|

|

#21

|

|||

|

|||

|

[ QUOTE ]

I've wondered about the "points" of stock market. If they dow jones is at 12k points and the Norwegian stock exchange is at 500 points, does that mean the value of all the companies registerred with the dow jones index fund is 24 times of those at the Oslo exchange? Or does it not compare like that? [/ QUOTE ] Don't know anything about the Oslo exchange but probably not. The Dow Jones Industrial Average (DJIA) is a price weighted index (as opposed to a market cap weighted index) of 30 stocks. Due to various changes in the composition of the index and stock splits over the years, price movements are adjusted with a multiplier as well. The S&P 500 is a market cap weighted index that is a proxy for the valuation of U.S. stocks in the aggregate. Although the DJIA and S&P 500 frequently have similar changes in valuations on a day to day basis, the S&P 500 is better proxy for the valuation of U.S. stocks which means it may be better to compare it to the Oslo index. As to your question about the interest rates and the money supply. The Fed uses the Fed Funds interest rate to control the size of the money supply more or less (over simplified a little bit). The following relationship should be considered along with the size of the money supply: Quantity theory of money |

|

#22

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] I've wondered about the "points" of stock market. If they dow jones is at 12k points and the Norwegian stock exchange is at 500 points, does that mean the value of all the companies registerred with the dow jones index fund is 24 times of those at the Oslo exchange? Or does it not compare like that? [/ QUOTE ] Don't know anything about the Oslo exchange but probably not. The Dow Jones Industrial Average (DJIA) is a price weighted index (as opposed to a market cap weighted index) of 30 stocks. Due to various changes in the composition of the index and stock splits over the years, price movements are adjusted with a multiplier as well. The S&P 500 is a market cap weighted index that is a proxy for the valuation of U.S. stocks in the aggregate. Although the DJIA and S&P 500 frequently have similar changes in valuations on a day to day basis, the S&P 500 is better proxy for the valuation of U.S. stocks which means it may be better to compare it to the Oslo index. [/ QUOTE ] yup, i thought the dow was computed like the S&P. typically when the "market" is used, it is almost always the S&P since it is broader based. but in terms of comparison in a direct sense (i.e. one unit of dow = x units of the norwegian index), i still don't think it makes sense. [ QUOTE ] As to your question about the interest rates and the money supply. The Fed uses the Fed Funds interest rate to control the size of the money supply more or less (over simplified a little bit). The following relationship should be considered along with the size of the money supply: Quantity theory of money [/ QUOTE ] yea but in practice (in terms of the fed's decision making), this was tried in the 80's in order to "break the back" of inflation. i.e. the money supply was tightened without an exact interest rate level in mind in order to get price rises under control. in the end, the velocity of money was the problem for the "monetization" methodology. anyways, it is definitely good to know. Barron |

|

#23

|

|||

|

|||

|

[ QUOTE ]

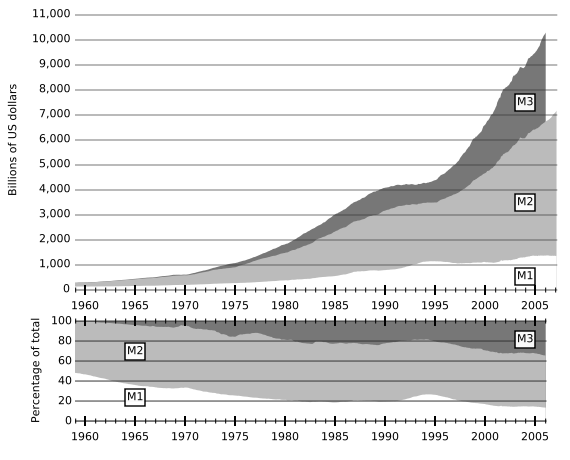

[ QUOTE ] [ QUOTE ] The important number is not the total of physical cash, but the total of fiduciary instruments, M3:  Before the Fed stopped reporting M3 (supposedly because it "cost too much" to measure; this from the people who can create money), M3 was expanding at about 15% per year. [/ QUOTE ] i'd like to take a second here and reiterate that you have absolutely no clue what M3 relates and you use the end of the publicatino of it as amo against the powers that be in a well thought out snide way. seriously boro, do you know what the notional value of repurchase agreements does to that figure? look at the divergence between M3 and M2. the divergence between M2 and M1 has actual economic significance since the latter is a much narrower definition, but the wider definition (M2) still retains actual usefulness as it relates to economic activity. M3 on the other hand includes far too much noise that actually diminishes the usefulness of it as a measure of anything substantial. eurodollar deposits and repos are by far i'm sure the biggest contributors to the M3 surge there towards the end of its publication. but many institutions and hedge funds engage in those activities far beyond what is useful to look at. increases in M3 don't actually correlate to anything relating to prices in the actual economy and the fed hasn't used it for a long time. here is the actual statement from the fed as to why M3 was stopped: [ QUOTE ] On March 23, 2006, the Board of Governors of the Federal Reserve System will cease publication of the M3 monetary aggregate. The Board will also cease publishing the following components: large-denomination time deposits, repurchase agreements (RPs), and Eurodollars. The Board will continue to publish institutional money market mutual funds as a memorandum item in this release. . Measures of large-denomination time deposits will continue to be published by the Board in the Flow of Funds Accounts (Z.1 release) on a quarterly basis and in the H.8 release on a weekly basis (for commercial banks). . M3 does not appear to convey any additional information about economic activity that is not already embodied in M2 and has not played a role in the monetary policy process for many years. Consequently, the Board judged that the costs of collecting the underlying data and publishing M3 outweigh the benefits. [/ QUOTE ] for somebody who speaks as authoritatively as you do it might help to know what you're talking about. (yes, pot-kettle but at least i readily acknowledge where my knowledge is lacking). Barron [/ QUOTE ] bump for more pot-kettle regarding borodog: he said: [ QUOTE ] I don't know which is more infuriating, your insults or your arrogant confidence in your mistakes. [/ QUOTE ] amazing how sure you were/are, boro about M3 and the fed's conspiracy to stop publication of it lol. Barron [/ QUOTE ] one last bump for you, borodog. let's hear how you can explain your statement in bold above in light of the fact that you state: [ QUOTE ] Before the Fed stopped reporting M3 (supposedly because it "cost too much" to measure; this from the people who can create money), M3 was expanding at about 15% per year. [/ QUOTE ] well boro, i don't know what is more infuriating, your insults or your arrogant confidence in your mistakes. Barron PS- adding austian economics, AC, austrian in case boro only searches for these words. also, evan, ahnuld, this is my last bump of this i promise. he really got under my skin here though so i apologize in advance for cluttering the forum w/ this garbage. |

|

#24

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] [ QUOTE ] [ QUOTE ] [ QUOTE ] this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar). first off, the statement is totally backwards. correctly it should read: when more money is released via open market operations, interest rates fall and then currency falls. in other words, when the decision to lower rates occurs, more money is injected into the system by open market operations in the NY Fed. this excess money lowers interest rates (lower interest rates doesn't result in more money printed. more money released results in lower interest rates). the value of the currency (all else equal) then goes down, not because more money is "printed" but because the relative demand to hold that currency drops when compared with the other available options. [/ QUOTE ] I like how you claim that the Austrians "reguritate drivel", and then proceed to describe exactly the situation as Austrians describe it. [img]/images/graemlins/tongue.gif[/img] Yet more evidence that you have no idea what the people you scorn are actually saying. And you are being slightly disingenuous when you say that "lowering the interest rate increases the money supply" is totally backwards. What is the intent when the Fed increases the money supply? To lower the interest rate, of course. They have an interest rate target, and if the market gets too far away from their target they will inject (or drain) reserves into (or from) the system to try to hit that target. The interest rate is the cart. The money supply is just the horse. It might come first, but what it's hauling is what's important from the Fed's point of view. [/ QUOTE ] dude. the point is that the OP regurgitated something he read here without understanding the distinction. the sound bites and snippets are what i refer to as "drivel"...the situation exactly as the austrians describe it (i.e. what the OP said) is not how it actually works in reality despite the fact that the result is the same. [/ QUOTE ] NO. The situation as the Austrians describe is EXACTLY how YOU yourself described it. In other words, you ascribed "drivel" to the Austrians and then went on to explain EXACTLY the situation as the Austrians decsribe it. If you BELIEVE the Austrians say anything otherwise then it is YOUR MISTAKE. Which you could CORRECT if you BOTHERED TO LEARN ANYTHING ABOUT THE STUFF THAT YOU HEAP SCORN ON. YOU have apparently conflated the intent, to lower interest rates, with the mistaken belief that the Austrians believe in a mistaken belief in the direction of cause and effect (lower interest rate inflates money supply), when nothing could be furhter from the truth (the Fed wants to lower interest rates, and hence inflates the money supply to achieve this). It boggles my mind that I have to explain the same exact thing to you TWICE because even after you are corrected the first time about it you still claim otherwise. This is like me telling you my favorite color is purple and you saying, "No it isn't, your favorite color is blue!" [img]/images/graemlins/tongue.gif[/img] I don't know which is more infuriating, your insults or your arrogant confidence in your mistakes. [/ QUOTE ] don't you get it. my beef isn't content, it's presentation. man you're dense. it boggles my mind that i have to tell you again the content isn't what i'm bothered about. the fact that you tell people who aren't as smart/knowledgeable as you that the fed prints money and that printing money devalues the dollar is what i'm talking about. the intent regarding interest rates is clearly the driver, we all know that (we= those who have studied this)...but the literal action isn't the intent and those that get that confused end up like the OP. look at the OP's post. THAT is what i'm TALKING about. the op regurgitated that without having a clue what it actually meant...i.e. DRIVEL: [ QUOTE ] to utter childishly [/ QUOTE ] dictionary definition FTW! those utterances is what i'm heaping scorn upon. i've said in many posts recently that i agree to a large degree with what the austrian school is talking about. on another note, i think it is hilarious that you state "the austrians describe it" like their the only ones who know what is going on under the hood. it is common knowledge and on wikipedia (i checked). glad the austrians could clear up what an open market operation is. back to above: it is very clear you know i understand the difference between intent and action and i've described it clearly. you are a professor so maybe you have a pent up need to: [ QUOTE ] ...explain the same exact thing to you TWICE because even after you are corrected the first time about it you still claim otherwise. [/ QUOTE ] yea. thanks for your explanation. i clearly needed it otherwise i wouldn't have understood the complex workings of the federal reserve lol. those who can't do... Barron [/ QUOTE ] My God you have reading comprehension problems. Let's recap. You: "this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar)." What the [censored] does this say in your crazy world? Because in English, it says that you think "ACists" and "austrians" (Gosh, I wonder who that could be around here?) regurgitate ("to vomit, puke, hurl, barf, upchuck") drivel ("childish, silly, or meaningless talk or thinking; nonsense; twaddle"). So you snidely insult "ACists" and "austrians", like me, and then proceed to contrast their "drivel" with a description of the process that is identical to theirs. Then, when I point out that the Austrians describe it exactly the way you did, you claim that, no, they don't: You: "the situation exactly as the austrians describe it (i.e. what the OP said) is not how it actually works in reality despite the fact that the result is the same." Read this last bit [censored] carefully, and tell me what the [censored] you think it says in your crazy [censored] head, because in my world, it says that you are claiming that "the situation exactly as the austrians describe the situation it is not how it actually works in reality", even though it is identical to your own description of reality. Then I point out, AGAIN, that you are wrong. I point out that the Austrians describe exactly the way that you did, and since you apparently needed proof, provided a link. And what do you then do? You claim that oh noes, you didn't mean the "ACists" and the "austrians" were regurgitating drivel when you said "this sounds like some typical drivel regurgitated from ACists . . . or austrians . . . ", and your "beef" isn't "content" it's "presentation". Whatever the [censored] that means. And because I am forced to provide a link showing that the Austirans are not "regurgitating drivel", but are instead describing the situation the same way you do, you act like this is somehow claiming that ONLY the Austrians make these claims! All I'm trying to do is prove to a [censored] doorknob on the internet that the Austrians aren't saying anything different from he is and that's supposed to be a claim that they have some exclusive claim on the [censored] obvious??? I mean, do you even read the stuff you write or respond to? Or think about it before you do? Is it supposed to be my problem if you're [censored] writing things that don't have anything to do with what's in your [censored] head (or so you claim), or reading things that don't have anything to do with what's on the [censored] screen? This is my last post in this thread. Please. I beg of you. Don't ever respond to one of my posts again. I promise to never, ever, ever post again in BFI. Deal? Pretty please. With a [censored] cherry on top? Mmmk? Oh and I got your insulting jerk-off PM. [img]/images/graemlins/ooo.gif[/img] [img]/images/graemlins/mad.gif[/img] [img]/images/graemlins/cool.gif[/img] [img]/images/graemlins/smile.gif[/img] [img]/images/graemlins/frown.gif[/img] [img]/images/graemlins/blush.gif[/img] [img]/images/graemlins/crazy.gif[/img] [img]/images/graemlins/laugh.gif[/img] [img]/images/graemlins/shocked.gif[/img] [img]/images/graemlins/smirk.gif[/img] [img]/images/graemlins/confused.gif[/img] [img]/images/graemlins/grin.gif[/img] [img]/images/graemlins/wink.gif[/img] [img]/images/graemlins/tongue.gif[/img] [img]/images/graemlins/spade.gif[/img] [img]/images/graemlins/diamond.gif[/img] [img]/images/graemlins/heart.gif[/img] [img]/images/graemlins/club.gif[/img] |

|

#25

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] [ QUOTE ] [ QUOTE ] [ QUOTE ] [ QUOTE ] this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar). first off, the statement is totally backwards. correctly it should read: when more money is released via open market operations, interest rates fall and then currency falls. in other words, when the decision to lower rates occurs, more money is injected into the system by open market operations in the NY Fed. this excess money lowers interest rates (lower interest rates doesn't result in more money printed. more money released results in lower interest rates). the value of the currency (all else equal) then goes down, not because more money is "printed" but because the relative demand to hold that currency drops when compared with the other available options. [/ QUOTE ] I like how you claim that the Austrians "reguritate drivel", and then proceed to describe exactly the situation as Austrians describe it. [img]/images/graemlins/tongue.gif[/img] Yet more evidence that you have no idea what the people you scorn are actually saying. And you are being slightly disingenuous when you say that "lowering the interest rate increases the money supply" is totally backwards. What is the intent when the Fed increases the money supply? To lower the interest rate, of course. They have an interest rate target, and if the market gets too far away from their target they will inject (or drain) reserves into (or from) the system to try to hit that target. The interest rate is the cart. The money supply is just the horse. It might come first, but what it's hauling is what's important from the Fed's point of view. [/ QUOTE ] dude. the point is that the OP regurgitated something he read here without understanding the distinction. the sound bites and snippets are what i refer to as "drivel"...the situation exactly as the austrians describe it (i.e. what the OP said) is not how it actually works in reality despite the fact that the result is the same. [/ QUOTE ] NO. The situation as the Austrians describe is EXACTLY how YOU yourself described it. In other words, you ascribed "drivel" to the Austrians and then went on to explain EXACTLY the situation as the Austrians decsribe it. If you BELIEVE the Austrians say anything otherwise then it is YOUR MISTAKE. Which you could CORRECT if you BOTHERED TO LEARN ANYTHING ABOUT THE STUFF THAT YOU HEAP SCORN ON. YOU have apparently conflated the intent, to lower interest rates, with the mistaken belief that the Austrians believe in a mistaken belief in the direction of cause and effect (lower interest rate inflates money supply), when nothing could be furhter from the truth (the Fed wants to lower interest rates, and hence inflates the money supply to achieve this). It boggles my mind that I have to explain the same exact thing to you TWICE because even after you are corrected the first time about it you still claim otherwise. This is like me telling you my favorite color is purple and you saying, "No it isn't, your favorite color is blue!" [img]/images/graemlins/tongue.gif[/img] I don't know which is more infuriating, your insults or your arrogant confidence in your mistakes. [/ QUOTE ] don't you get it. my beef isn't content, it's presentation. man you're dense. it boggles my mind that i have to tell you again the content isn't what i'm bothered about. the fact that you tell people who aren't as smart/knowledgeable as you that the fed prints money and that printing money devalues the dollar is what i'm talking about. the intent regarding interest rates is clearly the driver, we all know that (we= those who have studied this)...but the literal action isn't the intent and those that get that confused end up like the OP. look at the OP's post. THAT is what i'm TALKING about. the op regurgitated that without having a clue what it actually meant...i.e. DRIVEL: [ QUOTE ] to utter childishly [/ QUOTE ] dictionary definition FTW! those utterances is what i'm heaping scorn upon. i've said in many posts recently that i agree to a large degree with what the austrian school is talking about. on another note, i think it is hilarious that you state "the austrians describe it" like their the only ones who know what is going on under the hood. it is common knowledge and on wikipedia (i checked). glad the austrians could clear up what an open market operation is. back to above: it is very clear you know i understand the difference between intent and action and i've described it clearly. you are a professor so maybe you have a pent up need to: [ QUOTE ] ...explain the same exact thing to you TWICE because even after you are corrected the first time about it you still claim otherwise. [/ QUOTE ] yea. thanks for your explanation. i clearly needed it otherwise i wouldn't have understood the complex workings of the federal reserve lol. those who can't do... Barron [/ QUOTE ] My God you have reading comprehension problems. Let's recap. You: "this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar)." What the [censored] does this say in your crazy world? Because in English, it says that you think "ACists" and "austrians" (Gosh, I wonder who that could be around here?) regurgitate ("to vomit, puke, hurl, barf, upchuck") drivel ("childish, silly, or meaningless talk or thinking; nonsense; twaddle"). So you snidely insult "ACists" and "austrians", like me, and then proceed to contrast their "drivel" with a description of the process that is identical to theirs. [/ QUOTE ] excellent ... glad you posted that. here is what i said in the 3rd post: [ QUOTE ] -------------------------------------------------------------------------------- this sounds like some typical drivel regurgitated from ACists or something (or austrians or whatever group is always commenting on the demise of the dollar). -------------------------------------------------------------------------------- this made me chuckle.. watch out though... I'm pretty sure Borodog searches for the word Austrian and will come here calling it semantics that it's "released" money and not "printed" money or something similar -------------------------------------------------------------------------------- well he'd be correct, but i get the feeling that many people who don't know what really happens in the economy literally think that when somebody says "hey the fed is printing money" that they are litereally sitting there with a printing press. of course the fed is in the end responsible for the whole kit'n'kaboodle in one way or another but the distinction is nonethelessimportant. Barron [/ QUOTE ] keep at it though without responding to YOUR ATTROCIOUS mistakes regarding the M3 issue i PMed you about. [ QUOTE ] Then, when I point out that the Austrians describe it exactly the way you did, you claim that, no, they don't: You: "the situation exactly as the austrians describe it (i.e. what the OP said) is not how it actually works in reality despite the fact that the result is the same." Read this last bit [censored] carefully, and tell me what the [censored] you think it says in your crazy [censored] head, because in my world, it says that you are claiming that "the situation exactly as the austrians describe the situation it is not how it actually works in reality", even though it is identical to your own description of reality. [/ QUOTE ] it means that the literal relationship is "money released ---> interes rates fall ---> currency falls relative to others cetaris parabis" NOT what the OP said in the first sentence of his OP [ QUOTE ] Then I point out, AGAIN, that you are wrong. I point out that the Austrians describe exactly the way that you did, and since you apparently needed proof, provided a link. And what do you then do? You claim that oh noes, you didn't mean the "ACists" and the "austrians" were regurgitating drivel when you said "this sounds like some typical drivel regurgitated from ACists . . . or austrians . . . ", and your "beef" isn't "content" it's "presentation". Whatever the [censored] that means. [/ QUOTE ] it means that the DRIVEL (i.e. childish regurgitation) is spouted TYPICALLY (i.e. usually) by those who follow the austiran viewpoint without understanding it. i've said time and time again that you have convinced me of a lot regarding free market economics, but the way that you go about explaining your points is horrible. that is what i mean in terms of content vs. presentation. [ QUOTE ] And because I am forced to provide a link showing that the Austirans are not "regurgitating drivel", but are instead describing the situation the same way you do, you act like this is somehow claiming that ONLY the Austrians make these claims! All I'm trying to do is prove to a [censored] doorknob on the internet that the Austrians aren't saying anything different from he is and that's supposed to be a claim that they have some exclusive claim on the [censored] obvious??? [/ QUOTE ] you made it sound that way. [ QUOTE ] I mean, do you even read the stuff you write or respond to? [/ QUOTE ] yes. do you??? i.e. DID YOU READ THE F*CKING SH*T YOU WROTE ABOUT M3??????????????????? [ QUOTE ] Or think about it before you do? Is it supposed to be my problem if you're [censored] writing things that don't have anything to do with what's in your [censored] head (or so you claim), or reading things that don't have anything to do with what's on the [censored] screen? [/ QUOTE ] no it isn't your problem. but it IS your problem that you speak RETARDEDLY about things you claim to be knowledgable about...again M3. [ QUOTE ] This is my last post in this thread. [/ QUOTE ] unfortunate because YOU NEVER RESPONDED TO THE MAIN PROBLEM YOU STARTED REGARDING THE M3 MONEY SUPPLY or maybe it isn't unfortunate...but coincidental... [ QUOTE ] Please. I beg of you. Don't ever respond to one of my posts again. I promise to never, ever, ever post again in BFI. Deal? Pretty please. With a [censored] cherry on top? Mmmk? Oh and I got your insulting jerk-off PM. [img]/images/graemlins/ooo.gif[/img] [img]/images/graemlins/mad.gif[/img] [img]/images/graemlins/cool.gif[/img] [img]/images/graemlins/smile.gif[/img] [img]/images/graemlins/frown.gif[/img] [img]/images/graemlins/blush.gif[/img] [img]/images/graemlins/crazy.gif[/img] [img]/images/graemlins/laugh.gif[/img] [img]/images/graemlins/shocked.gif[/img] [img]/images/graemlins/smirk.gif[/img] [img]/images/graemlins/confused.gif[/img] [img]/images/graemlins/grin.gif[/img] [img]/images/graemlins/wink.gif[/img] [img]/images/graemlins/tongue.gif[/img] [img]/images/graemlins/spade.gif[/img] [img]/images/graemlins/diamond.gif[/img] [img]/images/graemlins/heart.gif[/img] [img]/images/graemlins/club.gif[/img] [/ QUOTE ] nope...i'll respond when i want to...and this post of yours DID NOTHING TO SOLVE YOUR HORRIBLE DISGUSTING REPLY REGARDING M3... and i will keep at you until you deal with it. i will not stop hounding you and linking this thread until you deal with the fact that you started insulting me and claiming the fed's conspiracy to stop publishing M3 while you DONT EVEN UNDERSTAND what M3 means in modern times. so no, i won't make that deal with you, you condescending, selectively answering, twit. Barron |

|

#26

|

|||

|

|||

|

[ QUOTE ]

I promise to never, ever, ever post again in BFI. [/ QUOTE ] This alone has made the entire post worth tolerating. Jimbo |

|

#27

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] I promise to never, ever, ever post again in BFI. [/ QUOTE ] This alone has made the entire post worth tolerating. Jimbo [/ QUOTE ] nah, i'd rather him post here and deal with the M3 issue. he actually PM'd me back and said "do YOU KNOW WHAT A EURODOLLAR IS?" lol like that was the big issue w/ the M3 M2 divergence. i PM'd him about repos and he hasn't spoken a word about htem since he posted the snide remark about "those that control the money supply" stopping the publication of M3. he also gets "stressed out" when he communicates w/ me lol so i'm not gunna stop hounding him until either: a) he deals with his own bullsh*t about M3 in a reasonable manner, or b) apologizes for being a d*ck when he clearly didn't understand what was being said. Barron |

|

#28

|

|||

|

|||

|

here is a post i made in politics summing up my recent confrontation w/ our in house astro-physics/amatuer tilting economics major borodog:

Linky some may find it enjoyable, some may hate me for it. either way, feel free to comment. Barron |

|

#29

|

|||

|

|||

|

[ QUOTE ]

some may find it enjoyable, some may hate me for it. either way, feel free to comment. [/ QUOTE ] I'll only be mildly perturbed but not hate you if he and his kooky friends invade this forum like a plague of locusts. This is the last safe haven for sanity on two plus two. Jimbo |

|

#30

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] some may find it enjoyable, some may hate me for it. either way, feel free to comment. [/ QUOTE ] I'll only be mildly perturbed but not hate you if he and his kooky friends invade this forum like a plague of locusts. This is the last safe haven for sanity on two plus two. Jimbo [/ QUOTE ] unlikely negative externality. Barron |

|

|

|