[ QUOTE ]

CMI: I would also try your model by selling the stock at the opening price on the next day. Lots of companies report earnings overnight and you might be losing lots of EV this way.

[/ QUOTE ]

ohh wow. I didnt even know they were different. I just assumed each day's closing price was the next opening price. So, all calculations made were actually assuming you would sell your current day's stocks at close, and buy your next days stock also at close.

Anyway, given a $10/trade fee, I did the following simulation:

Start 10,000 accounts at $10,000 each. Get the top 15 picks for each day, then have each account randomly select 3 of those 15 picks for the day, spending 1/3 of their current worth on each of the stocks. Then, sell at close. Repeat for the 1999 days of testing. (subtract 30 dollars from the account each day)

In the end, there was about a 3.8% chance of being down, and about a 3.5% risk of ruin

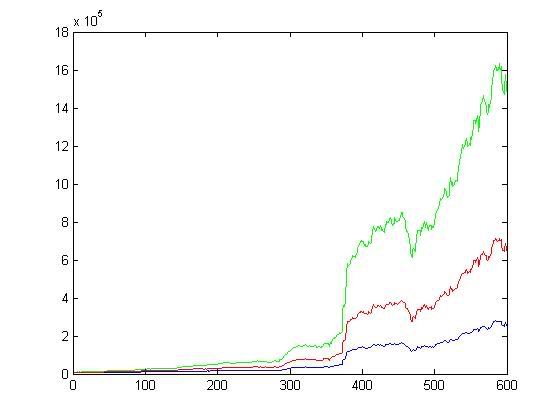

These are graphs for the 25th/50th/75th percentiles for each day. I zoomed in on the first 600 days of the test in graph 2.

Obviously, these results are encouraging / seem too good to be true. Ive looked through the code again, and cant find any big mistakes. I even ran the simulation using coefficents that were trained on the same days as the ones they were tested on to make sure I didnt accidentally do that, and I got the expected blowup in results.

Also, I'd imagine the inherent assumption that you can invest large sums in a stock and still have it behave the same way it would have without that investment is pretty flawed. Even with that considered, the results still seem pretty encouraging.