When we say "printing money form nothing", it's a figure of speech. The money doesn't need to be physically printed to expand the money supply. An entry is simply created in an electronic account at the Fed, and then the Fed purchases government securities from special brokers during "Fed Time" in open market operations with that newly created money, via wire transfer I believe (although I'm not sure; the Fed might physically cut a check). Those brokers then deposit those funds in the commercial banks, where they become increased reserves for the banks. If commercial bank reserves are increased by $50B in this manner, the banks can then create up to a total of $500B via loans, by the magic of fractional reserve banking, if the reserve rate is 10% for example. The artificial lowering of the interest rate of course encourages people to take out these loans, which is what actually does most of the expansion of the money supply.

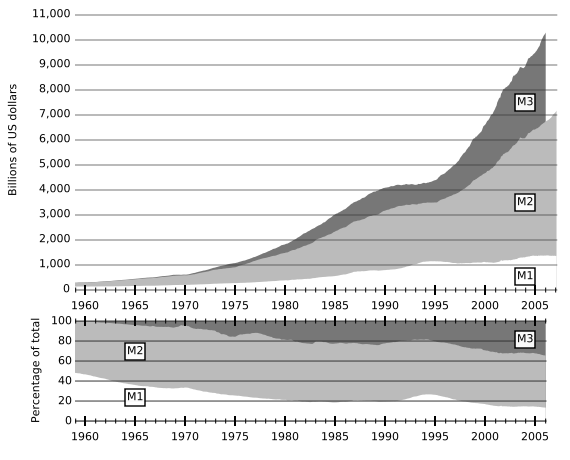

The important number is not the total of physical cash, but the total of fiduciary instruments, M3:

Before the Fed stopped reporting M3 (supposedly because it "cost too much" to measure; this from the people who can create money), M3 was expanding at about 15% per year.

And once again I will point out that artificially lowering the interest rate, which is really the market price for investment funds and hence access to physical resources, causes a misallocation of those physical resources, just as any price cap on any good or service causes a misallocation of that good or service. If you cap the price of mile at $0.25/gallon, people would be bathing in milk and watering their lawns with it, and a shortage would develop. That's what happens to the physical capital stock when the interest rate is artificially capped; productive capacity is misallocated and a shortage develops that is eventually revealed in, and correct by, a recession.