[ QUOTE ]

[ QUOTE ]

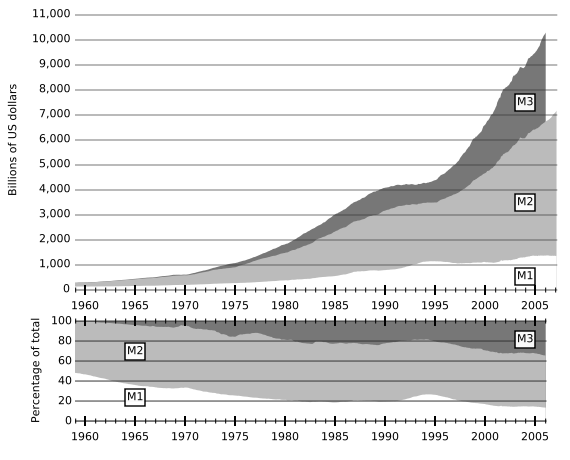

The important number is not the total of physical cash, but the total of fiduciary instruments, M3:

Before the Fed stopped reporting M3 (supposedly because it "cost too much" to measure; this from the people who can create money), M3 was expanding at about 15% per year.

[/ QUOTE ]

i'd like to take a second here and reiterate that you have absolutely no clue what M3 relates and you use the end of the publicatino of it as amo against the powers that be in a well thought out snide way.

seriously boro, do you know what the notional value of repurchase agreements does to that figure? look at the divergence between M3 and M2. the divergence between M2 and M1 has actual economic significance since the latter is a much narrower definition, but the wider definition (M2) still retains actual usefulness as it relates to economic activity.

M3 on the other hand includes far too much noise that actually diminishes the usefulness of it as a measure of anything substantial. eurodollar deposits and repos are by far i'm sure the biggest contributors to the M3 surge there towards the end of its publication. but many institutions and hedge funds engage in those activities far beyond what is useful to look at.

increases in M3 don't actually correlate to anything relating to prices in the actual economy and the fed hasn't used it for a long time.

here is the actual statement from the fed as to why M3 was stopped:

[ QUOTE ]

On March 23, 2006, the Board of Governors of the Federal Reserve System will cease publication of the M3 monetary aggregate. The Board will also cease publishing the following components: large-denomination time deposits, repurchase agreements (RPs), and Eurodollars. The Board will continue to publish institutional money market mutual funds as a memorandum item in this release.

.

Measures of large-denomination time deposits will continue to be published by the Board in the Flow of Funds Accounts (Z.1 release) on a quarterly basis and in the H.8 release on a weekly basis (for commercial banks).

.

M3 does not appear to convey any additional information about economic activity that is not already embodied in M2 and has not played a role in the monetary policy process for many years. Consequently, the Board judged that the costs of collecting the underlying data and publishing M3 outweigh the benefits.

[/ QUOTE ]

for somebody who speaks as authoritatively as you do it might help to know what you're talking about. (yes, pot-kettle but at least i readily acknowledge where my knowledge is lacking).

Barron

[/ QUOTE ]

bump for more pot-kettle regarding borodog:

he said:

[ QUOTE ]

I don't know which is more infuriating, your insults or your arrogant confidence in your mistakes.

[/ QUOTE ]

amazing how sure you were/are, boro about M3 and the fed's conspiracy to stop publication of it lol.

Barron