of the number of loans taken out inflation rates must lag behind loan rates. The increasing interest rate is a signal to potential investors to stay or go, what means do they have to figure this out when the interest rate is being altered by a third party? You can't remove valuable information from the equation and then expect investors to make decisions that are just as good as when they had that information. |

|

#32

|

|||

|

|||

|

[ QUOTE ]

let's first agree the point i was stating: it has to do with future consumption ability. i contend that investment in a passive portfolio to collect risk premia will deliver excess returns that will increase consumption ability in the future rather than just move that consumption (as a result of time preference) from the present to the future. do you agree with that statement? [/ QUOTE ] There are somethings your analysis is missing. Im going to try only go over the things i think are relevant to this thread though. Here's how i see the issue, while recognizing your perspective. For one, we must produce to be able to consume. People need to mix labour and nature to produce consumable goods. If people want to shift to a greater level of consumption over time, they must create (put discoveries with no cost association aside for the moment) some way to improve efficiency. How and why do they do this? Well, man is always trying to choose a means of producing that will satisfy a given output in the shortest possible time. If all costs are equal, the more efficient process will be chosen. However, the increased productivity does come with extra costs. The opportunity cost amounts to efforts away from current production and consumption for which some reserve must account for. To engage in the procreation of an expectantly more efficient production methodology or to use resources to maintain a current methodology there must be some extra available resources to aid the sustenance and resources employed throughout. Whatever amount of consumption is necessary for sustenance would need to have been saved in the past. Basically, for any new production or costly maintenance to occur there must've been some sacrifice of past consumption. As discussed before, the extent to which people choose to save is manifested through time preference: the rate at which people value current consumption over future consumption. Any distortions of this will by definition create a mismatch between the time preference of people and entrepreneurial judgments regarding those time preferences. If the present level of enjoyment resides in current consumption, for example, then no one will bother putting forth any efforts to sacrifice and produce more efficiently for the future. Entrepreneurs in society get involved in production to attempt to satisfy some level of consumption demands, which are basically infinite. In order for sustainable productivity increases there must be some individuals in the past who forfeited consumption to make possible the new production process or old production maintenance. If the current time preference and, therefore, savings does not enable sufficient property to become available for creating a new production process, any efforts to make these productions processes succeed will eventually end in failure. What artificial credit boosts do is distort the information process by indirectly convincing society that more means exist for attempts at current productions than are physically sustainable. People are fooled to believe more has been saved than actually has when society creates credit for itself out of thin air. Since entrepreneurs are trying to formulate new production methods that are not reflecting the actual consumer time preferences, which can only be measured by the available savings for investment in production, the process must collapse. Savings essentially entails decreasing one's spending on consumer goods for some increase in spending on the production process. Creating new paper receipts and more claims on current assets will not amount to savings since in the long run these cannot be used to actually purchase producer goods. Savings, again, can only come from sacrifices in past consumption. To avoid further misunderstanding, Austrians dont think entrepreneurs ar immune to error. They may or may not make errors in the predictions for the future. All Austrians are saying is that entrepreneurs will generally not make so many errors since their success depends on as much. In the long run successful entrepreneurs are generally very good predictors. However, since the non free market banks act as intermediaries between savers and investors and they artificially distort the rates with little consideration for societally dynamic time preference this will ensure that error occurs. What must be realized is that subjective wants cannot make property appear out of thin air. If monetary policy allows for distortions of consumer time preferences then the production structure assembled around the distorted information will for sure be at least partially erroneous. Lets also not forget, "The system ensures error, though of course it does not preclude success; thus, the existence of genuine economic growth alongside malinvestments." *This is mostly a much a briefer summary with less examples of Dan Mahoney's summary of the Austrian Business Cycle Theory: http://www.mises.org/story/672 |

|

#33

|

|||

|

|||

|

[ QUOTE ]

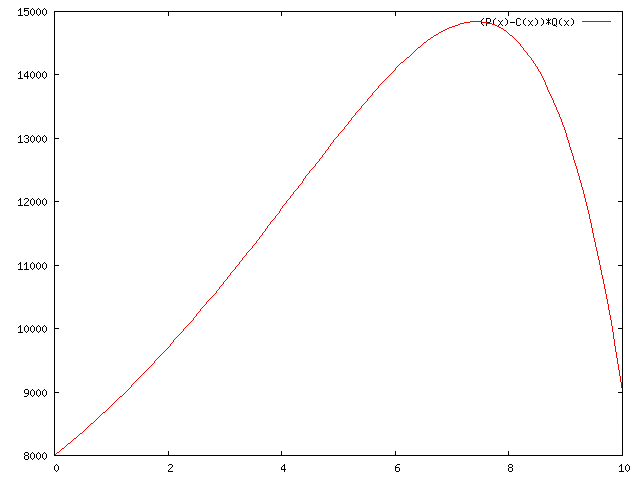

[ QUOTE ] tl;dr: Artificial credit expansion causes the business cycle. [/ QUOTE ] tl/dr: And how do you distinguish btw natural credit expansion and 'artificial? [/ QUOTE ] Simple. Printing money and making it available for loan is artificial. Producing in exchange for money and then making it available for loan is not artificial. [ QUOTE ] How do you know that assessment is correct, since it relies on 'self-evident' assertions rather than math and econometrics? [/ QUOTE ] A) I think you must be joking if you claim that you cannot understand how printing money out of nothing and loaning it out is an artificial expansion of credit; B) What is self evident is not an assertion; it's self evident that human beings act purposefully. If you'd like to dispute this fact, then I invite you to start another thread. C) I always find this particular attack on Austrian analytics particularly ironic, since mathematics itself is based on a priori logical deduction, hence all of the real empirical sciences, as well as mainstream economics is in fact based on a priori logical deduction. D) None of the ABCT depends much on the fundamentals of Austrian epistemology; it works exactly the same way in a neoclassical economic analysis (unless your claim is that under neoclassical economics the conservation of mass and energy are violated, which is really the core of the theory, that the factors of production are finite; the PPF analysis can be found in any mainstream econ textbook; they just typically fail to apply it to the macro economy, since to do so leads to rather embarrassing results). Neoclassical economists have traditionally neglected it becomes the policy recommendations it leads to are political poison. E) Why even bother to google and cut and paste something about something that you admittedly can't be bothered to even read? [ QUOTE ] I do believe that they have made several important contributions to the field, however. '3.4.2. The Incorrect and Controversial Aspects of the ABC What then remains controversial about the ABC - and, as the sequel argues - incorrect? Some of the more important features of the ABC include: Proposition 3: Monetary expansion distorts the structure of production in an unsustainable way. Proposition 4: The ABC explains the "sudden general cluster of business errors." Proposition 5: The ABC provides the best explanation for why downturns hit the capital goods sectors especially hard. Proposition 6: Only the Austrian theory can explain the existence of inflationary depressions (or "stagflation"). Austrians along with almost all other economists accept that expansionary monetary policy tends to reduce interest rates (definitely real interest rates, and usually nominal rates as well) in the short term.[46] There is no question that this change in interest rates tends to affect the profitability of different investments; as Austrians emphasize, with lower interest rates, more "round-about" investments will become profitable. Projects with returns further in the future previously might have had a negative present discounted value; lower the interest rate, and the PDV quite possibly might become positive. Bohm-Bawerk's capital theory - focusing on the intertemporal coordination of numerous stages of production - does incline Austrians to be particularly aware of the tendency of lower interest rates to stimulate more round-about projects. But modern neoclassicals would surely also accept the claim that lower interest rates alter PDV calculations in favor of investments with more distant returns.[47] Thus, it is readily conceded that (a) expansionary monetary policy reduces interest rates, and (b) lower interest rates stimulate investment in more round-about projects. Where then does the disagreement emerge? What I deny is that the artificially stimulated investments have any tendency to become malinvestments. Supposedly, since the central bank's inflation cannot continue indefinitely, it is eventually necessary to let interest rates rise back to the natural rate, which then reveals the underlying unprofitability of the artificially stimulated investments. The objection is simple: Given that interest rates are artificially and unsustainably low, why would any businessman make his profitability calculations based on the assumption that the low interest rates will prevail indefinitely? No, what would happen is that entrepreneurs would realize that interest rates are only temporarily low, and take this into account. In short, the Austrians are assuming that entrepreneurs have strange irrational expectations. Rothbard states this fairly explicitly: "[E]ntrepreneurs are trained to estimate changes and avoid error. They can handle irregular fluctuations, and certainly they should be able to cope with the results of an inflow of gold, results which are roughly predictable. They could not forecast the results of a credit expansion, because the credit expansion tampered with all their moorings, distorted interest rates and calculations of capital."[48] Elsewhere, he informs us that: "[S]uccessful entrepreneurs on the market will be precisely those, over the years, who are best equipped to make correct forecasts and use good judgment in analyzing market conditions. Under these conditions, it is absurd to suppose that the entire mass of entrepreneurs will make such errors, unless objective facts of the market are distorted over a considerable period of time. Such distortion will hobble the objective 'signals' of the market and mislead the great bulk of entrepreneurs."[49] Why does Rothbard think businessmen are so incompetent at forecasting government policy? He credits them with entrepreneurial foresight about all market-generated conditions, but curiously finds them unable to forecast government policy, or even to avoid falling prey to simple accounting illusions generated by inflation and deflation. Even if simple businessmen just use current market interest rates in a completely robotic way, why doesn't arbitrage by the credit-market insiders make long-term interest rates a reasonable prediction of actual policies? The problem is supposed to be that businessmen just look at current interest rates, figure out the PDV of possible investments, and due to artificially low interest rates (which can't persist forever) they wind up making malinvestments. But why couldn't they just use the credit market's long-term interest rates for forecasting profitability instead of stupidly looking at current short-term rates? Particularly in interventionist economies, it would seem that natural selection would weed out businesspeople with such a gigantic blind spot. Moreover, even if most businesspeople don't understand that low interest rates are only temporary, the long-term interest rate will still be a good forecast so long as the professional interest rate speculators don't make the same mistake. ' http://www.gmu.edu/departments/econo...an/whyaust.htm [/ QUOTE ] A) This would require that all entrepreneurs, or at least a majority of them, understand Austrian business cycle theory, when in fact government economic propagandists, most notably neoclassical economists like the one quoted, do their damndest to set businessmen up with the belief that the low interest rates are the norm and that Fed manipulation of the economy is required; while they might recognize that the Fed is artificially jimmying the rates, they usually think the Fed is "fine tuning" or "stabilizing" the rate, rather than simply and uniformly depressing it. In short, his critique is that the ABCT can't be correct because businessmen have a tough time seeing through the obfuscations and apologia that people like himself weave. B) This neglects the fact that entrepreneurs are caught in a prisoners dilemma type situation. If other entrepreneurs are taking out low interest loans and bidding away factors of production, the entrepreneur who sits on his hands faces the short term increase in input costs and the squeezing of his profit margins (i.e. he is _robbed_ by the artificial loose credit policy). To maintain his profit margins, he is pretty much forced to invest in either longer more productive processes or in expanding current production, either of which is a distortion and malinvestment that will ultimately be revealed. Even if his output prices are rising because of increased consumer spending, the economy is still eventually [censored], because input prices will rise faster than output prices, and his profits will eventually be in for a nasty surprise:  Rising output prices (P), rising costs (C) and rising sales (Q), inevitably lead to a crash in profits as long as C rises faster than P, which is the case because producers are bidding up the finite factors of production trying to put them into more lines than there exist factors to complete. In short, to not invest on the upsloping part of the curve is to cooperate while the rest of the economy is defecting. Combine this with the fact that the apologists do everything they can to hide the fact that loose credit is the source of the problem, and it is no surprise at all that businessmen behave the way they do. This also neglects the entire basis of the ABCT, that the factors of production are alas finite; it's not just that interest rates will eventually rise revealing projects to be unprofitable (that can happen of course), it's also that businessmen are starting more projects and lines of production than there exist factors to create, and eventually someone is going to realize this when the prices of those factors are bid up past the point where all those projects become unprofitable. You can't get around it, it's a law of physics, which I know a little something about. Conservation of mass and energy. If you're going to quote anti-Austrians, you should do try to do better than Caplan; the guy has been destroyed so many times it's not even funny. http://www.mises.org/journals/qjae/pdf/qjae6_3_4.pdf http://www.mises.org/journals/jls/19_1/19_1_5.pdf http://www.mises.org/misesreview_det...ortorder=issue http://www.mises.org/story/1163 Better yet: http://www.googlesyndicatedsearch.co...mp;btnG=Search |

|

#34

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] Thus, it is readily conceded that (a) expansionary monetary policy reduces interest rates, and (b) lower interest rates stimulate investment in more round-about projects. Where then does the disagreement emerge? What I deny is that the artificially stimulated investments have any tendency to become malinvestments. Supposedly, since the central bank's inflation cannot continue indefinitely, it is eventually necessary to let interest rates rise back to the natural rate, which then reveals the underlying unprofitability of the artificially stimulated investments. The objection is simple: Given that interest rates are artificially and unsustainably low, why would any businessman make his profitability calculations based on the assumption that the low interest rates will prevail indefinitely? No, what would happen is that entrepreneurs would realize that interest rates are only temporarily low, and take this into account. [/ QUOTE ] A major point in the ABC explanation is that when credit is expanded the money supply is expanded and this leads to inflation .... If the interest rate is tied to savings [/ QUOTE ] The real level of IR is not tied to 'savings,' you don't honestly believe that do you? |

|

#35

|

|||

|

|||

|

[ QUOTE ]

The real level of IR is not tied to 'savings,' you don't honestly believe that do you? [/ QUOTE ] I do. You ever heard of time preference and originary interest? What do you think explains passive interest? |

|

#36

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] [ QUOTE ] tl;dr: Artificial credit expansion causes the business cycle. [/ QUOTE ] tl/dr: And how do you distinguish btw natural credit expansion and 'artificial? [/ QUOTE ] Printing money and making it available for loan is artificial. Producing in exchange for money and then making it available for loan is not artificial. [/ QUOTE ] But private banks and other firms can make loans and extend/expand credit greatly without printing money, no? Or are you calling that 'production?' [ QUOTE ] in fact government economic propagandists... do their damndest to set businessmen up with the belief that the low interest rates are the norm and that Fed manipulation of the economy [/ QUOTE ] This is really a silly strawman, and these assertions about 'propagandists' and loaded terms 'manipulation' are laughable if you are interested in having a discussion. Genius bizmen are so easily misled on top of that, huh? Wow. from wiki - 'In Austrian theory, the proportion of consumption to saving or investment is determined by people's time preferences, which is the degree to which they prefer present to future satisfactions. Austrians believe the pure interest rate is determined by the time preferences of the individuals in society, and the final market rates of interest reflect the pure interest rate plus or minus entrepreneurial risk and purchasing power components.... Soon the new money percolates downward from the business borrowers to the factors of production: in wages, rent, interest. Austrians conclude that, since time preferences have not changed, people will rush to reestablish the old proportions, and demand will shift back from the higher to the lower orders. Capital goods industries will find that their investments have been in error; that what they thought profitable really fails ...' Time preferences often/constantly change [i.e. the tradeoff btw FV and PV changes, or utility thereof], and can do so overnight if not sooner. Witness the CP market. Also, 'Austrian economists claim that, in the purely free and unhampered market, there will be no cluster of errors, since trained entrepreneurs will not all make errors at the same time.' This is a false assertion, as there are any number of free markets where errors cluster which have led to prices/assets getting overbid or oversold throughout history. Regardless, if you believe that such things will never happen, you have to prove it somehow rather than hand-waving that it is 'self-evident.' |

|

#37

|

|||

|

|||

|

[ QUOTE ]

But private banks and other firms can make loans and extend/expand credit greatly without printing money, no? Or are you calling that 'production?' [/ QUOTE ] People arent forced to accept the notes of private banks. This is why money must arise from some commodity. In private banking they cant expand credit at whim any more than a private business could start demanding a tax from people. Aside, a bank that attempts to expand credit will lose their assets very fast as they are forced to ship them to other banks as receits are redeemed all over. They will likely lose customers too and in private banking there is no one to protect and bail out poorly managed banks. Increase in the money supply in private banks corresponds with an increase in demand which is why there is no inflation. This is why production increases describe the free market but artifical injections describes the open market operation process. |

|

#38

|

|||

|

|||

|

http://www.mises.org/story/672

'Entrepreneurs make judgments about the future and, of course, ... However, judgments will be in error when one is confronted with the illusion of a greater pool of savings than actual consumer time preferences would justify. This is precisely the situation established by the banking system— as intermediaries between savers and producers, or "investors" — as currently exists in the Western world. The system ensures error, though of course it does not preclude success...' There doesn't seem to be any sort of proof that there is this 'illusion' that is not 'justified by consumer time preferences.' Also, simply asserting 'the system ensures error' is again, more hand-waving. [Altho economists of all stripes are famous for hand-waving, of course.] 'Whatever plans appear to be feasible during the early phase of a boom will, of necessity, eventually be revealed to be in error due to a lack of sufficient property. This is the crux of the Austrian business cycle theory.' Again, a nice theory, but this sort of hand-waving that all 'feasible' plans during a 'boom' will 'be in error' needs some proof[s] behind it, besides some Viennese economists, and their current believers, to make progress and/or further converts in this field. Also, waiting until after the fact during an economic downturn and then pointing back to your self-defined 'boom' and saying, 'aha, the culprit!' is circular logic. You would need to rigorously identify such booms before as they occurred prior to downturn, and also successfully posit when such booms would end, rather than that old econ fall-back 'in the long-run/eventually.' Given enough time, any economy will suffer a downturn, if only due to war/famine/pestilence, etc. The 'hard money' school has been left behind by most for a good reason, it doesn't successfully answer a lot of the most important questions of our day. And while simply fixing the amount of money and loans, or tying them to gold/other assets would serve to reduce inflation, so do other measures. I'm sure we all agree the gov't often makes mistakes with their actions/laws/economic policies. There also exist solutions to those problems which are not ABCT. |

|

#39

|

|||

|

|||

|

[ QUOTE ]

What am I missing? Do Austrians just consider the price system as the most useful proxy available? Thanks! [/ QUOTE ] You sort of answered your own question. What you're missing is the fact that the fed does no set the interest rate based on individual's time preferences. Intervention distorts individaul value by definition. |

|

#40

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] [ QUOTE ] Thus, it is readily conceded that (a) expansionary monetary policy reduces interest rates, and (b) lower interest rates stimulate investment in more round-about projects. Where then does the disagreement emerge? What I deny is that the artificially stimulated investments have any tendency to become malinvestments. Supposedly, since the central bank's inflation cannot continue indefinitely, it is eventually necessary to let interest rates rise back to the natural rate, which then reveals the underlying unprofitability of the artificially stimulated investments. The objection is simple: Given that interest rates are artificially and unsustainably low, why would any businessman make his profitability calculations based on the assumption that the low interest rates will prevail indefinitely? No, what would happen is that entrepreneurs would realize that interest rates are only temporarily low, and take this into account. [/ QUOTE ] A major point in the ABC explanation is that when credit is expanded the money supply is expanded and this leads to inflation .... If the interest rate is tied to savings [/ QUOTE ] The real level of IR is not tied to 'savings,' you don't honestly believe that do you? [/ QUOTE ] Of course it is (or should be) how can you loan something that doesn't exist? |

|

|

|